My back-to-work morning train WFH reads:

• Is the Stock Market Gaslighting Us? A downturn in the market doesn’t always precede a downturn in the economy. Yes, the stock market is forward-looking, but sometimes it sees things that aren’t there. At its low, the S&P 500 was 25% below its high. It’s hard to completely dismiss this as a leading indicator and I’m not here to do that, but while most drawdowns of this magnitude have led to economic contractions, they haven’t always. (Irrelevant Investor)

• Cumulative vs. Cyclical Knowledge: Knowledge in some fields is cumulative. In other fields it’s cyclical (at best). (Collaborative Fund) see also In the Markets Nothing is as Dependable as Cycles: Nothing is more dependable than cycles because market psychology, fundamentals, risk appetite and investor emotions are constantly changing. Strategies, asset classes and securities go in and out of style in part because the pendulum always swings back and forth between fear and greed but also because the future is unknowable. (A Wealth of Common Sense)

• Why Stock Multiples Say the Market Could Continue to Drop: History suggests the stock market’s current bottom would be `the most expensive bear-market low.’ (Morningstar)

• The Home-Improvement Boom Isn’t Over Yet: The housing market has turned from hot to freezing cold, but spending on home renovation appears well insulated for now. (Wall Street Journal)

• The Front Trunk Is Electric Cars’ Most Divisive Feature: The “frunk” that comes standard with most electric vehicles is proving the best kind of marketing engine: one that runs on its own. (Green)

• How Twitter Will Change as a Private Company: The social media company went public in 2013. But Elon Musk is taking it private as part of his acquisition of the firm. Here’s what that means. (New York Times)

• China’s GDP blackout isn’t fooling anyone There is diminishing faith in the few economic indicators that, after years of obfuscation, still see the light of day. (Financial Times)

• How Genes Can Leap From Snakes to Frogs in Madagascar: The discovery of a hot spot for horizontal gene transfer draws attention to the possible roles of parasites and ecology in such changes. (Quanta Magazine)

• It’s a Bad Time to Be a Booster Slacker: Americans aren’t getting the new bivalent COVID shot. What does that mean for the looming winter wave? (The Atlantic)

• “Thank You, and Goodbye” On October 30, 2002, a cancer-stricken Warren Zevon returned to the ‘Late Show With David Letterman’ stage for one last performance. Twenty years later, Letterman and more remember the gravitas and emotion of that stunning night. (The Ringer)

Be sure to check out our Masters in Business interview this weekend with The Jeremies! Professor Jeremy Siegel of Wharton, and Jeremy Schwartz, Chief Investment Officer at the $75 billion Wisdom Tree Asset Management. Siegel is the author of Stocks For The Long Run; Schwartz is his research partner/editor. The two discuss the sixth edition of SFTLR, the latest and most widely expanded edition of the investment classic.

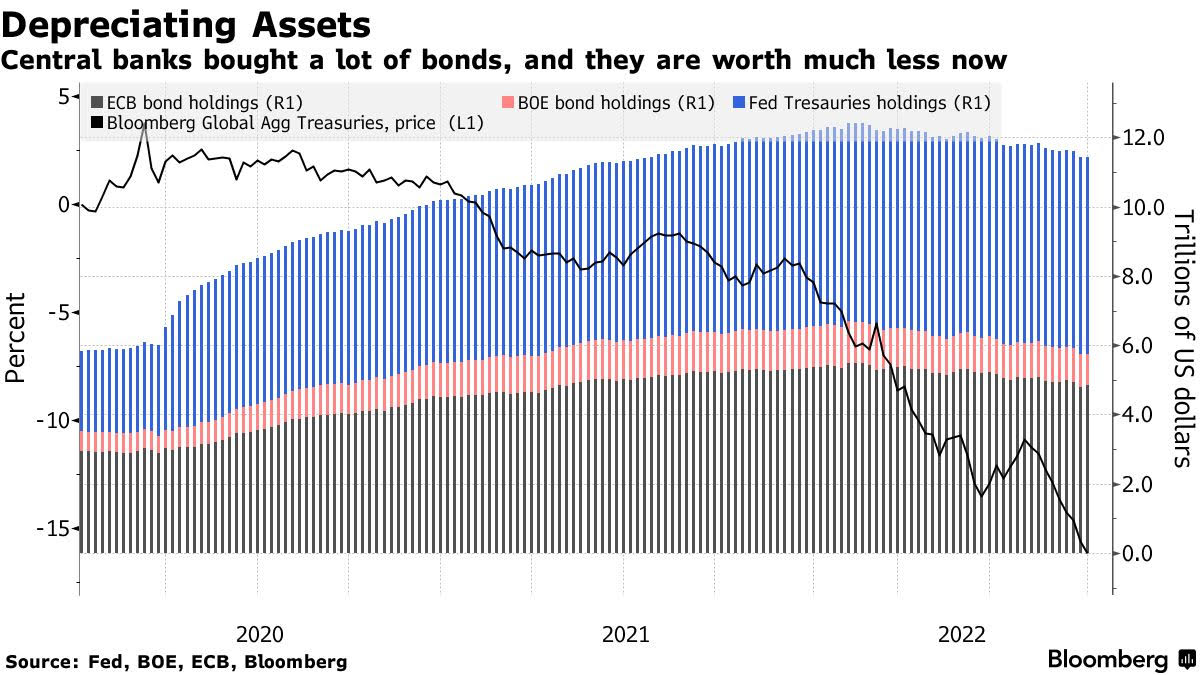

Fed Is Losing Billions, Wiping Out Profits That Funded Spending

Source: Bloomberg

Sign up for our reads-only mailing list here.