The Power of Tax Planning with the XY Tax Solutions Tax Team

Share this

Get a sneak peek at content reserved for XYPN members with XY Tax Solutions Office Hours program!

Available exclusively to XYPN members, each month one of XYTS's tax experts hosts an office hours session where tax-specific topics are discussed and attendees can ask any top-of-mind questions.

If you're interested in learning how adding tax planning benefits your business model and how to easily incorporate it into your service offerings, this session, hosted by XYPN's Director of Tax, Sam Nguyen, CFP®, EA is for you!

Enjoy the recording!

Some highlights include:

#1: Why tax planning is important

We all understand how unpleasant taxes can be: the tax codes are not easy to understand, people are afraid the government will come knocking on their doors if there is an error in their returns, and taxes are due so early into the following year.

Although taxes are unpleasant, it is important to mitigate a client’s tax expense as it is one of the largest expenses a client will have in their lifetime. Mitigating a client’s tax expenses helps the client achieve their financial, personal, and professional goals. How should one mitigate a client’s tax expense? Tax Planning! Financial planning and tax planning are very intertwined. When looking at the CFP exam, you can see that tax planning makes up 14% of the exam. Tax planning is a great way to not only mitigate a client’s tax expense but also add value to your services.

#2: Incorporating tax planning into your service offerings

There are many ways you can incorporate tax planning into your service offerings. You can do tax planning in-house, hire a tax professional to work at your firm, refer to or partner with an outside tax professional, or use XYTS.

If you are a DIYer, Holistiplan is a tax software that XYTS has seen a lot of DIYers use in the past. Holistplan provides an easy-to-use interface and provides reports that are aesthetically pleasing from what we have heard. In addition to Holistiplan, Bloomberg Income Tax Planner and Planner CS are great tax planning softwares to use. They do a lot more detailed calculations as they use the same calculations as tax preparation software however, their interfaces are less user-friendly and their reports are less aesthetically pleasing. If using a tax planning software is not for you, you could review their prior year returns or use Excel or Google templates if you are versed in the tax codes and feel comfortable using them.

#3: How services like XY Tax Solutions can help

XYTS can help you provide tax planning and preparation services to your clients. XYTS has the tax professionals, experience, and tax planning software to help provide detailed tax projections. We can review a tax plan you created or start from scratch on a new tax plan for your clients. In addition, we can help try to resolve tax issues such as IRS notices, state notices, preparing prior year returns, amending prior year returns, and preparing clients returns that they extended but haven’t filed.

#4: Examples of tax planning

Tax planning can cover a variety of options. A few examples of tax planning are:

- Tax projections: quarterly estimates withholding, etc.

- Retirement savings planning and Roth conversion projections

- Investments: tax loss/gain harvesting, asset location

- Employee equity and stock option planning

- Schedule C considerations: deductions, SE retirement

- Schedule C vs. S-Corp analysis

- Life events: filing status changes, moving states, etc.

