Announcing Expanded IAR CE And Price Updates And The State Of The (Nerd’s Eye View) Blog

Nerd's Eye View

DECEMBER 12, 2022

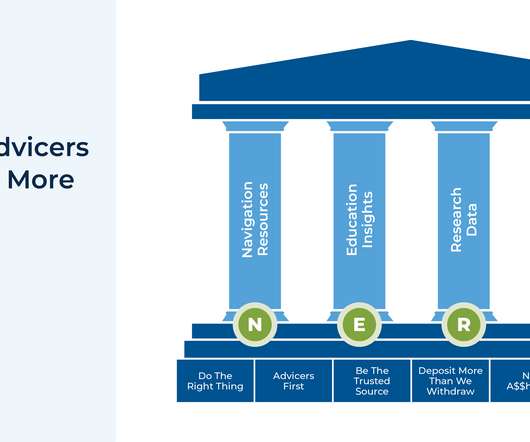

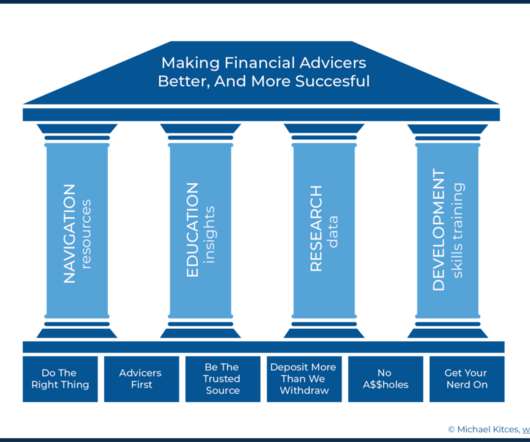

Earlier this year, we introduced our own Investment Adviser Representative (IAR) CE programs that allow those in the growing number of states that have adopted the NASAA Model Rule to meet their 12 hours/year CE requirement. All in pursuit of our mission: Making Financial Advicers Better, And More Successful. Read More.

Let's personalize your content