My mid-week morning train reads:

• The insider: how Michael Lewis got a backstage pass for the fall of Sam Bankman-Fried: As author of The Big Short and Moneyball, Michael Lewis is perhaps the most celebrated journalist of his generation. Now he delivers an astonishing portrait of the fallen crypto billionaire. But did he get too close? (The Guardian) but see In Michael Lewis, Sam Bankman-Fried found his last and most willing victim. The main hazard in telling a big story through the eyes of its main participant is the need to rely on his version as the honest truth. Journalism schools will be able to use “Going Infinite: The Rise and Fall of a New Tycoon,” Michael Lewis’ new book about the collapse of the FTX cryptocurrency exchange and the fall of its boss, Sam Bankman-Fried, as a textbook on the imperative need to approach a subject with a healthy helping of skepticism. (Los Angeles Times)

• $67 Billion of Rare Minerals Is Buried Under One of the World’s Biggest Carbon Sinks: A fight is brewing in Canada about how, or whether, to dig out materials essential for EV batteries that lie deep beneath vast peat bogs. (Wall Street Journal)

• Why Almost Every Family Office Employee Is Getting a Fat Raise in 2023: The wealthiest families are fighting each other for a small pool of talent and driving up compensation. (Institutional Investor)

• The Yen Still Looks Weak. That’s Good for Japanese Stocks: Deflationary Japan is seeing unheard-of price rises, with core inflation staying above 3% annually for the past year. BOJ Governor Kazuo Ueda hinted in a press interview three weeks ago that the bank might respond by lifting its -0.1% prime interest rate, sparking a mini-rally in the yen. Then the bank stood pat at a Sept. 21 policy meeting, citing “extremely high uncertainties.” The yen then tumbled anew toward a record low of 150 to the dollar. (Barron’s)

• Why a US Recession Is Still Likely — and Coming Soon: The government is staying open for now. But Bloomberg Economics sees risks ahead, from strikes to higher rates and oil prices. (Bloomberg) see also A New Interest-Rate Regime Has Begun. These Are the Market’s Winners and Losers. Bond prices, the Magnificent Seven and emerging markets are under pressure. (Wall Street Journal)

• New York Loves to Hate Him. Can a $2.3 Billion Sphere Redeem Jim Dolan? Mr. Dolan, who controls the company that owns the Knicks and the Rangers, is set to open a behemoth arena in Las Vegas that he hopes will revolutionize live entertainment. Back home in New York, he is facing the wrath of lawyers, politicians and sports fans. (New York Times)

• Cybersecurity Investing Must Navigate Growth Slowdown: Despite the ongoing hacker threat, some customers are pulling back on digital defense spending. (Chief Investment Officer)

• How Many Microbes Does It Take to Make You Sick? Exposure to a virus isn’t an all-or-nothing proposition. The concept of “infectious dose” suggests ways to keep ourselves safer from harm. (Quanta Magazine)

• Why do people love living in Canada? Three of the Canada’s cities — Vancouver, Calgary and Toronto — are all ranked in the top 10 of the Global Liveability Index 2023, we speak to residents in each city to find out what makes life so sweet. (BBC)

• What ‘The Office’ reboot should look like, according to office workers:Dwight is now monitoring your key strokes, Stanley and Kevin are always black tiles on Zoom and there’s a new Gen Z office influencer filming everything. (Washington Post)

Be sure to check out our Masters in Business with Gary Cohn, Assistant to the President for Economic Policy and Director of the National Economic Council from 2017-2018; he was President and Chief Operating Officer of The Goldman Sachs Group from 2006-2016. Currently, he is Vice Chairman of IBM.

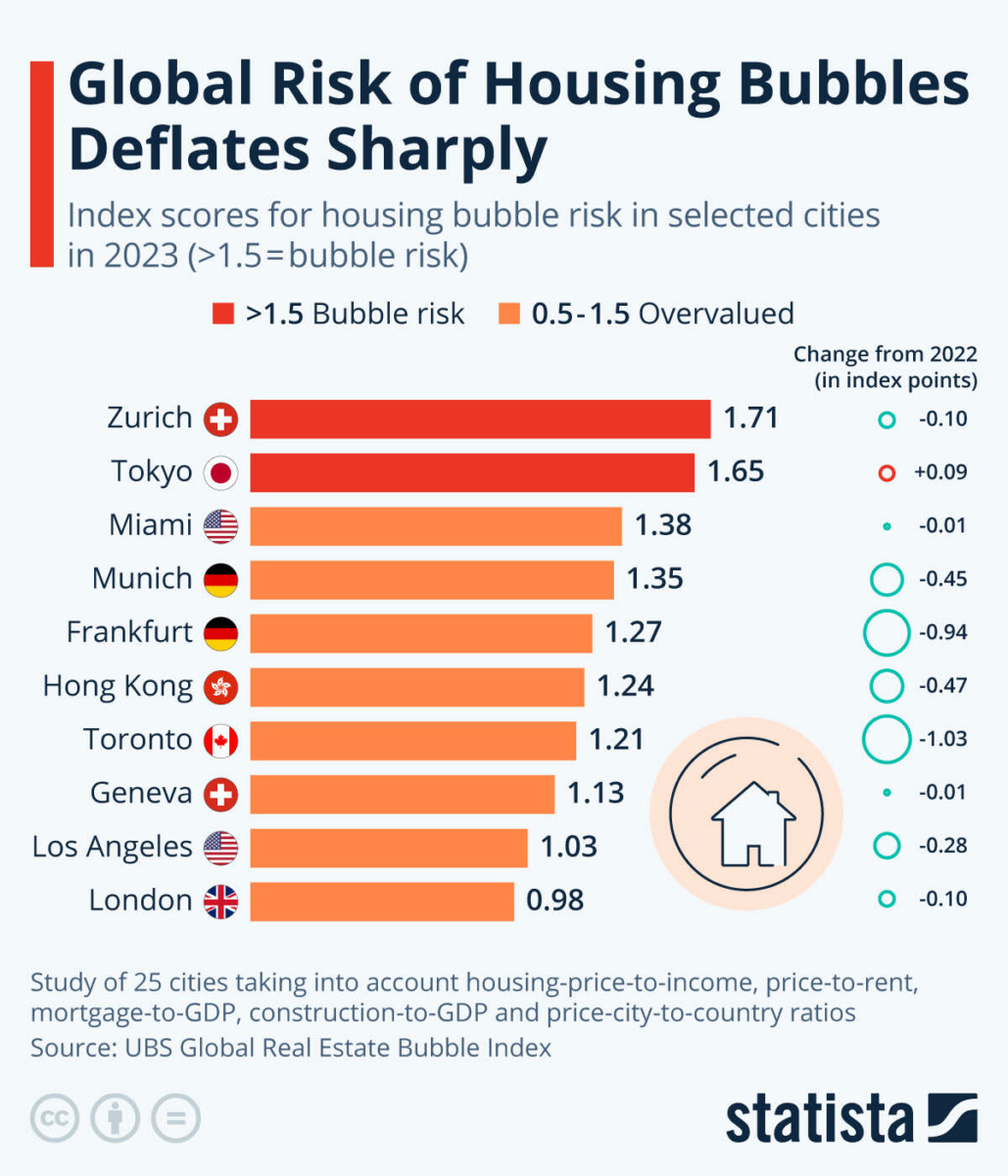

Global Risk of Housing Bubbles Deflates Sharply

Source: Statista

Sign up for our reads-only mailing list here.