Here are three things I think I am thinking about this weekend.

1) SBF is not an effective altruist. Michael Lewis has been a literary hero of mine for decades. Liars Poker was a book that both excited me about getting into the financial services industry and also made me deeply question the motives of people in the financial services industry. So I was surprised this week to see Lewis doing a book tour and framing Sam Bankman Fried as a good person who just flew too close to the sun. He even went so far as to distance SBF from Bernie Madoff.

I have a take a deep breath here because this one actually makes me mad. SBF is exactly how most Bernie Madoff’s start. The only difference is that SBF got caught quickly. You see, most financial services ponzi schemes start with good intentions. It’s usually someone with dreams of generating huge returns running a fancy strategy that blows up. It often involves commingling client funds with firm funds. And in an effort to climb out of the hole they exploded they oftentimes make things worse. And before you know it this well-meaning person is in a financial hole so deep that they have almost no choice but to try to continue digging in the hope that no one ever asks for the shovel. In the case of SBF people asked for the shovel quickly. In the case of Bernie Madoff it took 20 years for people to ask for enough shovels to realize that he was digging with his hands.

I’m a little disheartened by the Lewis commentary because he’s trying to diminish the severity of what happened here by claiming that SBF ran a good business on one side and got into hot water in an unrelated hedge fund. Okay, but this is precisely what Madoff did. Madoff Securities was one of the largest and most innovative market makers on Wall Street for many decades. They ran a large and legitimately great business. They were also commingling client funds and running the fraud in accounts on the side. This is almost exactly what SBF was allegedly doing.

This kills me because the lack of compliance is so egregious that it’s inexcusable. I don’t care that Sam or Bernie seemed like good guys. They were negligent about compliance and commingling of funds. According to Lewis, SBF treated everything like a game inside his unregulated casino. But this is exactly why casinos (and financial firms) need to be regulated. SBF isn’t just a guy who flew too close to the sun. He’s as prone to irrationality as the rest of us and that’s why sensible regulations need to exist. There’s no excuse for this sort of thing to be happening in an age where third party firewalls are the easiest first line of defense in finance.

2) Interest rates – Doom or Boom? There are two camps on the recent rise in long-term interest rates. On the one side you have the doomers and on the other you have the boomers. The doomers say that “bond vigilantes” are driving up interest rates because the US government is insolvent and they’re forcing rates up. The boomers say the economy is booming and that means interest rates are repricing higher to account for the scenario where the Fed remains higher for longer.

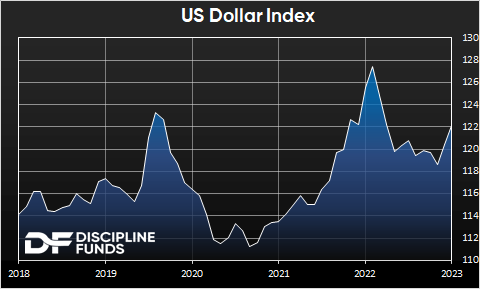

There’s probably some shred of truth to both camps, but I tend to fall more into the boomer camp. The bottom line is that the doomer narrative doesn’t make much sense in a world where the US Dollar is surging relative to everything else. As you can see in the accompanying chart, the US Dollar index has been rising in recent months at the same time longer yields are rising. This is a sign that demand for Dollars is rising even if demand for long bonds is declining. This isn’t indicative of doom. This is more consistent with the boom narrative and interest rates are adjusting because the Fed is likely to keep rates higher for longer because of the stronger than expected economy.

This is important to understand in the context of government “solvency”. As I’ve written many times in the past, the US government cannot run out of money. It has a printing press. But it can destroy demand for the currency and that would show up not only as inflation, but also as a collapse in the foreign exchange rate. That clearly isn’t happening so even though the US government’s finances look abysmal, the recent rise in yields isn’t consistent with a narrative that says demand for Dollars is declining.

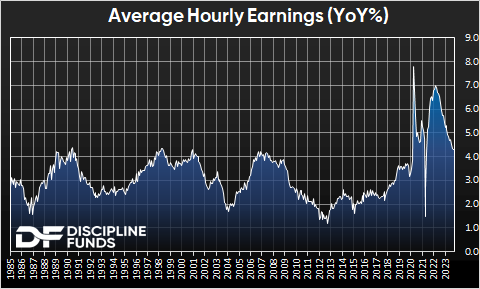

3) Labor Market Keeps Defying the Fed. We got another interesting labor market report on Friday. The private sector added 263K jobs, well above expectations of 150K. And while the headline figure is always interesting it also gets revised heavily so it’s not always useful to read too much into this. What is useful, however, is the average hourly earnings. And that showed another steady decline in wages.

This continues what has been one of the most dominant trends all year. Disinflation is becoming increasingly entrenched and there’s virtually no signs of a wage spiral like we saw in the 1970s. But the data just isn’t coming down as fast as the Fed would like so they’re continuing to err on the more cautious side. Which is understandable, but also putting them in a strange situation where the longer they stay tighter, the higher the odds of a mistake become. It’s as if they’ve achieved this so-called “soft landing”, but instead of putting the plane in the hangar and declaring victory they’re slamming the brakes on just in case.

I hope you have a wonderful weekend. We’ll be off early next week as I am making it to the Grand Canyon for the first time in my life. And boy it will be a doozy as we’re doing the famous Rim 2 Rim 2 Rim hike. 50 miles of pain in what should be a beautiful background. I’d prefer to T-Bill and Chill, but I guess we all need some diversification in life.