11 Financial Tips for Starting a Family

Starting a family is a big moment and a wonderful life transition! Babies are adorable, but having a family will have an impact on…your relationships, your health & well-being, and your wealth. Taking the time to develop a plan will help you and your partner get on the same page and strengthen your bond so you can enjoy your growing family.

I hope this helps you think through the financial demands of having a larger household and the impact on your spending plan, so you understand what you need to do financially to stay on track!

1. Review your health coverage. Plan for out-of-pocket costs for fertility treatments and costs to deliver your baby. Once your new dependent arrives your monthly premiums for healthcare will increase.

2. Plan for family leave from work. You may have reduced income if you take some time off from work.

3. Arrange for childcare. Childcare will likely represent the biggest increase to your monthly expenses. Explore the childcare options available to you and choose an option that is affordable for you.

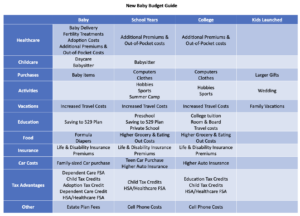

4. Make a new baby budget. Your spending plan will change as your child grows. There will be many competing demands on your money. Stay on track with this New Baby Budget Guide.

5. Top off your emergency fund. Your emergency fund should be 3-6 months of your expenses. With additional expenses and possible loss of income, make sure that your emergency fund is fully funded.

6. Get a social security number for your child. You can request a social security number along with your baby’s birth certificate.

7. Update your life and disability insurance. Now more than ever you want to have appropriate life and disability insurance coverage, so if something unexpected happens your family will be OK.

8. Start saving for college now. Saving for college is like saving for retirement, the earlier you get started the easier it is to save the money you will need to meet your goal. Open a 529 plan and begin contributing as soon as you can.

9. Start saving for future expenses. As your baby grows there will be additional expenses for kid activities, summer camps, hobbies, etc. Start saving and investing in a brokerage account so you have funds saved up to meet these future expenses.

10. Take advantage of tax breaks. There is some relief from all these increased expenses! Be sure to take advantage of child and dependent care tax credits when filing your taxes. Also, your employer may offer an opportunity to contribute to a Healthcare FSA, Dependent Care FSA and HSA, these plans allow you to make pre-tax contributions and use the money for eligible expenses tax-free.

11. Get your estate plan in order. Name a guardian for your child in the event something unexpected happens to you. Without the appropriate legal documents, the courts would decide who cares for your child.

Being a mom of two boys is one of the greatest joys in my life and it will be for you too! Just like with most things in life…taking the time to make a plan can provide you with peace of mind. If you need some guidance creating your New Baby Budget we can help!