My end-of-week morning train WFH reads:

• What Was Nate Silver’s Data Revolution? Silver, a former professional poker player, was in the business of measuring probabilities. Many readers mistook him for an oracle. (New Yorker)

• Beyond Meat Wannabes Are Failing as Hype and Money Fade: A shakeout in once-hot sector is widening as funding dries up; Consolidation could help winners emerge if growth rebounds (Bloomberg) see also Is it chicken? Here’s how the first bite of ‘cell-cultivated’ meat tastes: Short answer: Tastes like chicken. Longer answer: It’s strange to think of eating a totally new kind of meat — chicken that doesn’t come from a chicken, meat that will be sold as “cell-cultivated” chicken. (AP)

• US Supply Chains are Recovering: After a Years-long Supply-Chain Crisis, Relief is Finally Here—Especially in Key Sectors like Semiconductors and Motor Vehicles. (Apricitas Economics)

• Boaz versus BlackRock: the fight over closed-end funds: Saba founder says he never planned to be an activist investor. Now he’s battling BlackRock – again. (Risk.net)

• Tech’s Toughest Cuts Could Draw New Talent to Asset Management: Asset managers are eyeing thousands of workers laid off by the tech industry as asset management firms build out their own capabilities. (CIO)

• American Companies Are Hostage to the Whims of TikTok: The social-media giant has become ‘a billion-person focus group,’ disrupting business cycles and upending corporate R&D. (Wall Street Journal)

• Why it’s so hard to fix the information ecosystem: Misinformation is a job; correcting misinformation is a hobby. (Noahpinion)

• How much did Congress lose by defunding the IRS? Way more than we thought. Unfortunately, it’s likely to have the opposite effect. Every dollar available for auditing taxpayers generates many times that amount for government coffers — and the rate of return is especially astonishing for audits of the wealthiest Americans, according to new research. (Washington Post)

• Arnold Schwarzenegger’s Secret to Lasting Influence: He’s outmuscled and outsmarted his way to the tippity-top of bodybuilding, Hollywood, and politics. But can he master the art of online influence? (Men’s Health)

• The Real Lesson of The Truman Show: Twenty-five years later, the film’s most powerful insight isn’t about reality TV so much as the complicities of modern life. (The Atlantic)

Be sure to check out our Masters in Business next week with Peter Borish, founding partner at Tudor Investments, where he was Director of Research for 10 years working directly with Paul Tudor Jones. He has also been Chairman and CEO of Computer Trading Corp, and Chief Strategist for quant fund at Quad Group. Borish is also a founding trustee of the Robin Hood Foundation, formed with Paul Tudor Jones in 1988.

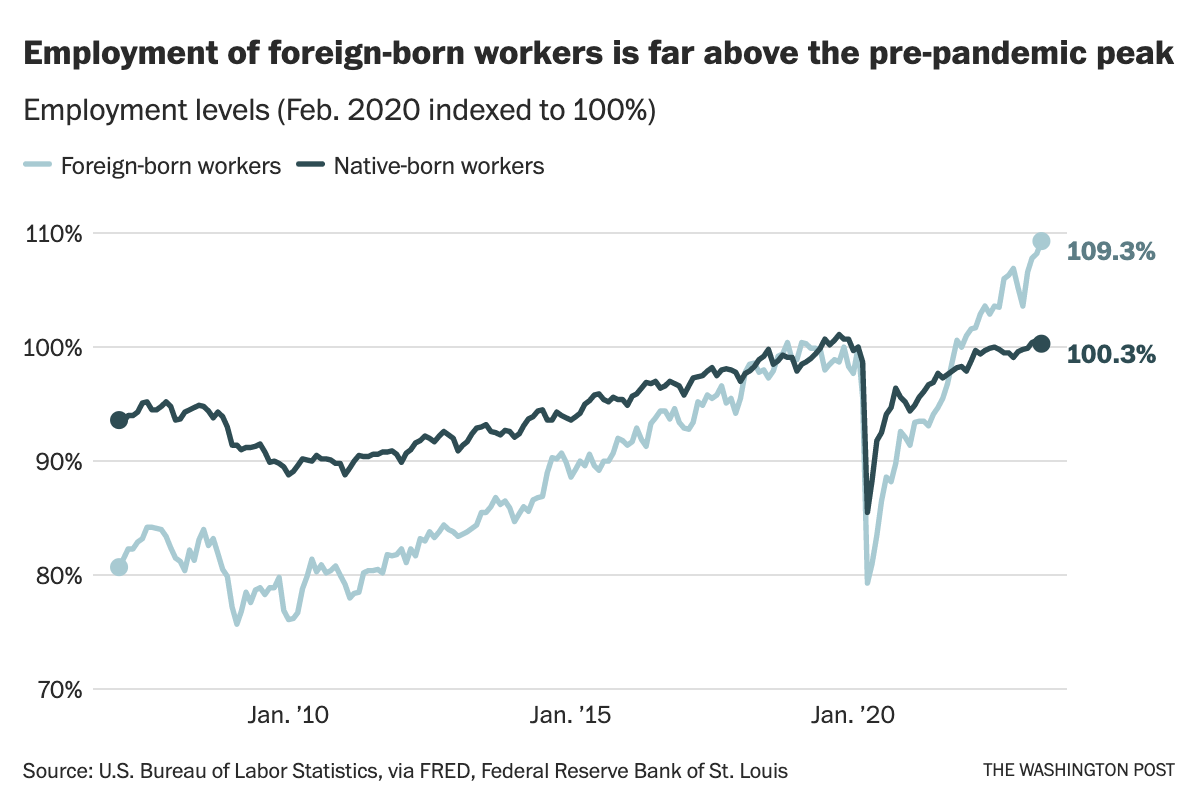

One reason for the surprise jobs boom? Immigrants are back.

Source: Washington Post

Sign up for our reads-only mailing list here.