My back-to-work morning train WFH reads:

• The Problem with Valuation. I have an issue with valuation models in general. Because basically all the valuation metrics tell the same story—U.S. stocks are overvalued, therefore, we should expect a major crash as these metrics return to their long-term historical averages. Whether you use Hussman’s measure, the Buffett indicator, or Shiller’s CAPE (cyclically-adjusted price-to-earnings) ratio, the logic is always the same. But, there’s a huge problem with this logic—there is nothing that says that these metrics have to return to their long-term averages… (Of Dollars and Data)

• How to spot an AI cheater: Students, lawyers and others are passing off writing drafted by artificial intelligence as their own. Alex O’Brien investigates the technological tools and critical thinking skills needed to identify if AI is the real author. (BBC) see also The $1 billion gamble to ensure AI doesn’t destroy humanity: The founders of Anthropic quit OpenAI to make a safe AI company. It’s easier said than done. (Vox)

• ‘No way out’: how video games use tricks from gambling to attract big spenders: Controversy over tactics used by some firms to target players who are on track to spend high sums (The Guardian)

• Why so many brands use sound to make you buy stuff: Netflix made sonic logos — the new version of jingles — trendy. But its success is hard to replicate. (The Hustle)

• Billions of Dollars Are Flowing, But Money Alone Can’t Fix US Infrastructure: Biden’s urge to claim political dividends from public works projects is running headlong into a local group’s efforts to rebuild lost neighborhoods in Ohio. (Businessweek)

• Europeans Are Becoming Poorer. ‘Yes, We’re All Worse Off.’ An aging population that values its free time set the stage for economic stagnation. Then came Covid-19 and Russia’s war in Ukraine. (Wall Street Journal)

• Maximum Canada is happening: Canada has a nation-building population strategy. Does America? (Noahpinion)

• She’s on a Mission From God: Suing Big Oil for Climate Damages: A lawyer started small with a creative tactic. It grew into an effort that could force fossil fuel companies to pay hundreds of billions in damages. (New York Times)

• Stephen Curry is too good to pretend his success is merely down to hard work: A new documentary on the four-time NBA champion shows a man driven by a grudge against those who doubted him. But there is more to his success. (The Guardian)

• The Impossible Story of the Bomb: Ever since its detonation in 1945, people have been grappling with the enormity of the atomic bomb’s power. This is the complex tale Christopher Nolan is trying to tell with ‘Oppenheimer.’ (The Ringer) see also Emily Blunt: ‘Women are still pressured to be warm and likable. Men are not’ The star of Christopher Nolan’s nuclear epic Oppenheimer discusses sexism in cinema, her support for the strikes and speaking a secret language with her sister.’ (The Guardian)

Be sure to check out our Masters in Business interview this weekend with Jawad Mian, CFA and Chartered Market Technician, who runs the independent global macro research and trading advisory firm Stray Reflections. The firm’s focus is on major investment themes, and its clients include many of the world’s largest hedge funds and alternative asset managers.

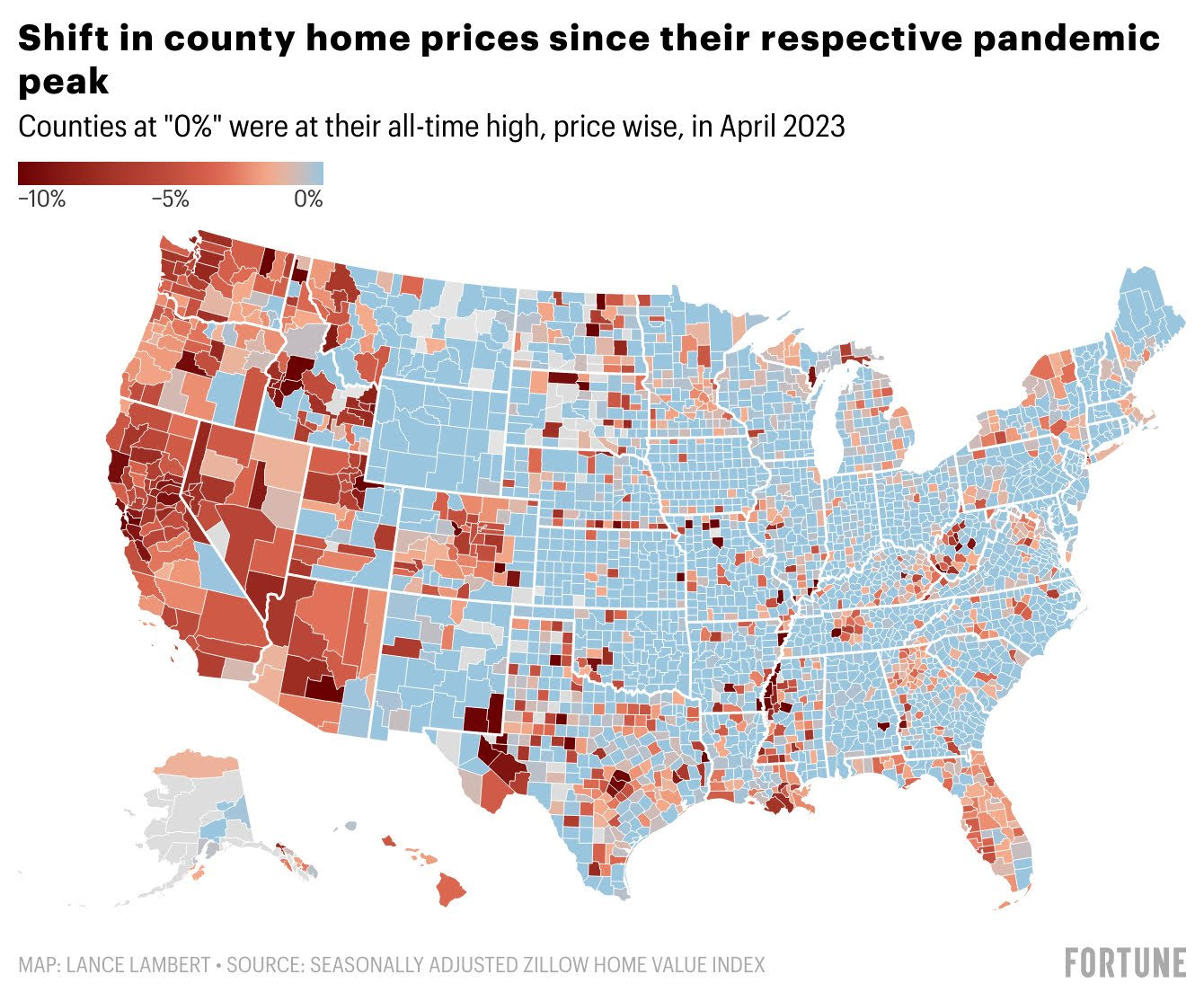

Every county shaded blue is at or just set a new all-time high for home prices

Source: Zillow Home Value Index via Lance Lambert

Sign up for our reads-only mailing list here.