iCapital Raises $820M in Latest Financing Round

Wealth Management

JULY 10, 2025

The commitments from T. Rowe Price, SurgoCap, BNY, State Street and others bring iCapital's valuation to $7.5 billion.

Wealth Management

JULY 10, 2025

The commitments from T. Rowe Price, SurgoCap, BNY, State Street and others bring iCapital's valuation to $7.5 billion.

Nerd's Eye View

JULY 10, 2025

As the financial advice profession has matured, behavioral finance has become an increasingly important element of modern advice. This holistic approach to financial advice, often referred to as life planning, focuses on helping the advisor understand the client’s financial history, deep-seated goals, and overall relationship with money, which can allow for more targeted and comprehensive advice.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 10, 2025

Advisor Anna Rathbun goes live with Grenadilla Advisory, a Cleveland-based RIA specializing in creating personalized alternative investment portfolios for clients.

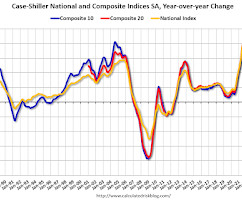

Calculated Risk

JULY 10, 2025

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-July 2025 A brief excerpt: Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-July 2025 I reviewed home inventory, housing starts and sales. I noted that the key stories for existing homes are that inventory is increasing sharply, and sales are essentially flat compared to last year (and sales in 2024 were the lowest since 1995).

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JULY 10, 2025

Tony Parr shares Parr McKnight Wealth Management Group's journey at Wells Fargo Private Client Group, and how it leveraged the firm’s independent channels to achieve a “frictionless” launch of its RIA.

Calculated Risk

JULY 10, 2025

The DOL reported : In the week ending July 5, the advance figure for seasonally adjusted initial claims was 227,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 233,000 to 232,000. The 4-week moving average was 235,500, a decrease of 5,750 from the previous week's revised average.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Advisor Perspectives

JULY 10, 2025

The Treasury market rallied after an auction of 10-year notes drew strong demand, easing concerns that investors will balk at financing swelling US deficits.

Wealth Management

JULY 10, 2025

Life’s milestones don't take a vacation, and neither does the demand for sound financial advice.

Carson Wealth

JULY 10, 2025

Whether you’re an experienced investor or new to the market, 2025 has brought an unprecedented degree of simultaneous market momentum and uncertainty. The first half of the year saw both sharp market swings and heightened volatility, leaving many investors feeling like they’re navigating uncharted waters. With shifting tariff policies, proposed tax cuts, and a potentially higher federal deficit, market stability might seem like a distant opportunity.

Trade Brains

JULY 10, 2025

Bernstein holds a positive outlook on India’s housing finance sector, citing structural growth and resilience. It initiated ‘Buy’ ratings on Home First, Aptus, and Aadhar Housing, highlighting scalability, rate resilience, and strong AUM growth potential. India’s housing finance sector is experiencing robust growth, with the total outstanding housing loans reaching ₹33 trillion as of March 2024.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Carson Wealth

JULY 10, 2025

We’ve hit the halfway mark of 2025—and what a ride it’s been. From economic uncertainty to market resilience, the latest Take 5 , featuring Ryan Detrick, Chief Market Strategist, and Sonu Varghese, VP, Global Macro Strategist, breaks down where we are so far in 2025 and where we might be headed in the second half of the year. Key Takeaways Why we don’t expect a recession in 2025—even with some economic soft spots.

Advisor Perspectives

JULY 10, 2025

In this article, you’ll learn how to evaluate crypto ETFs with the same rigor you apply to traditional investment products.

Validea

JULY 10, 2025

Dividend growth stocks form a cornerstone of long-term wealth building by offering investors a dual benefit: consistent income streams and opportunities for capital appreciation. These investments represent companies that systematically increase their dividend payments year after year, demonstrating robust financial health, stable business models, and a commitment to returning value to shareholders.

Trade Brains

JULY 10, 2025

Synopsis: Krystal Integrated Services has secured a ~Rs. 20.3 crore, 3-year contract from AAI to manage facility operations at Patna’s new airport terminal, enhancing passenger experience and ensuring global service standards. During Thursday’s trading session, shares of a leading provider of integrated facility management solutions hit a 5 percent upper circuit on the stock exchanges, after securing a 3-year management contract worth nearly Rs. 20.3 crores from the Airports Authority of India.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Advisor Perspectives

JULY 10, 2025

Private equity firms are bringing their portfolio companies back to the US IPO market, testing investor demand for firms that have more debt than other recent listings.

Trade Brains

JULY 10, 2025

Synopsis- This article is all about the best cashback credit cards in India for 2025, ranked by their real-world cashback potential. It helps you choose cards that fit your spending habits, while detailing the important attributes, cashback rates, fees, and useful tips for getting the most everyday savings by using credit wisely. Cashback credit cards are growing in popularity because they are simple and offer instant value.