- Charitable contribution strategies

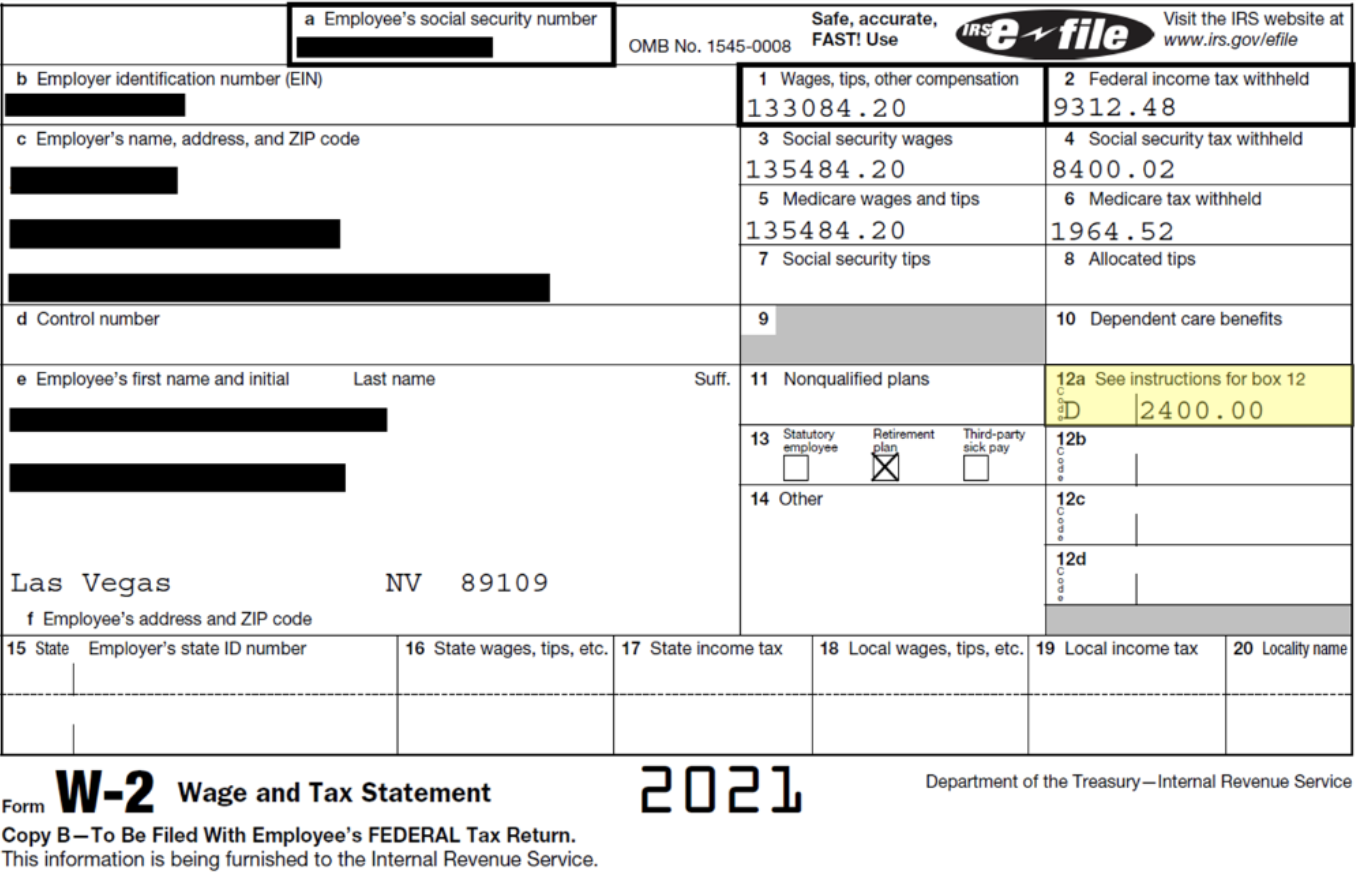

Retirement Contributions Example

The client did not max their retirement contributions (2021 – maximum was $19,500). Maximizing their retirement contributions could allow them to save more in taxes and contribute more to their retirement. For 2023 the maximum is $22,500 with a $7,500 catch-up contribution if 50 or older.

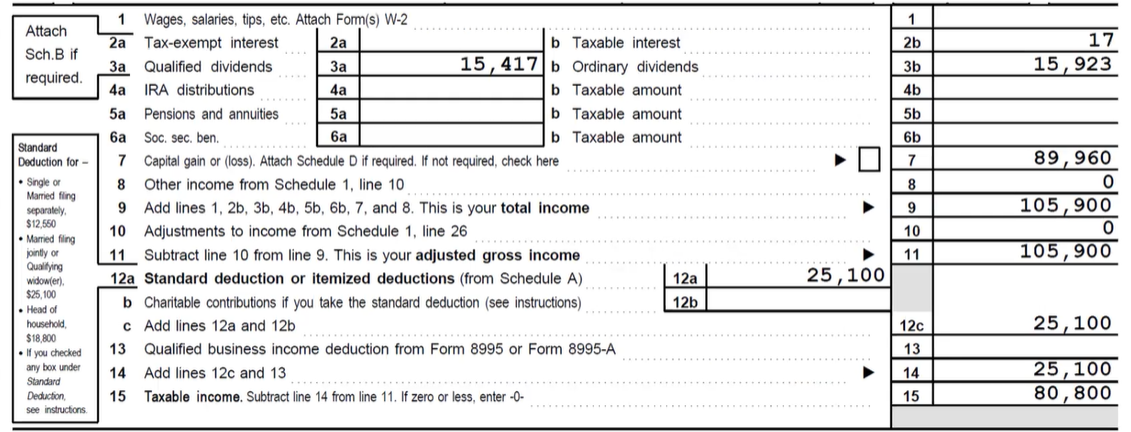

Investments: Long-term Capital Gain Harvesting

The client had $80,800 of taxable income in qualified dividends and long-term capital gains. The client was able to owe $0 of taxes due to taking advantage of the 0% long-term capital gains tax bracket and having the other income be from qualified dividends.

