My morning train WFH reads:

• The Cult of the Retail Trader Has Fizzled: The GameStop and AMC manias are long gone, with individual investor returns falling 40% this year and digital currency prices tumbling. (Businessweek)

• FTX’s Bahamas Headquarters Was the First Clue: Bankman-Fried is just the latest in a long string of notorious characters who moved their business to the island nation, from the pirate Blackbeard to organized crime figures and assorted “financial wizards.” (Bloomberg) see also The Crypto Industry Struggles for a Way Forward: The implosion of the exchange FTX shows how an industry built in the wake of the 2008 financial crisis has drifted far from its original ideals. (New York Times)

• So When Will Stocks and Bonds Un-Link? It’s a rarity for the two main asset classes, almost always negatively correlated, to perform a duet. Here’s what allocators can do about that. (CIO)

• What’s Going On With the Housing Market? Home buyers and sellers are trying to make sense of a downturn that’s full of contradictions: Demand has seized up but supply is still low; prices are sliding but not plummeting; and no one can agree on what comes next. (Wall Street Journal)

• How Web Platforms Collapse: The Facebook Case Study: (The Honest Broker)

• If There Is a ‘Male Malaise’ With Work, Could One Answer Be at Sea? As concerns about labor force participation among American men mount, maritime transportation firms are desperate for new mariners. (New York Times)

• What Ukraine’s Drone Strike Deep in Russian Territory Means: This is a turning point, especially in showing Russia’s vulnerability. (Slate)

• We’re in Denial About the True Cost of a Twitter Implosion: Elon Musk’s platform may be hell, but it’s also where huge amounts of reputational and social wealth are invested. All of that is in peril. (Wired) see also Chris Hayes: Why I Want Twitter to Live: Unlike message boards that are segmented by interest (Reddit, for example), Twitter is a place where all kinds of perspectives and obscure expertise are instantly accessible and overlapping. (New York Times)

• The Ankylosaur’s Tail-Club Wasn’t Only Swinging at T. Rex: A dinosaur named for a demon dog in “Ghostbusters” had a sledgehammer attached to its rear. A new study found it could both shatter shins and woo potential mates. (New York Times)

• How the Kanye West Subreddit Finally Turned on Kanye West: Having witnessing Ye’s yearslong escalation from “dragon energy” mantras to open Hitler worship, many of these former stans are finally ready to leave their onetime idol behind—though not “the friends we made along the way,” as r/Kanye moderator Clement Leveau put it to me. “Kanye brought all of us together, but we don’t identify with him anymore.” (Slate)

Be sure to check out our Masters in Business next week with Kathleen McCarthy, Global Co-Head of Blackstone Real Estate. Blackstone is the world’s largest owner of commercial real estate globally with a $565 billion portfolio and $319 billion in investor capital.

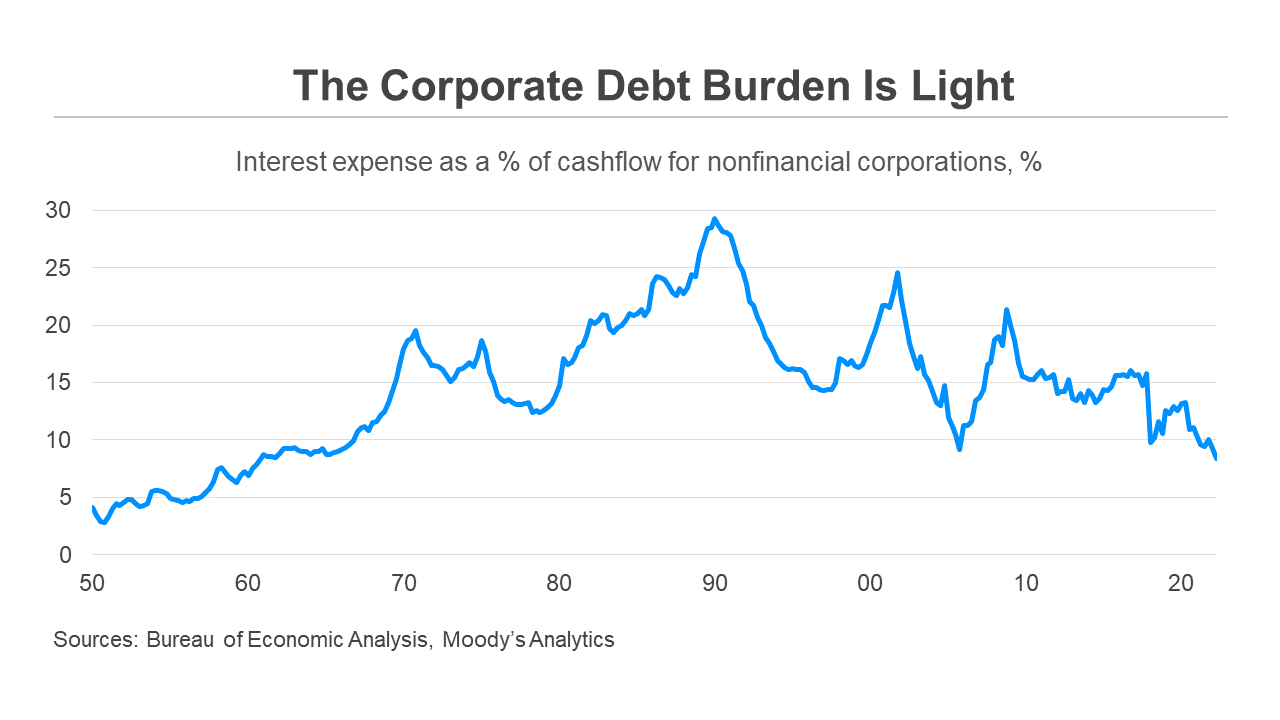

It has been 50 years since nonfinancial corporations devoted such a low % of cash flow to interest expense.

Source: @Markzandi

Sign up for our reads-only mailing list here.