As discussed in Part 1 of this blog series, the Certified Financial Planner (CFPⓇ) exam can be a stressful and intimidating experience. With eight areas of content to cover – both as siloed financial knowledge and also as an integrated approach to building a comprehensive financial plan – it’s important to be organized and intentional in your study efforts.

One CRITICAL distinction to make – the CFP Review Course and the CFP Coursework Requirements are NOT the same:

- The CFP Review Course (which we are covering in this blog series) is not required by the CFP Board to pass the exam, and you do not have to complete the review course prior to sitting for the exam. Still, I’d imagine that most candidates find the review course immensely valuable (if not critical) to passing the CFP Board Exam and will, therefore build in enough time after finishing the required coursework to also complete the review course (further discussion on the required timeline below). From the CFP website:

- The CFP Coursework Requirement (which we are not covering in this blog series) is required by the CFP Board in order to sit for the exam and must be completed and verified by the CFP Board by the designated date for each exam window (typically about a month and a half before the exam date).

(**Note that there are alternative pathways that are detailed on the CFP site, and worth reviewing to determine if you are eligible to bypass any of the coursework requirements)

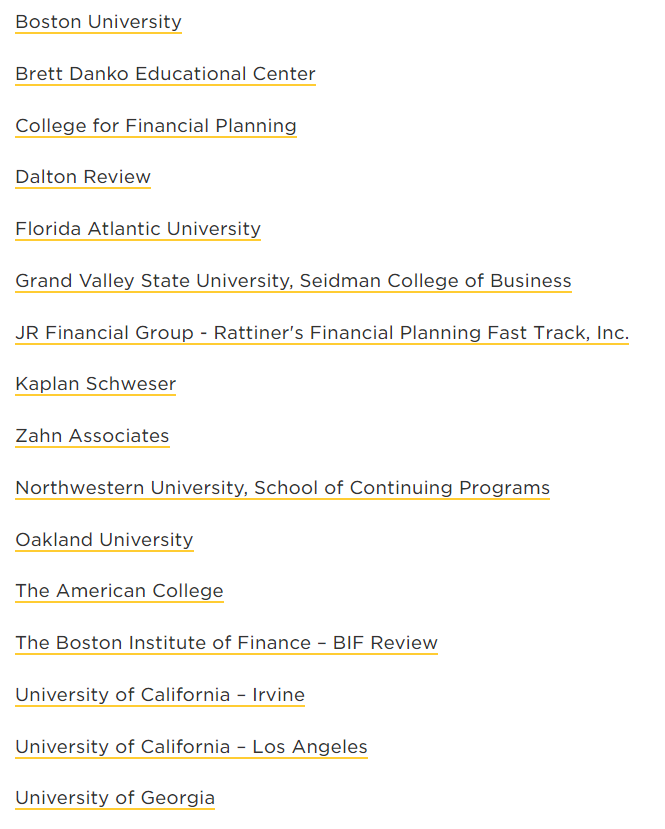

Now that we have that straightened out, let’s dive in on how to choose a CFP Review Course. The CFP website has a list of courses that I would imagine (hope) they’ve at least screened for efficacy, although they disclaim that “these courses and their providers are not endorsed or recommended by CFP Board.” By visiting the link above, you can click on each of these courses and review the specifics.

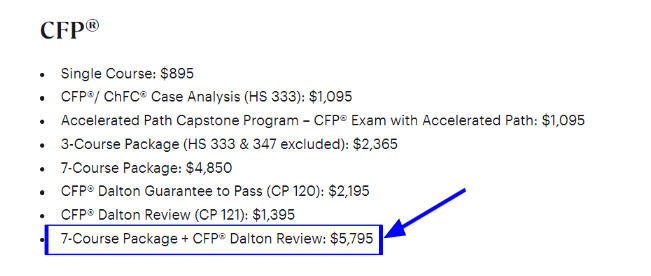

One of the situations you may find yourself in (which I did) is the option to bundle your CFP Coursework Requirement with a CFP Review Course for a discounted price across both. For example, I chose to complete my CFP Coursework Requirement at The American College of Financial Services, which is offered as single courses, packaged courses, and also the option to bundle the 7-course package with the CFP Dalton Review (which is what I elected to do) –

In retrospect, this involved a TON of front-loaded decisions that I shot at from the hip (fortunately…it ended up working out🙌). Of course now I recognize I could have wasted a ton of time and money trying to become a CFP (as many people do). My goal with this blog is – in part – to help some of you mitigate those potentially lost dollars and efforts and find the path to a CFP certification course that best aligns with your resources and needs. So, with that said, here are a few things that you’ll want to consider as you choose a CFP Review Course:

- COST

The cost of prep courses varies WIDELY – from a low end of $599 (Kaplan) to a high end of $2195 (Brett Danko & Dalton Review), with add-ons and potential travel expenses that could push the all-in cost even higher. While there is some truth to the old adage, “you get what you pay for,” cost may not be the most helpful sorting mechanism.

