Can You Live Off Dividends In Retirement?

Darrow Wealth Management

FEBRUARY 9, 2025

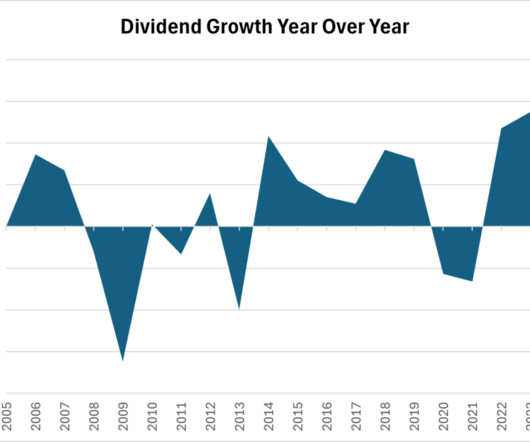

Simulated portfolio income using historical dividends Imagine you invested $1,000,000 on the last day of 2004. Hypothetical simulation assumes $1M was invested on 12/31/2004, 50% in SPY and 50% in AGG, portfolio was never rebalanced, dividends not reinvested, and no other contributions/withdrawals in the account. Source: J.P.

Let's personalize your content