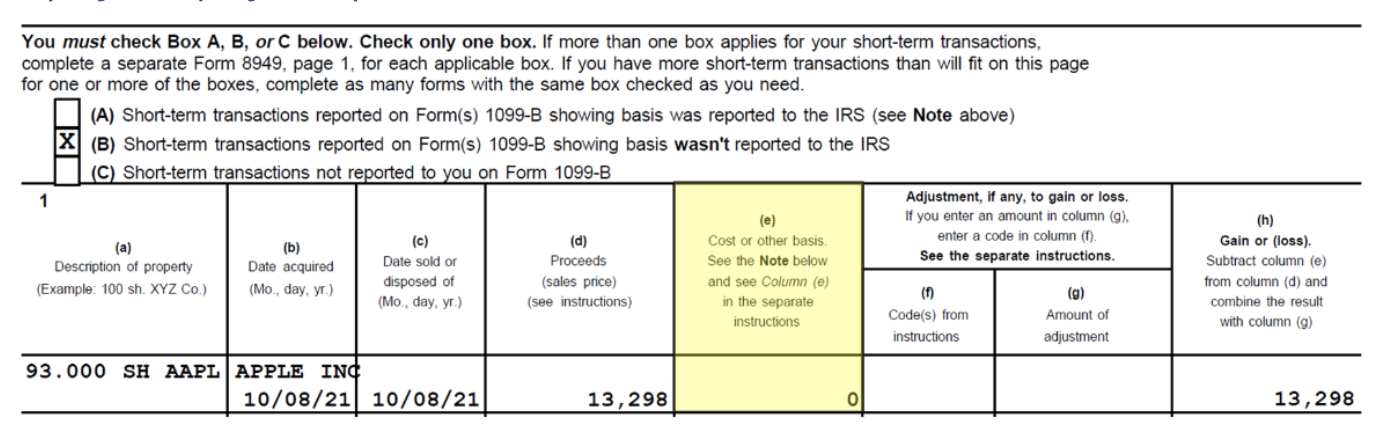

Employee Equity Compensation

The sale was reported with no basis on the client’s tax return. This could be due to the 1099-B showing no basis and the client not providing the basis to the tax preparer. The acquisition date and sale date are the same so there is a good chance that the sale is for Restricted Stock Units, Non-qualified Stock Options, or ISOs that were disqualifying dispositions. If this is the case, since the date sold and acquired are the same the cost basis should be the same as or very close to the proceeds. This could provide an opportunity for you to amend their return as well as make sure that the cost basis is accurately reported going forward.

