Animal Spirits: Investing in Gold

The Irrelevant Investor

SEPTEMBER 25, 2020

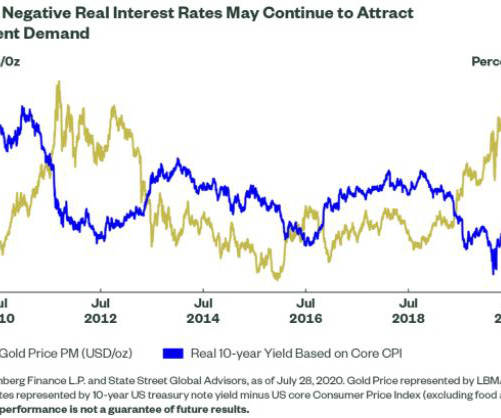

Today’s Animal Spirits is brought to you by State Street On today’s show we discuss: What variables drive gold the most? The boom and bust nature of commodities The role of gold in a portfolio Gold midyear outlook The Role of Gold in Today’s Global Multi-Asset Portfolio The Power of Gold: The History of an Obsession The Golden Constant Listen here: Charts Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Let's personalize your content