Bonds Don’t Feel Very Stable

The Irrelevant Investor

MARCH 22, 2022

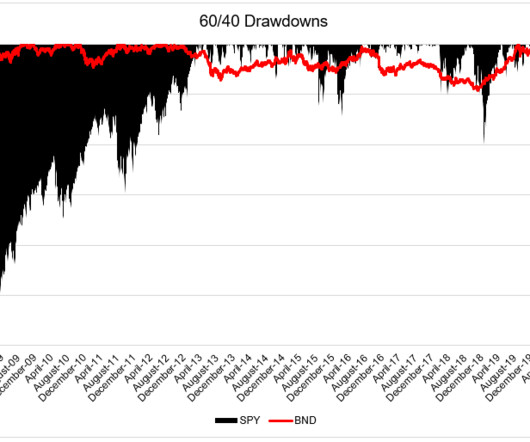

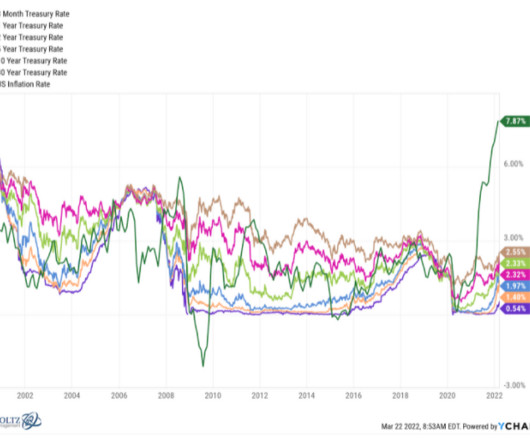

Normally, bonds offer protection from a stock market storm. But this is a weird environment where bonds are not buffering the decline in stocks, they're causing it.* Earlier in the month, both stocks and bonds were in a 10% drawdown for the first time since 2008. Bonds have had a rough run lately, but the next chart shows why you don't throw them in the garbage when they're treating you like trash.

Let's personalize your content