One thing to be cautious about is paying extra for “pass guarantees” without considering some of the embedded requirements in order to be able to utilize the full guarantee. For example, Dalton Review’s Guarantee to Pass program is $800 more than their regular review course. While it does include additional study materials, the full refund benefit can only be accessed if you achieve a minimum score of 70% on their proprietary “Exam Readiness Quiz” and then subsequently fail the CFP Board Exam. Interestingly, they advertise that a 70%+ on their Exam Readiness Quiz affords you a ~85%+ chance of also passing the CFP Board Exam, meaning the chances for fulfilling the necessary refund eligibility requirements and then actually failing the exam (and therefore cashing in on your refund) are pretty low.

Alternatively, the Brett Danko course also has an $800 up-charge option, but this one doesn’t seem to come with any pass promises and is more of a straightforward exchange of dollars for value: an additional 16 hours of online classes with Brett, two calculator sessions, six extra exams and case studies, flashcards, another Q&A session with Brett, recordings, and one virtual class retake (if you do fail the exam).

Kaplan’s $800 up-charge (total of $1399) is seemingly the best “pass protection” plan, but it still only provides one option: a free retake of the Kaplan course (within 3 exam cycles of the failed attempt). One thing to consider here is whether or not – given that you’d failed an exam attempt – you’d want to use the same prep course to prepare for your next attempt. If not, then the “pass protection” really isn’t going to provide any value for you.

One other cost consideration would be to investigate whether or not your workplace or other associations (like Onyx Advisor Network) provide you with a discount for the CFP Course Requirements and/or Prep Courses. For example, Boston University has partnered with a long list of financial firms and organizations to provide discounted pricing for their CFP courses.

Furthermore, the CFP website lists several organizations that provide scholarships for both the Required Coursework and Exam Prep Courses. Michael Kitces’ website also keeps an updated (and seemingly more extensive) list of scholarships available for those interested in pursuing their CFP designation.

Though I would caution against using scholarships & discounts as the sole factors for choosing your course, it’s certainly worth considering (and asking!) whether or not you have the opportunity to access your desired program at a discount.

- DELIVERY METHOD

Undoubtedly, one of the more important considerations when choosing a prep course is whether the course delivery matches your preferred learning style.

Some helpful questions to reflect on are

- Would I prefer to be able to ask questions during course lectures?

- Can I hold myself accountable to watching videos on demand?

- Am I on a time constraint (daily/weekly and overall) that would limit the amount of time I can spend in a scheduled lecture?

Based on the answers to the questions above, you’ll then decide between synchronous (live) and asynchronous (pre-recorded) instruction sessions.

- Synchronous lessons are less flexible but provide greater accountability and usually allow for on-the-spot or dedicated Q&A time during the lecture. Depending on the program, these are offered in-person and/or via zoom/virtual learning. **If you are leaning toward in-person instruction, be sure to account for travel dates, additional costs and other considerations of participating in-person.

- Asynchronous lessons are more flexible but provide less accountability. On-demand lessons allow you to sign in and watch the pre-recorded lesson on your own schedule. Additionally, depending on the platform the program uses, you may have the option to watch the lesson in 1.5-2x speed, which could be a huge benefit if you are on a time crunch (this is the option I utilized frequently via Dalton Education).

