How to Play Stock Market: Risk-Free

I'm very happy to have Myles Gage with us today. He's the co-founder, Chief Marketing Officer of Rapunzl Investments. It is a mobile application that allows individuals to simulate stock portfolios for you utilizing real-time market data.

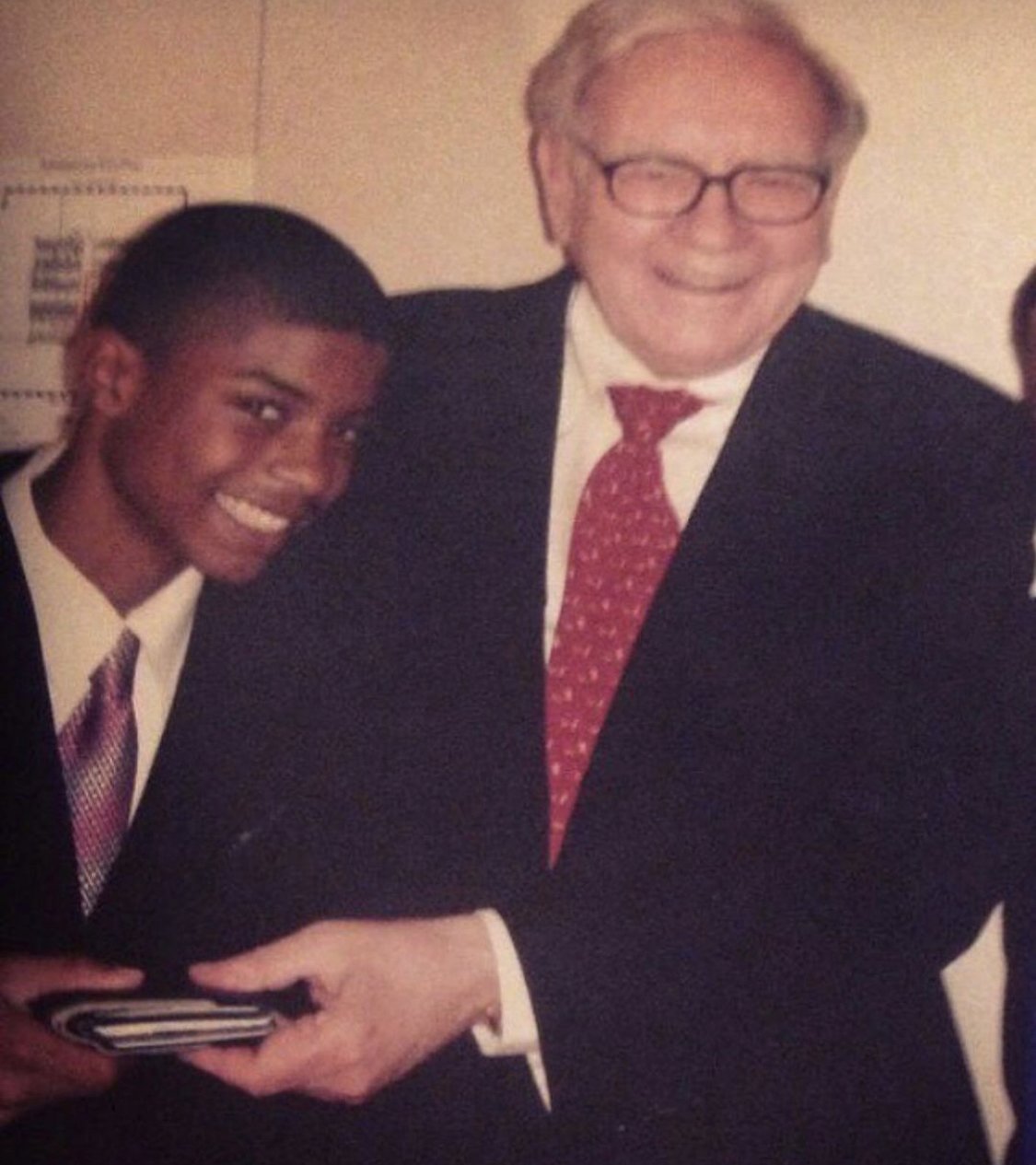

Myles has been an advocate for encouraging young people to invest in the stock market given his exposure to learning about it in elementary school where he won stock trading competitions and even got to hold Warren Buffet's wallet once! Myles began his career as a credit analyst at CIBC. He and his co-founder, Brian Curcio, realized that ordinary investors have paid a price to learn to invest — and that price typically was real money ending up in Wall Street’s pocket. Rapunzl was founded to provide an unparalleled investing education through fun (and free) investment competitions with scholarship and cash prizes.

In this episode, we’re discussing…

[2:04] How he gained exposure to the stock market through the elementary school

[3:49] His experience of holding Warren Buffet's wallet once won a competition in his eighth-grade school.

