What High-Net-Worth Prospects (Really) Want From A Financial Advisor

Nerd's Eye View

JANUARY 22, 2024

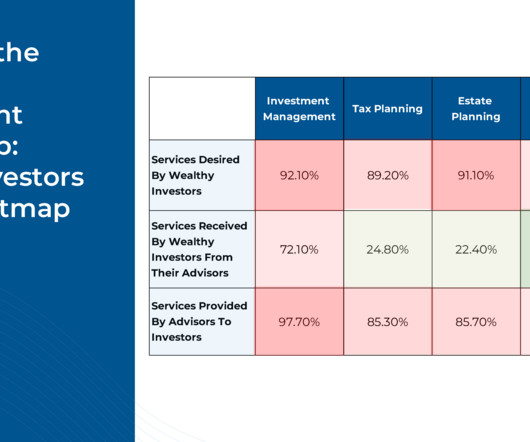

In the early days of wealth management, a financial advisor's value proposition was relatively explicit, typically focusing on a limited range of portfolio management activities (e.g., selling and trading) or on sales-oriented advice that centered on implementing insurance products.

Let's personalize your content