Avoid Making These Mistakes to Safeguard Your Wealth

WiserAdvisor

JUNE 13, 2025

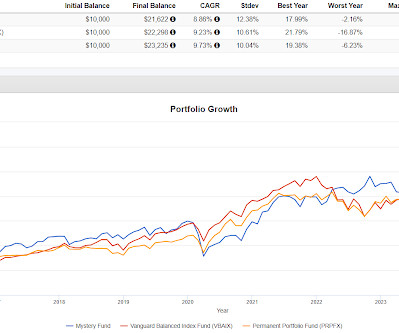

Keeping it safe, growing it wisely, and using it to support your future takes careful planning. It plays a crucial role in helping people achieve financial stability, prepare for retirement, and leave a lasting legacy for their families. Yet even the best financial plans can stumble. Look at what happened in early 2020.

Let's personalize your content