[5:10] How he started Rapunzl investments, how he reaches out to high schoolers and college kids, and Rapunzl goals itself

[9:54] What about people in their 30s or 40s or even older; the IRA and 401k

[11:49] Quit getting investment advice from Reddit

[15:37] His advice on people that like to do trading on apps that have ridden stocks into the ground and lost everything

[17:27] The basics of building a diversified portfolio

[21:18] How Gamifying the Stock Market

[23:19] How do they retain kids and young people since they have learned a different type of way

[24:36] Why do we need our children at a young age to get involved in this Rapunzl App

Myles Top Tip’s

“If you're never taught what to do with your paycheck, and how to save properly, or how to manage your money, then you're going to make all these poor decisions. And that's something that we've seen in society across the board. So, at an area, we started learning about personal finance and economics in first grade”

“We had the idea of creating a platform that would allow individuals to create simulator portfolios. And to paint the picture. This is around the time when mobile trading is becoming more popular and brokerage platforms are eliminating fees. So, its investing is more accessible. A lot of people that really don't understand the fundamentals are starting to create accounts and buying things that they hear on the internet, and ultimately losing money”

“Rapunzl is basically a mobile application that gives users 10,000 fictional dollars to buy and sell publicly traded companies in which users are able to see what their returns or losses would have been having they made those trades in real-time with real money. The platform is geared towards people that may be curious about investing, but don't know where to begin or apprehensive about putting money in the market especially for the younger demographic, that's such a great tool”

“We also have a bunch of educational tools. And they cover an array of financial concepts. It's something that our generation or just people in general, are in need of, especially as investing becomes more of a topic that's discussed in court are common conversations”

“The annual reports have the company's financial statement. You can look at the profit, you can look at the income statement and see if the company is profitable, you can compare those over years and see, is this company be more profitable year over year? Are they growing? You can also see a company's balance sheet so it gives you a snapshot of their financial health”

“There are several different industries that are listed on the Rapunzel app. And if you click the industry icon, you can see who the market leaders are. It provides resources or information on what the companies are, but I think everyone has to do their own independent research before they purchase a company. And that's going to vary from person to person, everyone has their own different strategy. What you like about a company may not be what someone else does. But that's what's unique about investing”

Do it on Rapunzl, then do it with your real money, to be honest, and I think that's one of the cool aspects about this is that, if you want to do a risky trade, or you want to be a trader, for however many periods you can test it out on Rapunzel, and you can enter a competition and maybe you win, or maybe you don't, but at the same time for those younger investors that may be doing that. It provides more light that maybe they're not good investors, but at the very least as they look at the leaderboard”

There was an acronym that was introduced to me in my investment club, which is called FETCH, and it represents five industries that are needed, regardless of the economic climate. The F stands for financial services, E stands for energy, T technology, C is communication, and H is healthcare. And those five industries are basically market cycle agnostic in the sense that, sure, they are impacted by recessions and bear markets. But at the same time, those businesses are always going to be needed”

“I think that competitions with scholarships are a great opportunity to expose students to the role that investing into the stock market. But, at the end of the day, doing your homework and doing your research, when it comes to making purchases with your actual money, that's serious. And I think that you have to do that. I don't think you can ever cheat that”

“If they do make money, then it's kind of like, alright, this worked for me. But then, at some point, if you don't have a philosophy or thesis, it's not going to work, because in theory that is gambling. But at the same time, this is where this generation is, and I think games are what's going to be more captivating to younger audiences”

Mike’s Top Tip’s

“It could also be for people that are in their 30s 40s, or even older that most of the people and I think in the world in the United States, it's the IRA, it's a 401k. And they don't get into individual stocks, they're just, here's the money and go at it. And because they may be a little apprehensive about buying it on their own. I think anyone could use this. I mean, if you're 45 years old, maybe I want to play around with it”

“I can see that even the universities themselves of teachers would absolutely love this app. Just teach people about the stock market, and in running the simulations, even if it's just during a classroom period. it's very cool. The heads kind of spinning, it's like on wow, I mean, this is just unbelievable”

Resources from Myles

ABOUT MYLES GAGE

Myles Gage is the Co-founder and Chief Marketing Officer of Rapunzl Investments a mobile application that allows individuals to simulate stock portfolios for utilizing real-time market data. Myles has been an advocate for encouraging young people to invest in the stock market given his exposure to learning about it in elementary school where he won stock trading competitions and even got to hold Warren Buffet's wallet once! Myles began his career as a credit analyst at CIBC. He and his co-founder, Brian Curcio, realized that ordinary investors have paid a price to learn to invest — and that price typically was real money ending up in Wall Street’s pocket. Rapunzl was founded to provide an unparalleled investing education through fun (and free) investment competitions with scholarship and cash prizes.