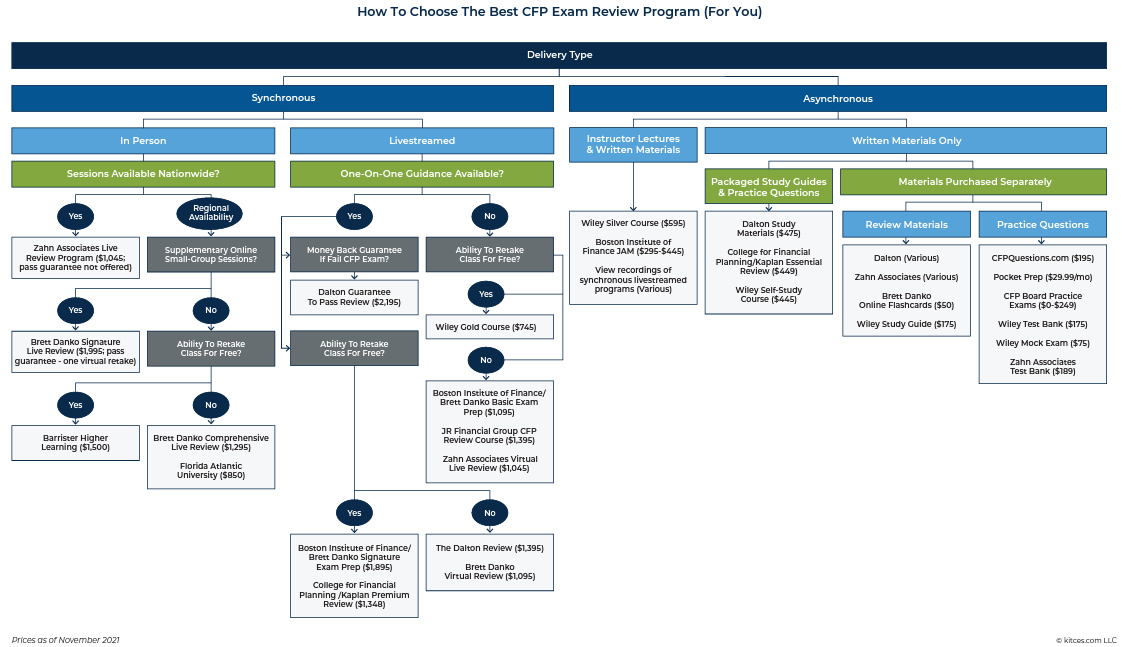

This table from Michael Kitces’ website is part of an in-depth blog on choosing a CFP Exam Review program and further provides a helpful schematic for identifying programs based on the delivery methods (click the previous link for a readable pdf).

- Content & Study Materials

Ideally, you’ll want to make sure your review course includes all of the following (seven!) layers of content/study materials. If you choose a lower-cost program, be wary that you do not lose an aspect you need to prepare for the exam adequately.

- Test Prep Questions

- Look for a review program with a minimum of 2000 questions in the Q-bank, across all 8 subject matters – this is easily the most critical study prep component

- Option to drill down into specific sections and focus on areas of weakness

- Option to practice with or without immediate answer feedback after each question

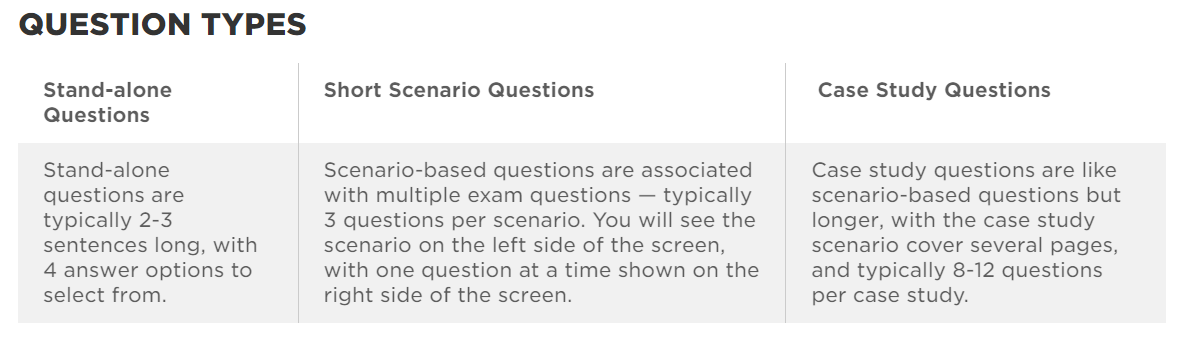

- Q-bank should include all 3 question types that you’ll see on the CFP Board Exam-

- Practice Exams

- Structured exactly like the CFP Board Exam (timed, 3 hours per section, 40 min break, mix of all question types, provides practice using pdf formula & tax sheets)

- Make the most of your practice exams by simulating the actual test conditions as closely as possible. Time yourself, answer the questions without referring to study materials, and review your answers afterward (or first thing next day) to identify any mistakes or areas of weakness.

