My Two-for-Tuesday morning train WFH reads:

• The Share of Americans Who Are Mortgage-Free Is at an All-Time High: Almost 40% of US homeowners own their homes outright as of 2022—many of them baby boomers who refinanced when rates were low. (Businessweek) see also Why Your Office Space Continues to Shrink: Despite more than a billion square feet of empty office space in the US, a return to roomier layouts and private offices does not seem to be in the cards. (Bloomberg)

• Satoshi Is Black: For some people of color, crypto isn’t in crisis. In the midst of the FTX trial, I went to the Black Blockchain Summit to talk to the movement’s biggest believers. (Wired)

• How to avoid losing money: My favourite insight from a new investing classic. (Behind the Balance Sheet) see also When Will We See New Highs Again in the Stock Market? We’re a little less than four years into the 2020s and half of those years have seen no new highs but there have already been plenty of them this decade. (A Wealth of Common Sense)

• A record number of $50 bills were printed last year. It’s not why you think: Last year, the government printed 756,096,000 of those bills — the highest total of the denomination printed in one year in more than 40 years. why are you seeing more $50s? Surprisingly, it has nothing to do with inflation — even if it may sometimes feel these days like an item that used to cost $20 now costs $50. (CNN)

• Congrats, Your House Made You Rich. Now Sell It. Lots of baby boomers are going to sell their homes in the years ahead. The trick is to beat the crowd. (Wall Street Journal) see also Why does it cost so much to sell a house? From staging to commission expenses, here’s what to expect. (The Week)

• The best place for product reviews is … Reddit? The hive mind of the internet is good, for once. Whether you’re looking for a new TV or the best bagel in Brooklyn, you’re bound to come across online reviews, and it’s hard to find something that feels trustworthy. There are a lot of reasons why this is true, and it doesn’t look like the situation will get any better soon. Despite regulators and tech platforms’ best efforts, the billion-dollar fake reviews industry is too big and complex to stop, as the New York Times reported this week. (Vox)

• Sacha Baron Cohen Slams TikTok: “Creating Biggest Antisemitic Movement Since the Nazis” “Shame on you.” A group of Jewish celebrities including Debra Messing and Amy Schumer had a confrontational call with executives for the popular social media app. (The Hollywood Reporter) see also Antisemitism was rising online. Then Elon Musk’s X supercharged it. After neo-Nazi protests in Charlottesville, white supremacists were confined mostly to fringe websites. Musk’s purchase of Twitter changed that. (Washington Post)

• Work, Wheels, and Wood: A conversation with Taylor Guitars and Singer Vehicle Design. (Hagerty)

• Has New York finally found a solution to its rat problem? Officials have hired an exterminator to kill the city’s most notorious residents by gassing their burrows (The Guardian) see also NYC Manhole Covers: History and How They’re Made: If you look down on New York City’s streets, you’ll see quite a cacophony of things from manhole covers, to spray painted symbols, to crosswalks, and more. (Untapped New York)

• David Letterman Ends Conspicuous Absence From ‘The Late Show’ The comedian has visited many shows in the past eight years — but not, until Monday night, the one he hosted for 22 years. (New York Times)

Be sure to check out our Masters in Business this week with Brad Gerstner, founder and CEO of Altimeter Capital. The tech-focused fund started in 2008 and invests in both public and private firms. Gerstner began as an entrepreneur and has had multiple exits, including travel startup NLG (to IAC). Openlist.com, (to Marchex) and Farecast (to MSFT). He also was an early investor in Zillow, Real Self, Nor 1, Instacart, Expedia, Silver Rail Tech and Room 77. After returning $7B in profits to its LPs, Altimeter manages currently manages $10B in assets.

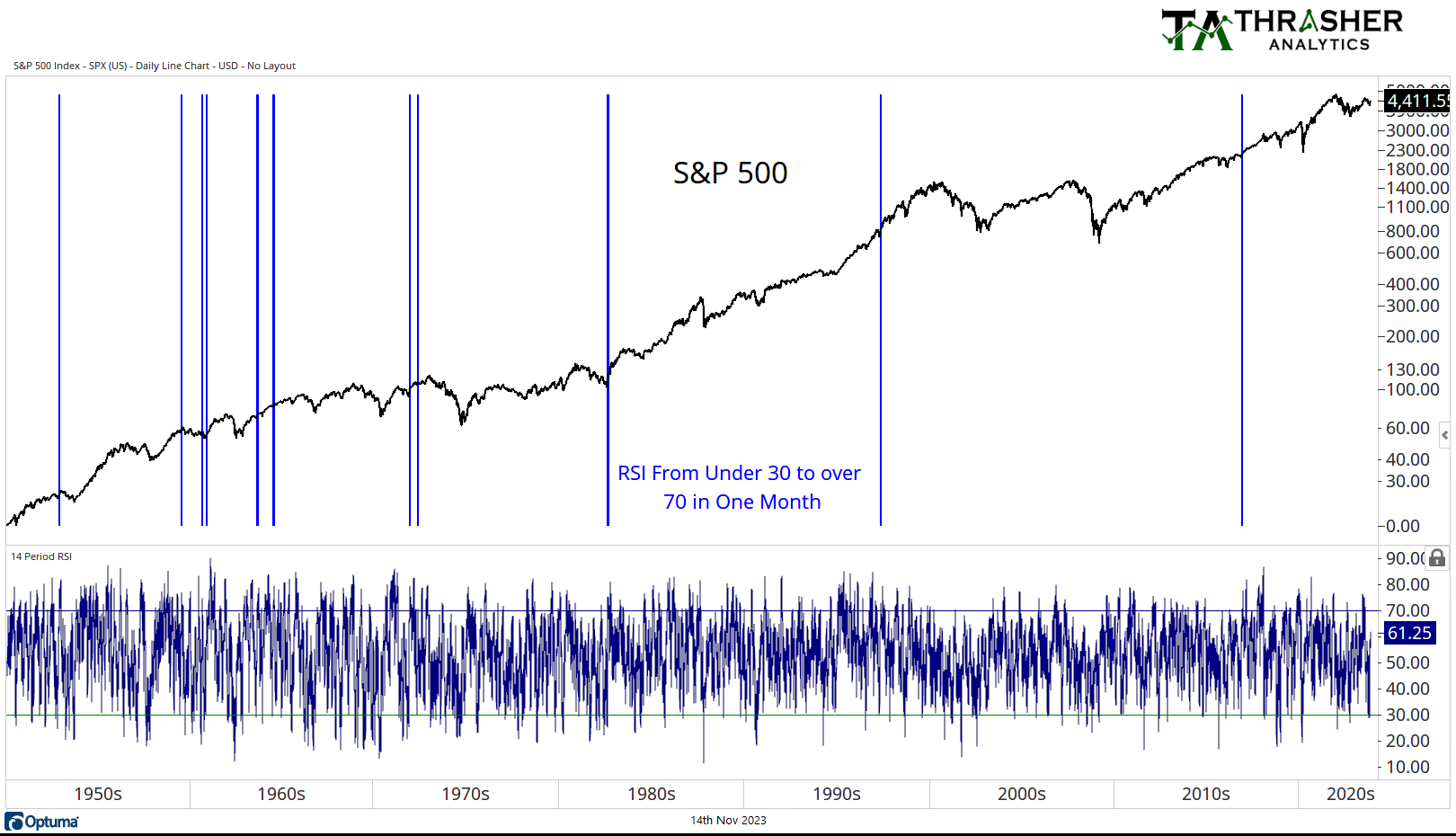

S&P 500 momentum rarely goes from ‘oversold’ to ‘overbought’ within one month.

Source: @AndrewThrasher