Back To The (Portfolio) Lab Again

Random Roger's Retirement Planning

DECEMBER 28, 2024

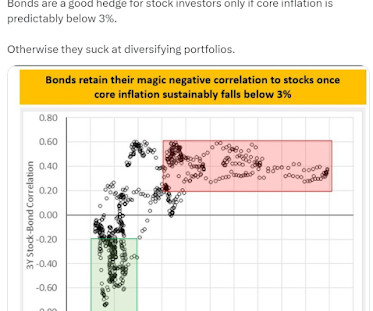

It would take an extreme move up in rates to cause a big move in the price of a two year instrument, very extreme, but if that happened, the time needed to bail you out would be very short as opposed to be far underwater on an issue that matures in 2035 or 2040. The argument I've been making has been simpler.

Let's personalize your content