Tax Strategies for High-Income Earners 2025

Yardley Wealth Management

FEBRUARY 4, 2025

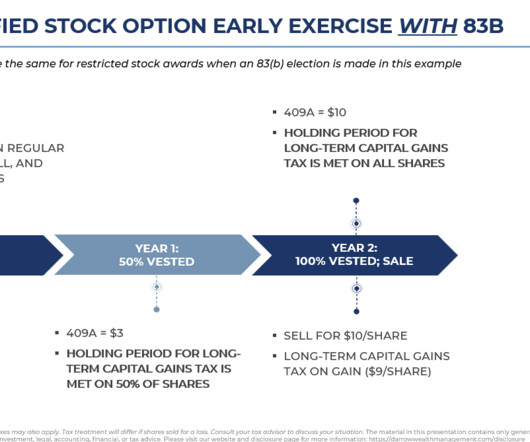

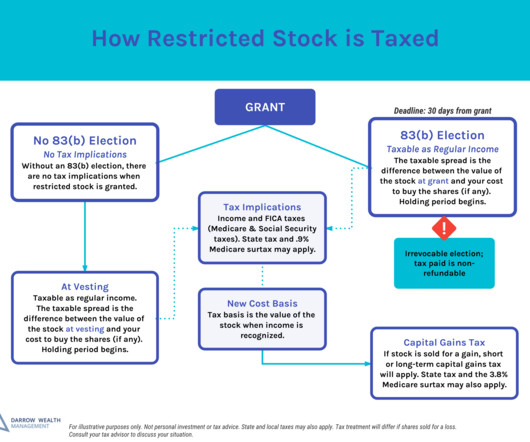

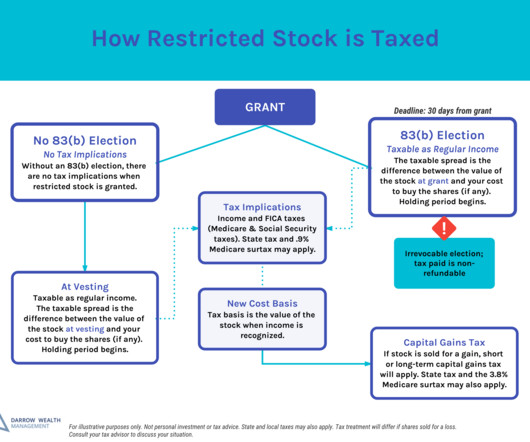

The post Tax Strategies for High-Income Earners 2025 appeared first on Yardley Wealth Management, LLC. Tax Strategies for High-Income Earners in 2025. It’s triggered by large deductions, multiple dependents, or significant capital gains, requiring careful planning of deductions and income recognition.

Let's personalize your content