Transcript: Jeffrey Becker, Jennison Associates Chair/CEO

The Big Picture

APRIL 29, 2025

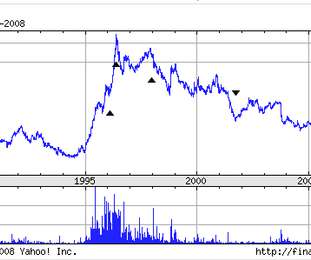

00:11:32 [Speaker Changed] Yeah, it, it happened because of another crisis In 2008, the, the great financial crisis ING had had gotten overexposed in, in, in mortgages and had to take a loan from the Dutch state to shore up their tier one capital ratios. So 2008, you know, as you remember, Barry fourth quarter was chaotic.

Let's personalize your content