- You are provided with one free exam from the CFP Board once you register for the exam, with an option to purchase a second one (I didn’t purchase the second exam). A couple of things to note about this exam.

- It’s structured EXACTLY like the CFP Board Exam, which is excellent for practicing your test-taking skills and strategyIt’s made up of previous exam questions that are no longer in use. Even though these are retired questions, the formatting gives you clues as to how you can expect questions to be asked on the examYou’ll be able to practice exactly how to flag questions, view the pdfs, and toggle between case study and questions on the exam (and added functionality of being able to mark up the case study) – this is super helpful if your review platform is formatted differentlyIMPORTANT!! If you want to know the answers to the questions on the Board Review Exam, you will need to click to review each individual answer BEFORE you move on to the next section. You can do this as you go or review at the end of each section before you move onto the next section (you’ll get a warning window that reminds you that you can’t go back to the previous section after moving forward). Just be careful to manage your time along the way since you are on the clock..Most sources I checked with said that a 70-80%+ score on the CFP Board Practice Exam indicates that you are ready for the real thing. After you finish the practice exam, you’ll get an email detailing your percentage score in each of the 8 areas of focus (but again, you won’t have any access to the actual questions you encountered).

- Take the practice exam 2-4 weeks before the real exam, to give you time to go back and dial in on your lower-scoring areas.

- Formulas & Calculator Practice

- Step-by-step instructional lessons that demo how to program and use your calculator for time series analysis questions and other formulas

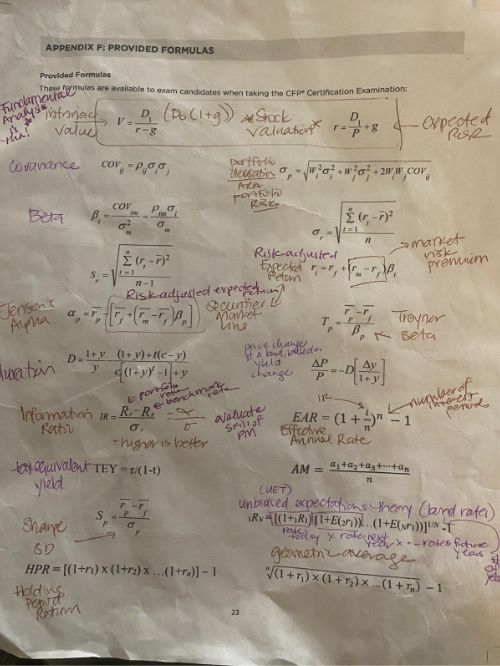

- Lesson(s) provides an in-depth review of the tax tables and formulas provided on the exam, the tax tables and formulas that you must memorize (not provided for you on the exam), and thorough descriptions of the scenarios in which each formula will be used. I highly recommend printing off the tax tables and formula sheet above and making notes all over the sheet to learn both HOW and WHY to use the given formulas. Most of these types o test questions will give you the variables but will not explicitly direct you to the formula you’ll need to use. (Here’s an example of how I marked up my formula sheet to help bring it all together!)

- Flashcards

- Some programs provide an option to download digital flashcards (Danko offers these as a one-off purchase even if you’re not enrolled in the full program)I opted to buy blank cards and create flashcards for questions I missed as I went through the question bank

- Especially helpful for

- Connecting certain types of test questions with the formula needed to solve

- Learning/Memorizing what each of the Greek symbols represented in the equations

- Behavior Finance vocabulary (i.e., anchoring, confirmation bias, overconfidence) – make a note on your card of specific test questions that relate to each specific BeFi concept

- Reading Material / Booklets that review each of the 8 financial planning domains covered on the exam

- Some programs may give you the option of a digital download or hard copy

- This may or may not be as important to you, depending on your learning style and study expectations (reading can be extremely time-intensive, so if you’re pressed for time, you might use the booklet as a resource for more complex concepts vs. thoroughly reading through the entire lesson)

- Video lessons that review the important concepts inside each of the 8 financial planning domains covered on the exam

- Again, learning-style dependent

- Flexibility is the critical point to assess here. Some programs offer live-only video lessons, while others provide an on-demand library that is accessible according to your scheduling needs

- Personal note, FWIW: I’m more of a visual learner (reader) than an auditory learner (listener), but I made an effort to utilize both the reading and the video lessons for the purpose of getting as many reps in on the material as possible. Therefore, I was grateful that my study prep course offered multiple ways to access the material.

