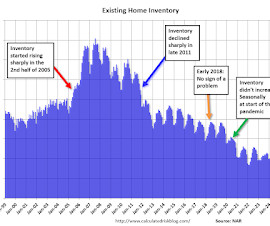

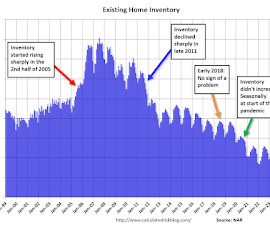

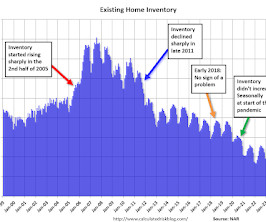

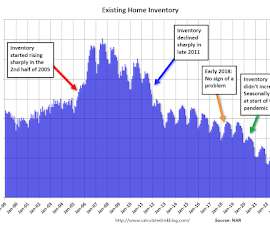

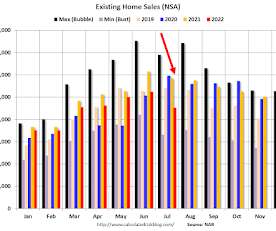

Watch Inventory and Why Measures of Existing Home Inventory appear Different

Calculated Risk

APRIL 14, 2025

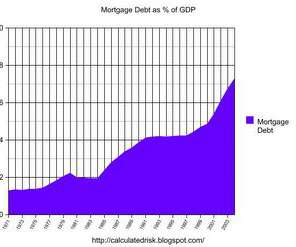

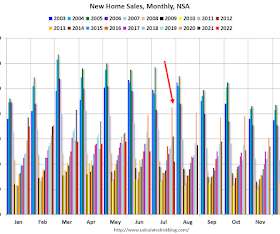

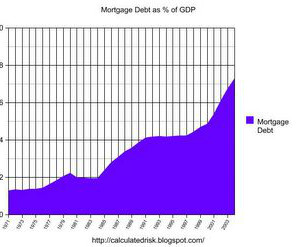

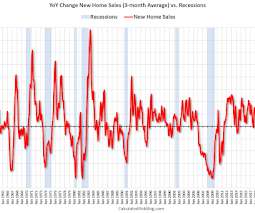

Watch Inventory Here are a few examples of when inventory helped me call some turning points for house prices (this section is an update to a previous article): Starting in January 2005, I was very bearish on housing , but I wasnt sure when the market would turn. Speculative bubbles can go on and on.

Let's personalize your content