My morning train reads:

• The Economy Is Great. Why Are Americans in Such a Rotten Mood? Lingering inflation can’t explain all of the unhappiness; maybe it is referred pain from the wider world. (Wall Street Journal)

• The Bond Market, a Sleeping Giant, Awakes: Soaring interest rates have the power to alter the direction of the economy and command the attention of Washington, our columnist says. (New York Times) see also World’s Safest Market Becomes a Magnet for Big Investors: US government debt was once among the sleepiest corners of finance. No longer. (Businessweek)

• The People Who Lost Serious Cash on NFTs: Five investors – whose losses range from a few thousand quid to $5 million – tell us what went wrong and what how they feel now. (Vice)

• At Fidelity, AI Provides Extra Eyes to Spot Red Flags: The artificial intelligence application Saifr uses natural language processing to help portfolio managers, sales and other staff review public-facing communication. (Chief Investment Officer)

• What’s Driving US Downtown Revivals: Despite hybrid work, major city centers from Nashville to Manhattan are filling up with people again. (CityLab) see also New York, Just Like I Pictured It: NYC has unique advantages regarding its outright size (output, labor force, purchasing power), business sector diversification and global financial sector dominance. Some NYC measures have now reached pre-pandemic levels: total employment, airport utilization and seated restaurant diners are notable examples. (J.P. Morgan Private Bank)

• X’s Tumultuous First Year Under Elon Musk, in Charts: The platform struggles to attract users and advertisers, third-party data suggest, while Musk has voiced optimism. (Wall Street Journal)

• Here’s the Truth Behind the Biggest (and Dumbest) Battery Myths: Yes, charging your phone overnight is bad for its battery. And no, you don’t need to turn off your device to give the battery a break. Here’s why. (Wired)

• 10 truths about food that people don’t want to believe: Subsidies didn’t create our terrible diets, Vegetables are a luxury product & Carbs aren’t uniquely fattening. (Washington Post)

• The World Solved Acid Rain. We Can Also Solve Climate Change: Lessons from how we tackled acid rain can be applied to our world today. (Scientific American)

• George Harrison, the quiet Beatle? Rubbish. Philip Norman’s new biography, ‘George Harrison: The Reluctant Beatle,’ tries to set the record straight on the misunderstood artist. (Washington Post)

Be sure to check out our Masters in Business this week with Zeke Faux, award-winning investigative reporter at BusinessWeek and Bloomberg News. He is the author of the new book, “Number Go Up: Inside Crypto’s Wild Rise and Staggering Fall.” The book is a hilarious deep dive into the many characters and scammers that have beset crypto.

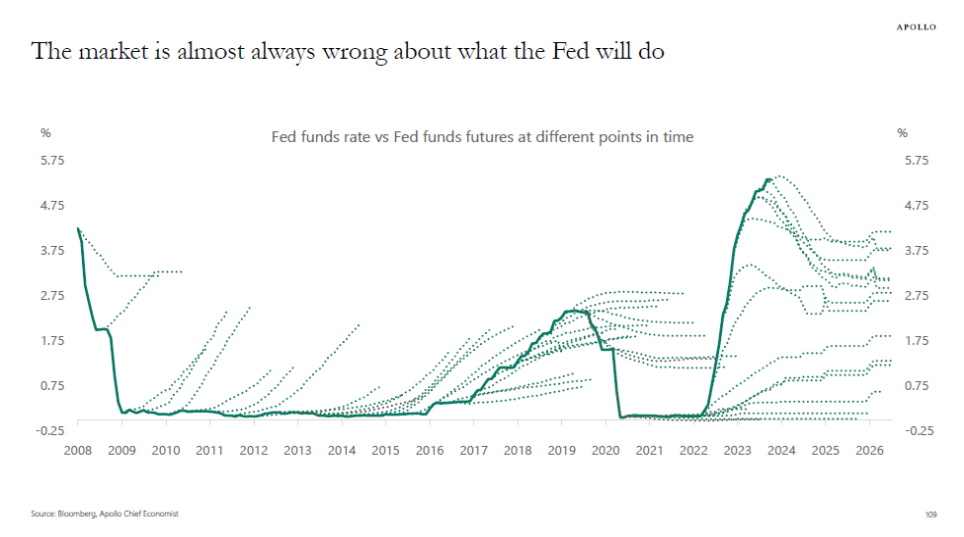

The market is almost always wrong about what the Fed will do beyond the next FOMC meeting

Source: Torsten Slok, Apollo Global Management

Sign up for our reads-only mailing list here.