Weekend Reading For Financial Planners (June 28–29)

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

MARCH 3, 2025

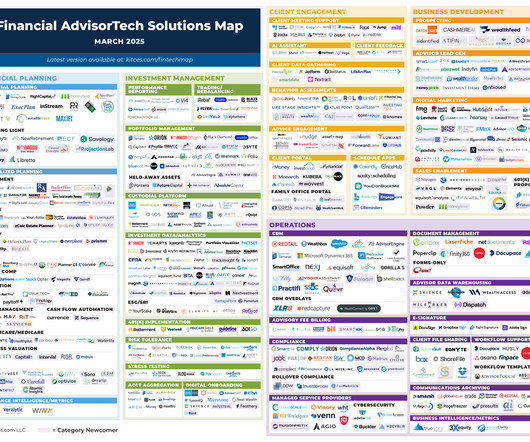

Welcome to the March 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

WiserAdvisor

JULY 4, 2025

These include: Military members Taxpayers and their relatives with disabilities Clergy members If you fall under any of these three categories, you can speak to a financial advisor to understand the specific rules that apply to you. Estate tax credits and gift tax exclusion Let’s talk estate planning for a moment.

Harness Wealth

NOVEMBER 12, 2024

Checklist: Year-end Tax Planning Strategies Review the following tax strategies with your tax advisor and/or financial advisor before the end of the year. This can be a particularly useful method for estate planning and maximizing tax benefits, as the funds grow tax-free when used for qualified education expenses.

Zajac Group

NOVEMBER 7, 2024

Creating wealth that can provide financial security for generations to come is an incredible feat, and it requires careful planning, consideration, and communication among family members. For reference, the federal estate tax exemption limit is set to revert back to $5 million (or around $7 million when adjusted for inflation).

Carson Wealth

MARCH 6, 2025

Whats less common, but just as important, is outlining a specific plan for this transfer and updating it as circumstances change. If its been some time since you established your estate plan, you may want to think about giving it a review. How will this affect your overall plan? million.

Harness Wealth

JANUARY 28, 2025

Get started Harness makes it easy to find tax and financial advisors best suited to your needs. Harness makes it easy to find tax and financial advisors best suited to your needs. These adjustments apply to income tax returns for the 2025 tax year, filed during tax season in 2026, as outlined by the IRS.

Let's personalize your content