Gold, What is it Good For?

The Irrelevant Investor

SEPTEMBER 4, 2018

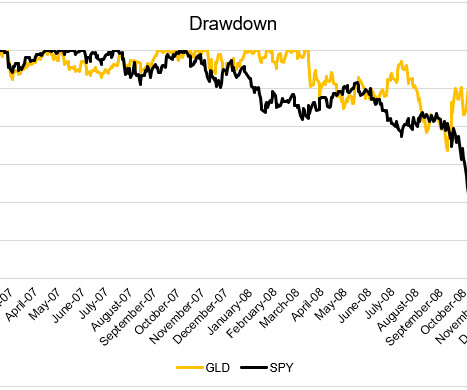

It has been 2,555 days since gold peaked in September 2011. Gold did fantastically well coming out of the GFC, but like most other assets, it got hit hard in the teeth of the crisis. The rare trifecta of portfolio management. The chart below shows the rolling 12-month correlation between gold and a 60/40 portfolio.

Let's personalize your content