83(b) Election for Stock Options and Restricted Stock

Darrow Wealth Management

APRIL 23, 2025

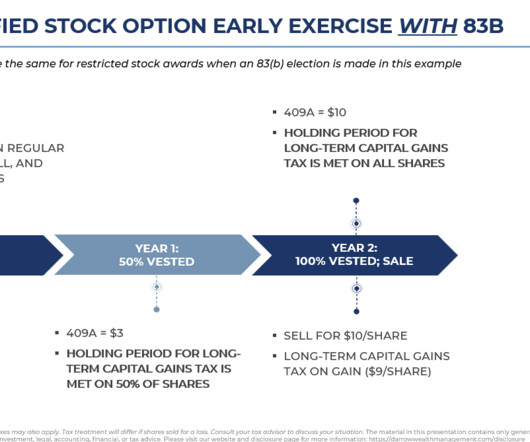

The 83(b) election has the potential to significantly reduce the overall tax liability, especially for startup founders and employees who receive stock-based compensation. It’s usually a key part of pre-IPO tax planning and exit strategies. This is only relevant for property subject to vesting requirements.

Let's personalize your content