- Q&A with an Instructor to go over your specific questions and/or problem areas

- These Q&A sessions might be embedded inside the video lessons – again, could be important to assess whether or not you have the ability to attend the “live” sessions as this might be your only option for asking questions

- Your prep course may also offer “Office Hours”(or similar format) to provide an additional platform for miscellaneous Q&A, and to give generalized study/test-taking recommendations

- Finally, check to see if you are able to email/call your test prep center with one-off questions you have. It’s much more time and energy-efficient to pause and send an email vs. agonizing over an answer that you can’t seem to figure out.

One final note: Your study materials & course content should provide you with links to and questions around the Code of Ethics and Standard of Conduct set forth by the CFP Board. Be sure to download and study these prior to sitting for the test, as you will definitely see ethics and conduct questions on the test (and you will need to know which are considered codes of ethics vs. standards of conduct).

- Length / Hours of Study

The length of time you need to prep for the exam is going to be highly dependent on your personal situation. If you’re not sure where to start, here’s a quick guide for setting up a plan:

- First, determine whether you are doing a live, in-person session or virtual session.

- If live, stop & block those off on your calendar NOW and go ahead and set up any necessary travel arrangements – hotel, flight, request time off, family scheduling, etc.

- If you plan to do virtual sessions, determine whether you will set aside a block of time weekly/bi-weekly/etc (stop & block off on your calendar NOW) or if you will be chipping away at on-demand videos as you move through the material (less accountability but more flexible if you are on a time crunch)

- Next, make a list of all the lessons you will need to review prior to the live/virtual review sessions.

- If you are doing a 3-5 day “intensive” review session, you will want to have ALL of your prep work (reading, question review, etc) done prior to attending the review. This could impact the amount of prep time you anticipated having, if the intensive review is coming up sooner rather than later.

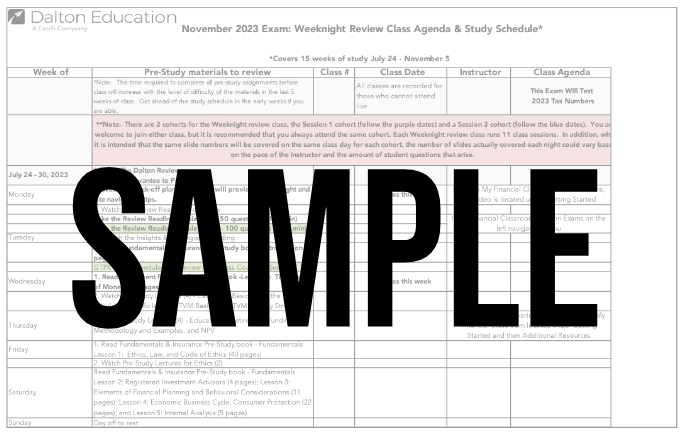

- Dalton Education provides a very detailed & structured weekly guideline that I absolutely relied on to keep me on track. I was behind on the schedule, but just moved through it at an accelerated pace. The feeling of scratching things off the list kept me engaged and motivated even on the toughest days. The sample below is from page one of the downloadable weekly review schedule I used (available once you purchase/gain access to the Dalton Review). It includes absolutely everything you need to do in order to utilize all resources available on their platform. They also provide similar (though not as detailed) guidelines for their alternative review schedules.

If your study program doesn’t provide a checklist, I’d highly recommend building one of your own in Google Sheets or Excel that’s similar to the format above. Here’s a sample framework if you want to use it to get started (to edit the doc, click on “File” and then “Make a Copy”)

- Once you have your checklist designed, compute the total number of hours you need to complete the study materials (tally up column E in the sample framework above and/or use the expected hours given by your study prep provider; if not sure, 200-400 hours is a reasonable range depending on your prep needs)

- Calculate the number of hours per week that you can dedicate to studying. Don’t forget to incorporate family vacations / holidays and intentional brain breaks from studying!

- Divide the total hours of studying needed by the number of hours per week that you expect to dedicate to studying.