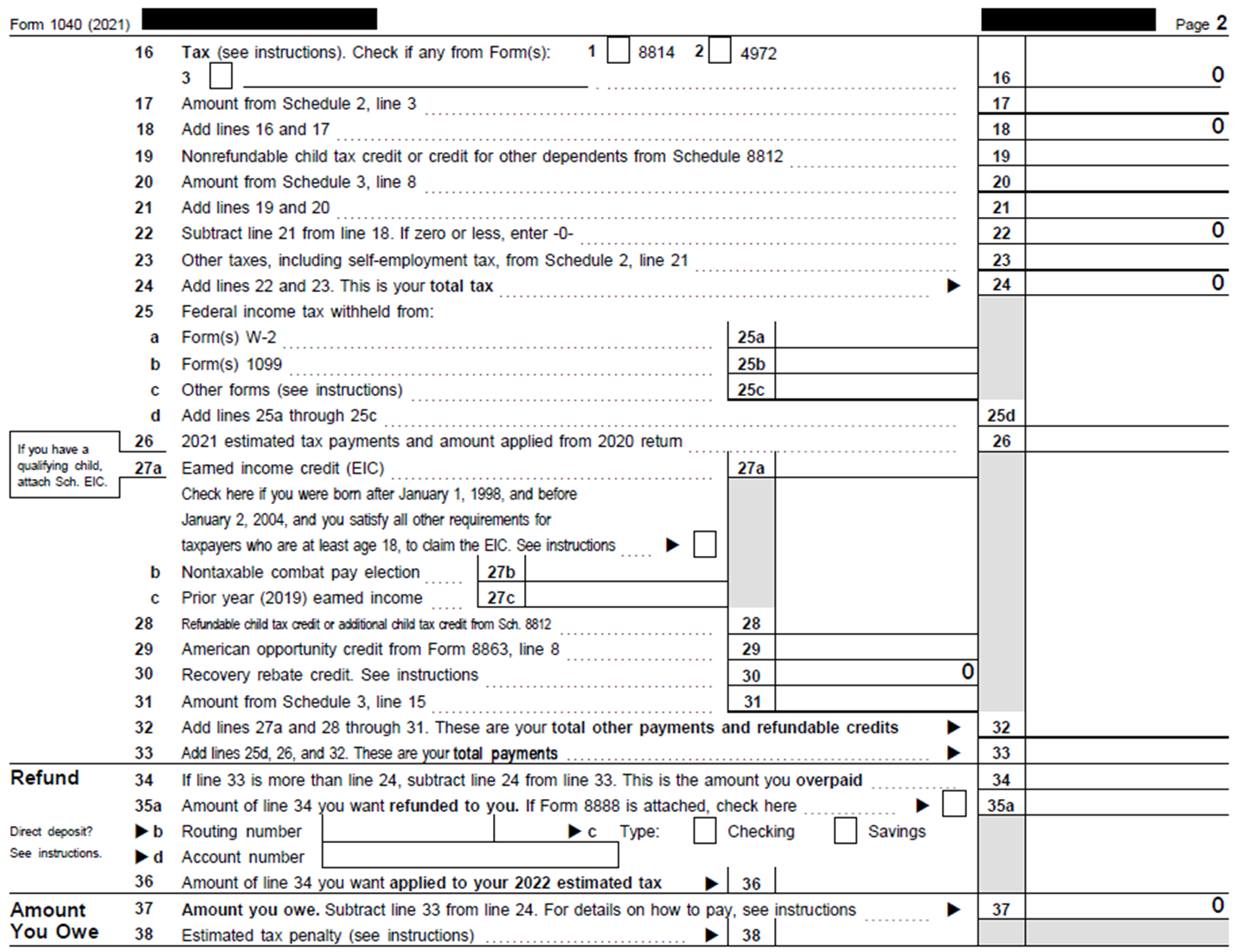

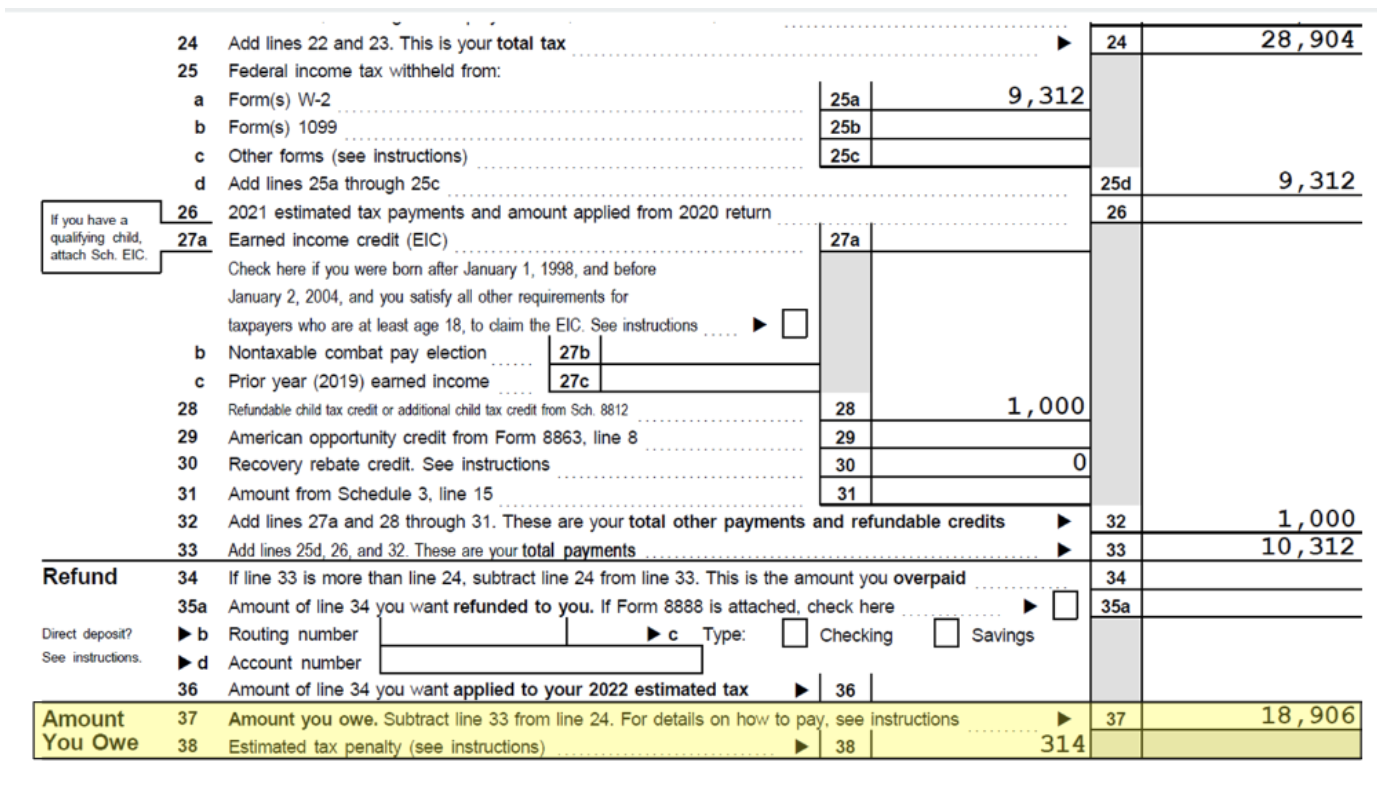

Quarterly Estimates and Withholding

There is an estimated tax penalty of $314 due to the very large amount due. This provides an opportunity for you to do tax planning to elevate a tax penalty going forward by looking at whether they need to increase their withholdings, make quarterly estimated tax payments, or do both.

All of this said we understand that anything tax-related can be stressful for you and your client. XYTS is here to support you both.

XYPN makes no representations or warranties regarding the timeliness, availability, accuracy, or completeness of any information in this material. Like any published material, the information provided may become outdated over time. XYPN undertakes no obligation to correct or update any content or information in this blog and reserves the right to alter or delete its content and information at any time.

About the Authors

About the Authors

Sam Nguyen is a Director of Tax at XYTS. He has over 11 years of experience in tax planning and preparation in the financial planning industry. He is an Enrolled Agent, a CERTIFIED FINANCIAL PLANNER™, and graduated from Virginia Tech’s financial planning program in 2009. Sam has extensive experience working with financial planners and their clients, and knows that understanding the goals and the comprehensive financial planning picture of a client allows for better tax planning and advising.

Kaitlin Holliday, CPA is a Tax Specialist at XY Tax Solutions. She is a graduate of Montana State University’s

Kaitlin Holliday, CPA is a Tax Specialist at XY Tax Solutions. She is a graduate of Montana State University’s

Master of Professional Accountancy program and earned her

Bachelor of Science in Business Administration with a focus in

Accounting. While earning her Bachelors and interning for Wipfli as a tax intern, Kaitlin found her passion for tax preparation and research.

Share this

- Fee-only advisor (381)

- Advice (305)

- Business Development (248)

- Independent Financial Advisor (203)

- Growing Your Firm (161)

- Marketing (133)

- Financial Planning (129)

- What Would Arlene Say (WWAS) (81)

- Business Coach (80)

- Firm Ownership (78)

