Warren's Wisdom

Random Roger's Retirement Planning

MAY 4, 2025

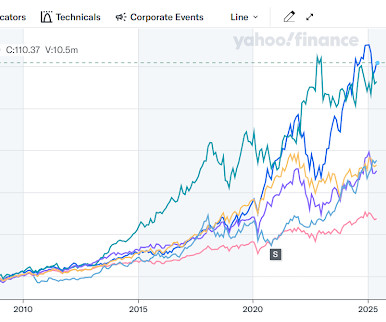

By now you've heard that Warren Buffett plans to step down at the end of the year. We talk frequently about the stock market's ergodicity, the natural inertia to go from the lower left to the upper right despite some bumps along the way. The more someone trades, the more they are fighting that natural inertia other than proper asset allocation targets and mitigating sequence of return risk when relevant.

Let's personalize your content