Here are some things I think I am thinking about.

1) Another Good Labor Report.

Friday’s employment report showed another solid gain in employment. The underlying data remained a bit mixed, but on the whole the job gains were broad and consistent with reasonably strong aggregate demand. Which, is great on the one hand, and not so great on the other hand. It’s great for the continuing trend in decent economic growth. But it’s bad because it means that inflation is likely to linger a little longer than the Fed wants.

There was a bunch of chatter in the last few weeks about how the Fed might cut rates as early as Q1. Interest rates have come down substantially in the last month in anticipation of this, but we think this is all getting ahead of itself. The problem is that the Fed isn’t going to start cutting rates until they know they’ve defeated inflation. Historically speaking, the Fed generally cuts rates when core PCE is below 2.5%. But Core PCE is still at 3.5% so we’re quite a ways off from the rate cut level.

Based on recent data the glide path to 2-2.5% remains a slow pace. We think it could be H2 2024 before we see levels of inflation that give the Fed an official “all clear” for rate cuts. Until then the Fed is likely to keep the overnight rate at 5%+.

2) Vanguard Countercyclical indexing?

Here’s an interesting new paper from Vanguard on countercylically rebalancing a 60/40 portfolio to better meet return targets. I’ve always loved this concept because a static 60/40 portfolio has so many obvious potential flaws since the underlying markets aren’t static. Static rebalancing is a fine approach, but from a strictly efficient market approach it doesn’t make much sense because the market caps of stocks vs bonds isn’t static. The composition of the market change and the size of the relative markets changes a lot. So a more efficient market based portfolio (a truly passive indexing approach) actually requires a more dynamic rebalancing approach.

More interesting here is that John Bogle personally used a Countercyclical rebalancing methodology using valuations. He did so purely to maintain a fully invested portfolio that he was more comfortable with. For instance, when valuations blew out in the late 90s he rebalanced his 70/30 to 30/70. He wasn’t doing this to “beat the market”. He was doing it to remain more comfortable with his portfolio. Behavior is the main benefit of rebalancing and this sort of methodology just makes sense in our view.

What Vanguard is doing here is a bit different because they’re advocating for superior returns and still maintaining a static 60/40 weight, but they’re changing the underlying components in a more active manner to mitigate some of the procyclical trends in the underlying. It’s an interesting read, but I am surprised they haven’t created something more like the John Bogle approach given that they’re Vanguard. And hey, if you’re from Vanguard and you’re reading this don’t hesitate to reach out. We’ve been tweaking and working on a Countercyclical index for 10+ years!

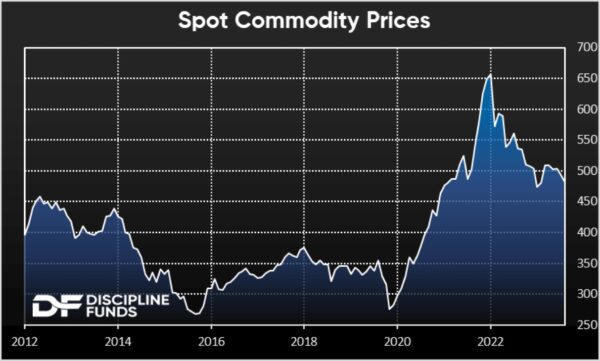

3) Commodities Can’t Catch a Bid.

2023 has been a pretty good year for financial markets as a whole. But one market that can’t catch a bid is commodities. Commodity prices are down 10%+ this year.

Now, this can be viewed in two ways. The pessimistic view is that it means global demand is falling. The optimistic view is that supply has outstripped demand and the recovery from the Covid supply chain mess is leading to lower prices.

The truth is probably somewhere in the middle, but leaning a bit more towards the latter. And that’s a good thing because it means that inflation isn’t resurgent even though aggregate demand has been stronger than many expected.

All of this means that inflation is likely to remain in a more disinflationary trend in the coming year. After all, commodities are one of the most important inputs in inflation data and the real-time commodity price data is all consistent with prices that are still high relative to the pre-Covid levels, but adjusting.

Have a great weekend. I hope your holiday season is off to a wonderful start. Personally, I am loving it. My daughters are just getting old enough to understand it all and it’s pretty fun getting to relive the holiday spirit through their eyes.