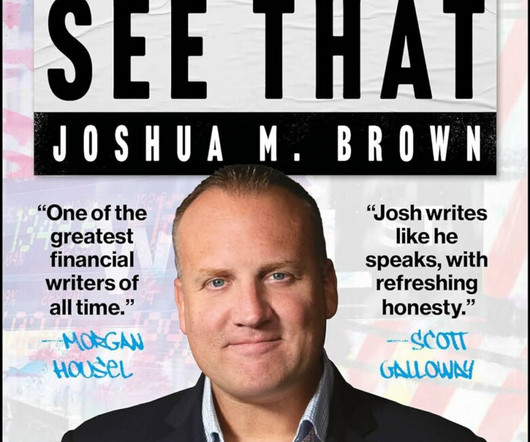

3 Things You Don’t Know About Josh

The Big Picture

SEPTEMBER 5, 2024

From “ The Relentless Bid ” comes the first explanation that resonates as to how and why the market’s character changed so much in the 2010s: “Morgan Stanley wealth management took in a massive $51.9 Not only are his decks hilarious, but you will leave so much more informed about this industry than you can imagine.

Let's personalize your content