Charitable Planning with Retirement Assets

Wealth Management

MARCH 13, 2023

Legacy IRAs and charitable remainder trusts are powerful tools to help defer or avoid certain taxes.

Wealth Management

MARCH 13, 2023

Legacy IRAs and charitable remainder trusts are powerful tools to help defer or avoid certain taxes.

NAIFA Advisor Today

MAY 28, 2025

Non-cash assets such as real estate, closely held business interests, and collectibles represent a massive and largely untapped opportunity in charitable giving. While these assets are estimated to total between $40 and $60 trillion in value, they make up less than 2% of all charitable donations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JANUARY 22, 2024

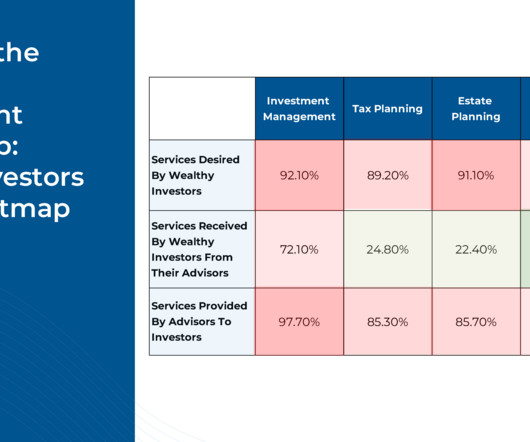

For example, an advisor may think of "risk management" in terms of life and property insurance coverage, whereas HNW clients may instead think of tax and estate-planning strategies as asset protection measures – particularly for the future wealth of their heirs.

MainStreet Financial Planning

DECEMBER 19, 2022

Having a simple plan and willingness to use alternatives to cash donations can help you lower your tax liability. Check out these charitable giving tax strategies to create your win-win charitable plan that you can implement throughout the year! Donate appreciated assets instead of cash. Bunch donations.

eMoney Advisor

JANUARY 31, 2023

We also follow a cadence that helps us plan our schedule. We start the year with a session focused on budgeting and typically end the year with a webinar related to tax and charitable planning. As our company has grown, so has our support team. We engage with our clients every day on what matters to them.

James Hendries

NOVEMBER 26, 2022

Those appreciated assets can be donated directly to charity without you or the charity incurring capital gains taxes (consult your tax professional to be sure). If you have any questions or need help mapping out your Charitable Plan, set an appointment to discuss with your financial professional. Donating Stock.

Ballast Advisors

SEPTEMBER 5, 2024

Strategic charitable planning can involve various forms of giving, each with distinct tax implications: Cash Donations : Direct contributions are straightforward and offer immediate tax deductions up to 60% of your adjusted gross income (AGI). DAFs offer flexibility and can be a powerful tool for strategic, long-term philanthropy.

Let's personalize your content