My end-of-week morning train WFH reads:

• The Home Buyer’s Quandary: Nobody’s Selling: Many are ready to move but don’t want to lose the low-rate mortgages they locked in a few years ago, crimping the supply of homes and keeping prices high (Wall Street Journal)

• Inflation Is Predictably Bad. That’s Progress. Rapidly rising prices have become a “known known” that the central bank and investors can incorporate into their decisions. It’s the surprise that can throw them off balance. (Bloomberg) see also 3% or Bust The FOMC’s 2% inflation target was a post-GFC, ZIRP/QE driven creature during a period of slow growth, no wage gains, and zero fiscal stimulus. Post-lockdown, pent-up demand met massive fiscal stimulus — $4 trillion in three CARES acts, an infrastructure and an inflation bill — to create a massive surge of consumer spending. The post-pandemic economy differs significantly from the 2010s. (The Big Picture)

• Who’s Not Sweating the Debt Ceiling? The Markets: Traders don’t believe that Congress is foolish enough to allow a default, and even if one were to occur, they are signaling it would be short-lived and less damaging than feared. (Bloomberg)

• The hidden force that shapes everything around us: Parking: It’s fueling the affordable housing crisis, worsening flooding, and driving us nuts. (Vox)

• The Executive Keeping Tesla Rolling Isn’t Elon Musk: Finance chief Zach Kirkhorn is little known outside the company, but inside he is widely admired for his skill navigating the demands of his boss. (Wall Street Journal)

• Almost Every Powerful Economist We Have Went to 1 of 6 Schools. That’s Not Great! New research shows how narrow the field of American economics has become.(Slate)

• Are the costs of Brexit big or small? Brexit has blown a sizeable hole in Britain’s economic model, accounting gor a 5.5% decrease in GDP; major reforms are needed to recover lost ground. (Centre For European Reform)

• 23 Pandemic Decisions That Actually Went Right: A lot went wrong with COVID, but the responses that worked could help guide us in future pandemics. (The Atlantic)

• Tribe: Why the Debt-Ceiling is Unconstitutional: The president should remind Congress and the nation, “I’m bound by my oath to preserve and protect the Constitution to prevent the country from defaulting on its debts for the first time in our entire history.” Above all, the president should say with clarity, “My duty faithfully to execute the laws extends to all the spending laws Congress has enacted, laws that bind whoever sits in this office — laws that Congress enacted without worrying about the statute capping the amount we can borrow.” (New York Times)

• Lost Movies: Almost three quarters of the golden age of Hollywood has been lost. Preservation only began when film came to be seen as art. (History Today)

Be sure to check out our Masters in Business interview this weekend with venture capitalist and seed investor Howard Lindzon. He is the founder and CIO of Social Leverage, where he makes early-stage investments. He founded Wall Strip (sold to CBS in 2007), co-founded StockTwits (which pioneered the ‘cashtag’ e.g., $AAPL), and was the first investor in Robin Hood. Social Leverage recently launched its 4th fund.

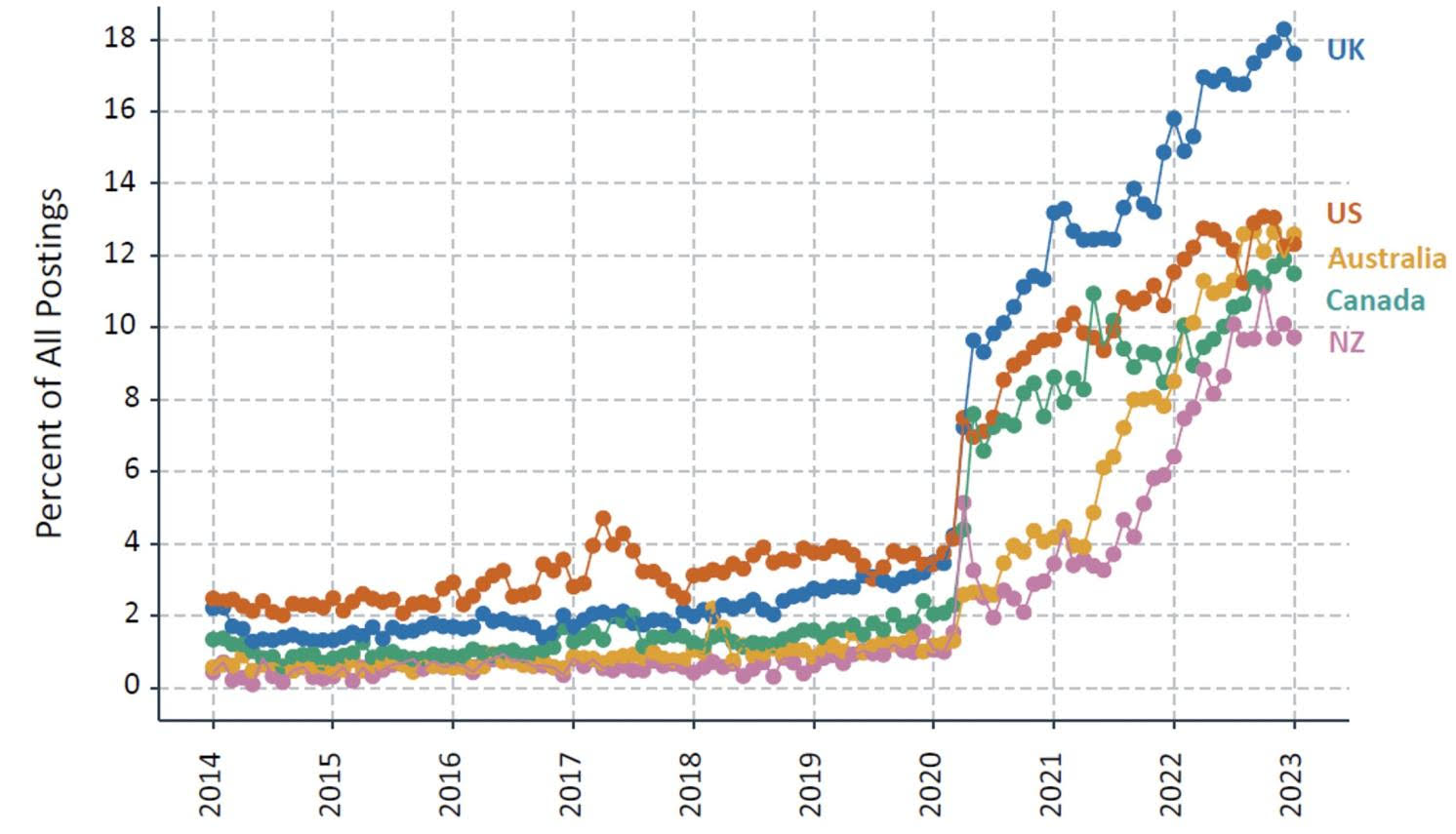

Vacancy postings that explicitly offer hybrid or fully remote work rose sharply in all five countries from 2020

Source: Vox EU

Sign up for our reads-only mailing list here.