- Training (75)

- Compliance (72)

- Business (69)

- Building Your Firm (65)

- Financial Advisors (63)

- Online Marketing (61)

- Events (59)

- Starting a Firm (52)

- Staffing & HR (49)

- Technology (49)

- From XYPN Members (48)

- Launching a firm (46)

- Advisors (41)

- Entrepreneurship (38)

- Taxes (37)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (31)

- Sales (27)

- Social Responsibility (27)

- Tax Preparation (27)

- XYPN Invest (26)

- Business Owner (25)

- Small Business Owner (20)

- Financial Management & Investment (19)

- Industry Trends & Insights (19)

- Financial Education (17)

- Financial Planners (17)

- Independent Financial Planner (17)

- Tech Stack (17)

- XYPN (17)

- Leadership & Vision (16)

- Investing (15)

- Niche (15)

- How to be a Financial Advisor (14)

- NextGen (14)

- RIA (14)

- Media (13)

- Preparing to Launch (13)

- Press Mentions (13)

- RIA Operations (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Goals (11)

- Scaling (10)

- Advisor Success (9)

- Building Your Firm (8)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Behavioral Finance (7)

- Growth (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Processes (6)

- Automation (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Mental Health (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- RIA Operations (5)

- Retirement (5)

- Risk and Investing (5)

- S Corpration (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Client Services (4)

- Outsourcing (4)

- Selling a Firm (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Budgeting (3)

- Career Changers (3)

- Engagement (3)

- Fiduciary (3)

- Getting Leads (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Partnership (3)

- Pricing (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Small Business (3)

- Staying Relevant (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Bookkeeping (2)

- Charitable Donations (2)

- Client Acquisition (2)

- Differentiation (2)

- Health Care (2)

- IRA (2)

- Inflation (2)

- Productivity (2)

- Implementing (1)

Subscribe by email

You May Also Like

These Related Stories

Your Guide to Tax Preparation and Tax Planning as an Advisor

8 Simple Tips to Optimize Tax Planning as an Advisor