Market Outlook: 3 Reasons Long-Term Investors Should Be Optimistic

Darrow Wealth Management

MARCH 6, 2023

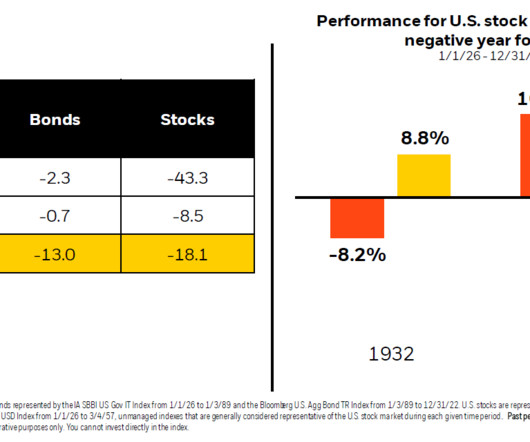

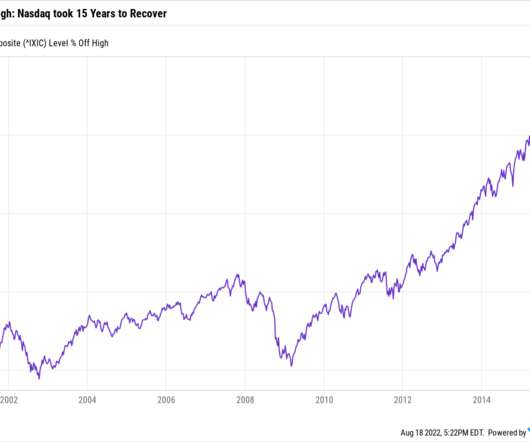

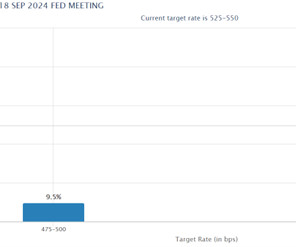

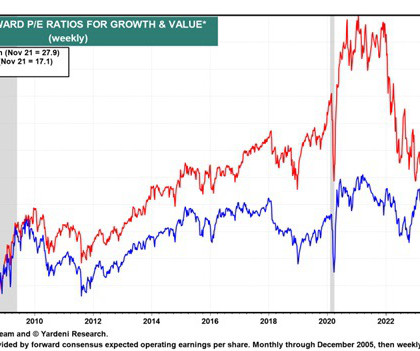

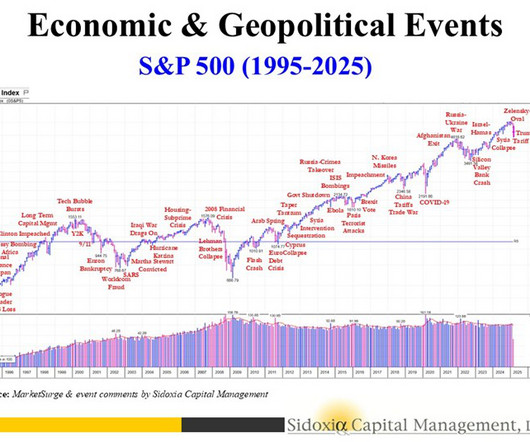

For much of last year, even good news about the economy was bad news for markets. Yes, 2022 was a terrible year for financial markets. 3 reasons for investors to be optimistic about the long-term market outlook Short-term market moves should always be expected, especially for equity investors.

Let's personalize your content