My Two-for-Tuesday morning train WFH reads:

• Stock Pickers Never Had a Chance Against Hard Math of the Market: In years like this one, when just a few big companies outperform, it’s hard to assemble a winning portfolio. (Businessweek) but see With cash earning 5%, why risk money on the stock market? Savings rates have rocketed and UK savers can earn over 5% on deposits. So doesn’t it make sense to cut risk and stick to the safety of cash? (Schroders)

• The Exact Age When You Make Your Best Financial Decisions There’s a magic number for when your expertise and cognitive powers align. (Wall Street Journal)

• Why Are Mortgage Rates So High? With the 10 year at 4.2% and inflation at 3.2%, mortgage rates should be lower…right? Mortgage rates typically trade a spread to the 10 year Treasury yield. If we were at 1990s spread levels we would be looking at mortgage rates of 5.7%. Even if we were at the average for the 2020s so far they would be at a more reasonable 6.4%. So why are spreads so high right now? (A Wealth of Common Sense) see also The Great and Awful Thing About These Interest Rates: The era of low interest rates is over. In the blink of an eye, the Fed went from punishing savers to punishing borrowers. If you’re depending on income to fund your retirement, 5% rates are a blessing. But if you’re in need of credit, current rates are a curse. (Irrelevant Investor)

• How To Be Lucky: What we get wrong about getting what we want: There are two contrasting ways of pursuing wealth, power and success. The approach that works the best is also the one most people ignore. (Sapient Capital)

• If the U.S. economy is doing well, why do so many Americans say it’s terrible? The leading economic indicators show the U.S. economy is performing well, but most Americans still believe economic conditions are extremely poor — as if the country was mired in a deep recession. What explains this discrepancy? (Popular Information) see also Is Partisanship Driving Consumer Sentiment? Does it make sense that current sentiment readings are worse than: 1. 1980-82 Double Dip Recession 2. 1987 Crash 3. 1990 Recession 4. 9/11 Terrorist Attacks 5. 2000-2003 Dotcom implosion 6. 2007-09 Great Financial Crisis 7. 2020 Pandemic Panic ?!? (The Big Picture)

• The Last Lyme Shot Failed. Can a New One Succeed? There’s been explosive growth in the number of cases of the disease since Lymerix was pulled from the market more than two decades ago. How much enthusiasm will there be for its replacement? (Businessweek)

• Businesses Want Remote Work, Just Not as Much: The enormous increase in remote work that occurred during the pandemic was a response to a temporary public health crisis. Now that the pandemic has passed, just how much remote work will persist and how much are businesses comfortable with? (Liberty Street Economics) see also Office Tenants Are Renewing Leases—but for Far Less Space: A record 217 million square feet of sublease space is also weighing down office values. (Wall Street Journal)

• The diaries of Amy Winehouse: ‘I’m the nutter of the class – loud and mouthing off!’ Using family photographs, journals, letters and handwritten lyrics, a new book sheds fresh light on the great singer’s life – while hinting at the tragedy to come. We publish exclusive images from the often heartbreaking work (The Guardian)

• What Your Insurer Is Trying to Tell You About Climate Change: Insurers are trying to send a message. The government is trying to suppress it. (The Atlantic) see also Rising Insurance Costs Start to Hit Home Sales: Vulnerable areas on coasts are first to feel impact of higher premiums (Wall Street Journal)

• Michael Jordan Is the Richest Basketball Player Ever With $3.5 Billion Fortune: The NBA legend’s wildly successful deal with Nike forms the cornerstone of his wealth, which has grown through endorsements and the sale of his majority stake in the Charlotte Hornets. (Bloomberg)

Be sure to check out our Masters in Business interview this weekend with Greg Davis, Chief Investment Officer of the Vanguard Group. Davis is responsible for the oversight of approximately $7 trillion managed by Vanguard fixed income, equity index, and quantitative equity groups. He also serves as a member of the Treasury Borrowing Advisory Committee of the US Treasury Department.

