My what am I doing in Orlando morning plane reads:

• It’s Time to Stop Crying About Bonds and Buy Them Instead: Treasuries have had one of their worst three-year stretches on record. Why it can’t get much worse. (Barron’s)

• Is E.S.G. Falling Out of Favor? Chevron’s $53 billion bid for Hess may drive consolidation in the oil patch. Meanwhile, investors are pulling back from climate-focused investment products. (New York Times) see also Why the Right’s Bud Light Boycott Worked: After 2020, brand politics moved left—and some consumers revolted. (Businessweek)

• Imaginary bitcoin ETFs are already 30 times more valuable than all the actual bitcoin ETFs: Two months ago a US judge said it was “arbitrary and capricious” that the SEC allows bitcoin futures ETFs while blocking ETFs that hold bitcoin. The ruling will probably force the SEC to approve spot bitcoin ETFs because its only other option, withdrawing previous approvals of futures ETFs, would be even more embarrassing. (Financial Times)

• When Sunset’s NOT SELLING: Nobody Is Buying the Fanciest LA Real Estate With a new mansion tax, fleeing insurers, and knock-on effects of the strike, multimillion-dollar homes are sitting, and sitting, on the market. (Vanity Fair)

• They Cracked the Code to a Locked USB Drive Worth $235 Million in Bitcoin. Then It Got Weird: lost the password to an encrypted USB drive holding 7,002 bitcoins. One team of hackers believes they can unlock it—if they can get Thomas to let them. (Wired)

• The restaurant nearest Google: Thai Food Near Me, Dentist Near Me, Notary Near Me, Plumber Near Me — businesses across the country picked names meant to outsmart Google Search. Does it actually work? (The Verge)

• It’s official: The era of China’s global dominance is over: Getting rich isn’t China’s big project anymore; the project is power. As a result, both the government’s priorities and its behavior have changed. In the past, whenever it seemed that a recession was on the horizon, the CCP came to the rescue. There’s no hefty stimulus coming this time. Nor will the explosive growth that experts once expected from China return. Beijing’s relationship with the outside world is no longer guided by the principles of economic rationality, but rather by its yearning for political power. (Business Insider)

• The ends of knowledge: Academics need to think harder about the purpose of their disciplines and whether some of those should come to an end. (Aeon)

• Hear that? It’s the sound of leaf blower bans. As restrictions spread, neighborhoods are getting quieter — and cleaner. (Grist)

• Taylor Swift’s 1989: Her biggest album returns with new tracks from the vault: On Friday, Taylor Swift released a new version of 1989 – the biggest-selling album of her career, and the one that definitively turned her into a pop star. Featuring hits like Shake It Off, Blank Space and Style, it was originally written during the 2013-14 Red Tour, with demos stored on her phone in a folder named “Sailor Twips”. Awarded a Grammy for album of the year, it has spent 325 weeks in the UK charts. But now she has re-recorded it as the latest part of an ongoing campaign to regain control of her work, after an investment company bought her master tapes in 2019. (BBC)

Be sure to check out our Masters in Business this week with Michael Carmen, who is the Co-Head of Private Markets at Wellington Management. He manages a diversified portfolio of late-stage growth equity in technology, consumer, health care, and financial services sectors. Wellington is one of the world’s top 20 asset managers, was founded in 1933, and runs $1.2 trillion in client assets.

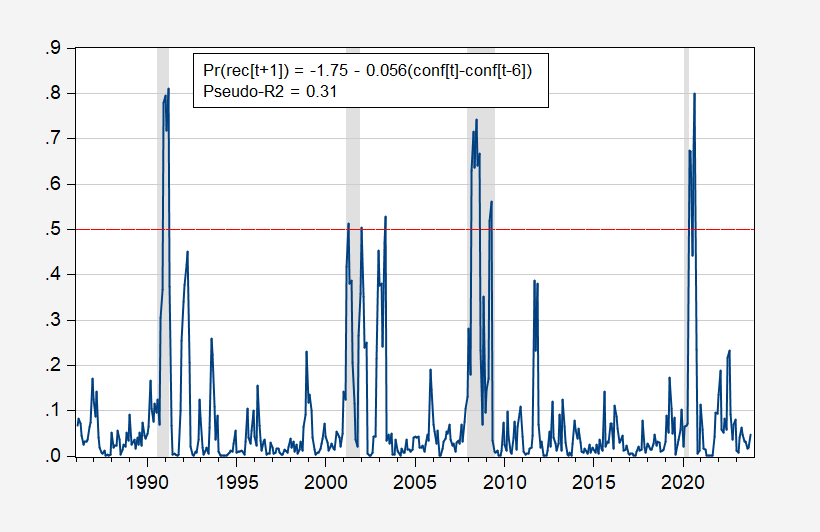

Does the Confidence Index Say We’re in a Recession?

Source: Econbrowser

Sign up for our reads-only mailing list here.