My end-of-week morning train WFH reads:

• Hip-hop stars and financial luminaries: Ritholtz Wealth Management redesigns the investment conference: Roughly 3,000 attendees are gathered to hear hip-hop legends Method Man and Redman, and financial headliners like Jeremy Siegel, Jeff Kleintop, Emily Roland, Cliff Asness, Jeff Gundlach and Jan van Eck. Plus there’s dancing, swimming, surfing, yoga, pizza and sushi and beer and wine sessions. Over four days, the emphasis is on personal interaction, with numerous “networking dinners” — giant parties for young RIAs and investors to get together and socialize. (CNBC)

• Everyone’s Worrying About China, But the Real Pain Is Coming From the Fed: For many countries, the side effects of higher US interest rates are taking a bigger toll than China’s slowdown. (Businessweek) see also The China Model Is Dead: The nation’s problems run so deep, and the necessary repairs would be so costly, that the time for a turnaround may already have passed. (The Atlantic)

• A Crafty Way to Earn Returns From the Inverted Yield Curve: Some allocators and managers are doing this, expecting a price pop ahead and collecting nice interest payouts along the way. (Chief Investment Officer)

• Amateurs Pile Into 24-Hour Options: ‘It’s Just Gambling’ Rookie speculators try to strike it big on short-term investments that often act like lottery tickets. (Wall Street Journal)

• Cable TV Is on Life Support, but a New Bundle Is Coming Alive: Cable companies have started to figure out a way to stay in the TV game: Reselling streaming services. (New York Times)

• Everybody Hates Marty: Martin Peretz would like a word. (The Baffler)

• 10 New Vehicles Join the American Electric Car Race: Tesla dominates the US market, but newcomers include the first electric models from Lexus and Fisker, two sedans from BMW and one mass-market Hyundai. (Bloomberg Green)

• Kim Jong Un: The US wants to engage North Korea but doesn’t know how. For decades, the West – and Washington particularly – has asked itself the question: how do you solve a problem like North Korea? (BBC)

• Kevin McCarthy Dares GOP Critics to Try to Oust Him: House speaker is working to avert a government shutdown. (Wall Street Journal)

• Mattel’s Windfall From ‘Barbie’ The company’s approach has paid off to a degree that even the C.E.O. could hardly have believed possible. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Elizabeth Burton, Managing Director and Client Investment Strategist at Goldman Sachs Asset Management. Previously, she was Chief Investment Officer of Hawaii’s Employees’ Retirement System (“HIERS”). She was named to Chief Investment Officer Magazines’ 40-Under-40, as well as winning the 2017 Industry Innovation Award, and a Power 100 member in 2019.

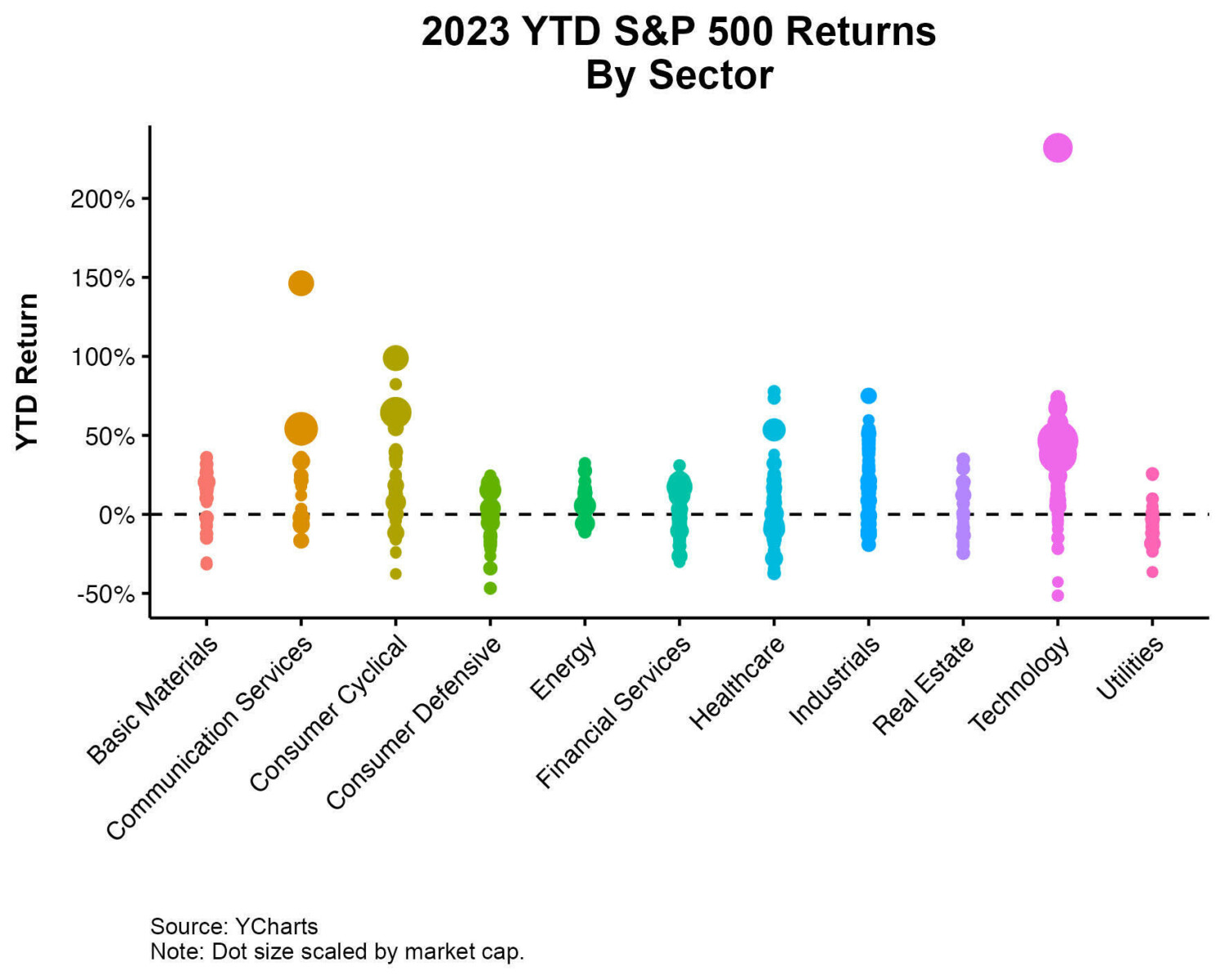

How all the stocks in the S&P 500 are performing within each sector

Source: Irrelevant Investor

Sign up for our reads-only mailing list here.