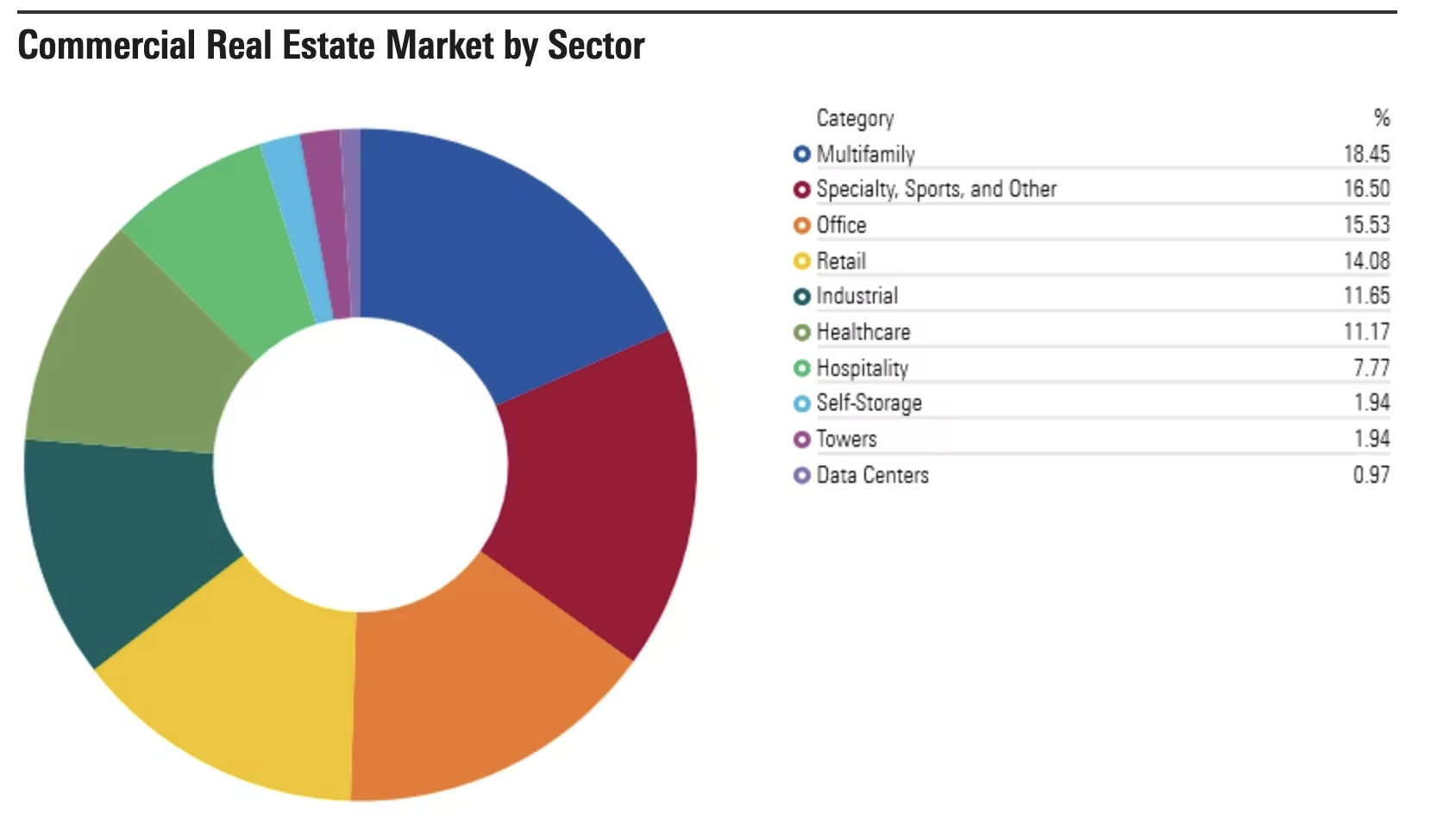

Commercial Real Estate Is in Trouble, but Not for the Reason You Think

Source: Morningstar