Don’t Chop Yourself Up

The Irrelevant Investor

MARCH 14, 2022

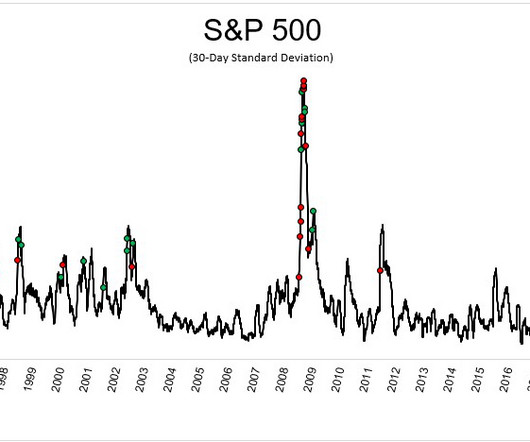

It's hard to get too bearish when nobody is bullish. But it's hard to get too bullish when the S&P 500 is just 13% off its all-time high. It's normal to have conflicting views like this when the market is going down. And it's normal for your views to ping pong on a daily basis; bearish on down days and hopeful on up days. One of the worst parts about bear markets, aside from just the losing money part, is the false hope along the way.

Let's personalize your content