Adviser links: a unique experience

Abnormal Returns

NOVEMBER 18, 2024

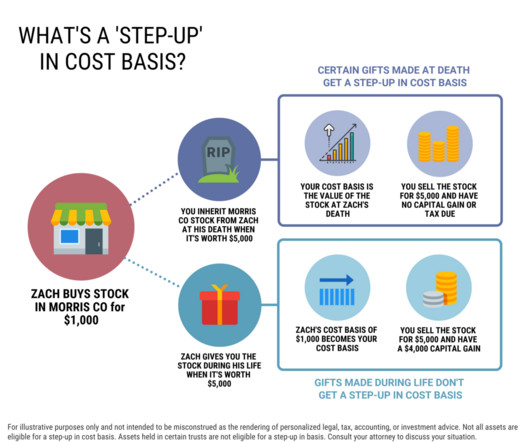

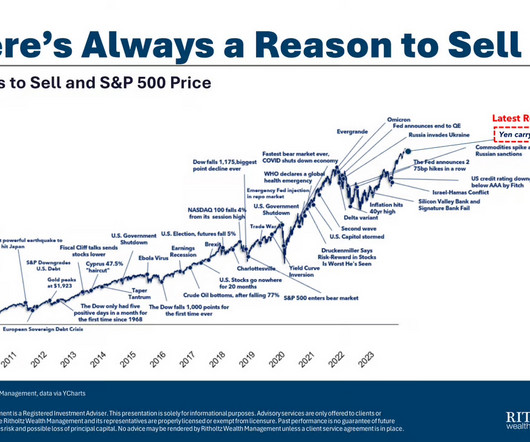

Podcasts Daniel Crosby talks with Christina Lynn about Motivational Interviewing in order to enhance the work of wealth advisors. justincastelli.io) Taxes Some speculation on what is next for the TCJA. kitces.com) Tax planning and wealth management go hand-in-hand.

Let's personalize your content