Carson Wealth

JULY 10, 2025

When most people consider a job offer, they tend to focus on one thing: salary. But while your paycheck is important, it’s only one piece of the puzzle. Your full compensation package also includes your employee benefits—retirement accounts, insurance, personal time off, and much more. Yet employee benefits are about more than just securing your family’s health or having the freedom to take time off from work—they also play a critical role in your long-term financial planning.

Trade Brains

JULY 10, 2025

Shares of Asset Management Companies (AMCs) came into focus after the Association of Mutual Funds in India (AMFI) released mutual fund data for June 2025. The report showed a notable recovery in equity mutual fund inflows, offering a positive signal after several months of decline. Net inflows into equity mutual funds moved up by 24 percent in June 2025 to Rs. 23,587 crores, marking a reversal after five consecutive months of decline.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Advisor Perspectives

JULY 10, 2025

A new era of regulation is bound to bring high hopes for the crypto bulls. House Republicans are now gearing up for “Crypto Week” – during which the committee has agreed to prioritize digital asset legislation and review several crypto-related bills.

Trade Brains

JULY 10, 2025

Effective Yield of up to 10.50% per annum Credit Rating: Crisil A+/ Stable by Crisil Ratings Limited Trading in dematerialized form only Allotment, in consultation with BSE Limited (the “ Designated Stock Exchange”) , shall be made on the basis of the date of upload of the application into the electronic book of BSE Limited. However, on the date of oversubscription and thereafter, the allotments shall be made to the applicants on a proportionate basis Mumbai, July 8, 2025: Edelweiss Financial Se

Advisor Perspectives

JULY 10, 2025

In this month’s issue, Franklin Templeton Emerging Markets Equity explains how markets in many regions are weathering US policy uncertainty and offers an upbeat assessment of Vietnam after a recent research visit.

Carson Wealth

JULY 10, 2025

The economy has weathered volatility and uncertainty to start 2025, with the ongoing bull market continuing its run and the labor market staying strong. But plenty of headwinds remain as we head into the second half of the year. Download the worksheet to get started. The post Midyear Market Outlook 2025 appeared first on Carson Wealth.

Speaker: Cheryl J. Muldrew-McMurtry

Remote finance teams are rewriting how the back-office runs—and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats have become more than just “growing pains”. They’re now liabilities. The challenge isn’t just team distribution, but building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Advisor Perspectives

JULY 10, 2025

At the recent 2025 Morningstar Investment Conference, CEO Kunal Kapoor highlighted a growing trend that is reshaping the investment landscape.

Trade Brains

JULY 10, 2025

Synopsis- Sonipat, a city 50 km from Delhi, is rapidly transforming from an industrial town to a real estate hotspot. Various committed investments in infrastructure, such as Delhi–Panipat RRTS, metro expansions, expressways, and industrial corridors, are promising double the investment returns. By 2031, the city will have a master plan by allocating over 20,000 hectares for integrated townships, industry, and commercial zones.

Advisor Perspectives

JULY 10, 2025

US equities swung between small gains and losses at the open Thursday as investors parsed through a slew of tariff headlines and looked ahead to corporate results that are due to start in the earnest next week.

Carson Wealth

JULY 10, 2025

The economy has weathered volatility and uncertainty to start 2025, with the ongoing bull market continuing its run and the labor market staying strong. But plenty of headwinds remain as we head into the second half of the year. The post Midyear Market Outlook 2025 Webinar : Uncharted Waters appeared first on Carson Wealth.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Advisor Perspectives

JULY 10, 2025

Our strategy work and quantitative insights suggest the conditions behind more than a decade of U.S. equity outperformance are starting to shift.

Trade Brains

JULY 10, 2025

Synopsis: GP Eco Solutions India surged sharply to hit a 5 percent upper circuit after it received a work order worth Rs 122 crore for a solar power plant project in Punjab. The shares of this leading solar power services provider surged sharply to hit a 52-week high on securing a work order worth Rs 122 crore for a solar project in the state of Punjab.

Advisor Perspectives

JULY 10, 2025

In the weeks leading up to last month’s Israeli and U.S. strikes on Iran, oil prices climbed – not due to actual supply disruptions, but in response to a geopolitical risk premium.

Trade Brains

JULY 10, 2025

Synopsis: Titagarh Rail Systems will raise nearly Rs. 200 crore via preferential issue of 21.16 lakh warrants to promoters Rashmi and Prithish Chowdhary, convertible into equity shares over 18 months. During Thursday’s trading session, shares of a leading comprehensive mobility solution provider with a strong presence in India and Italy surged nearly 2 percent on BSE, after the company’s Board approved a fund raise of Rs. 200 crores to the Promoter Category on a preferential basis.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Let's personalize your content