- Example:

Expected Hours of Studying: 250

Hours Per Week Available for Studying: 15

=17 Weeks (4 Months) Needed to Complete Study Plan

- (Take a breath 😅 Yes, it’s a lot. And also yes, you will make it to the finish line. And yes, it is helpful to recognize the magnitude of the commitment you’re about to make)

- If the timeline is or becomes unreasonable, just keep in mind that there are essentially three levers to pull:

- The amount of time you spend studying each week – if you’re running short on time, the option here would be to sacrifice more extracurricular activities in order to make more time for studying

- The number of weeks/months you have between now and the CFP Board Exam – if you’re not far enough along, the option here would be to push the exam back to the next exam window (make sure you keep an eye on time windows for making these changes and consider costs of pushing the exam to the next window)

- The material you cover/review before the CFP Board Exam – if you’re behind, the option here would be to cut some of the review material (prioritize question bank practice above all other materials)

Some final thoughts on creating a study plan that works for you:

Assess your strengths and weaknesses

Start by identifying the areas where you feel confident and the topics that you struggle with the most.

This will help you allocate your study time effectively and prioritize the topics that require more attention.

Pro Tip: If you’re feeling burnt out but still need to clock time studying (so you don’t get behind), consider making a temporary shift toward studying something that feels a little easier / that you have more confidence with. There’s definitely something magical about keeping a positive headspace while grinding through the material.

Set realistic goals

As discussed above, be sure you’re setting daily, weekly, and monthly targets to ensure that you stay on track and make consistent progress. Don’t stress about missing a day, especially if you need a brain break. If you start to get behind on your weeks, reconsider your extracurricular activities and rebalance as needed. If you get more than a month behind, it’s time to revisit the levers you need to pull in order to either catch-up or postpone.

Pro Tip: When setting aside time to study, create a checklist of EXACTLY the study material you intend to cover during that session and block off the time you will dedicate to that list. At the end of your dedicated time, STOP studying and add remaining items to the top of the next session’s list.

Use a variety of resources

Don’t limit yourself to just one study resource. Utilize textbooks, online courses, practice exams, and study guides to gain a comprehensive understanding of the material.

Pro Tip: Get the reps in. Prioritize your studying based on what helps you learn best (for me, that was question banks with answer review turned “on”). And – as time allows – study the material in as many different ways as possible, even if it’s not your “preferred” style of learning.

Stick to your schedule – both for study time and for non-study time.

Set aside dedicated study time each day or week. Find a study environment that works for you, whether it’s a quiet room at home or a local library, and stick to your schedule. “Excellent Boundaries” is the name of the game.

Pro Tip: Keeping your promises to yourself (to study / put in the required amount of effort) and to others (to break from studying and honor your relationships with / commitments to them) is one of THE most profound ways of aligning your heart and mind to the objective of studying for and passing the CFP Exam. If you find yourself struggling with transitioning away from studying, try lining up your study block next to a time-bound commitment (kids’ sporting event, dinner date, etc) vs transitioning to a less time-specific event (going for a walk, running an errand, going to bed, etc)

Seek support

Consider joining study groups or online forums where you can connect with other aspiring CFP professionals. The CFP Board also has a mentorship program available to CFP Candidates. Discussing concepts and challenging each other can deepen your understanding of the material.

Pro Tip: Know Thyself. I’m a solo learner so I wasn’t particularly motivated to find a study group, especially one full of people I didn’t know. Still, I quickly realized that the intensity and loneliness of this journey was particularly painful and thankfully connected with a few people I knew via Twitter (shout out to Cliff Cornell, CFP!) who were going through the studying process as well. Immensely grateful for their accountability and support during the lows (and for celebration and excitement when we passed!)

Prepare your friends, family & co-workers

You aren’t the only one who is about to embark on this journey, and you’re going to want (need) the buy-in and support of those closest to you. Avoid stress by creating good boundaries and telling loved ones how they can best support you during the studying process.

Pro Tip: Set up meetings with the people in your life that will likely be most affected by your goal and plan to specifically ask for their understanding and support. Ideally, your employer is excited about the mutual benefits of you receiving the CFP designation and is willing to provide you with some flexibility to attend and/or travel to the review classes (but even if they aren’t, you definitely want to anticipate this hurdle instead of discovering it mid-study window).

For those with families and especially young kids, be as upfront as you can with them about how studying will look different and how it will affect the time you would typically spend with them, especially if it means you will attend less of their events for a period of time. Emphasize that you have a plan to keep the commitments you’ve make to yourself AND to them during this season. Also – consider making it fun and interactive by creating a paper chain countdown together and planning a fun family trip on the other side of the exam!

There’s no denying that for most (mortal beings), passing the CFP exam requires dedication, discipline, sacrifice, and a well-thought-out study plan. My hope is that by sharing my experience and some guidance I learned through other friends and colleagues, you’ll have more clarity when it comes to choosing a CFP Prep Program that best fits your needs and will be able to protect yourself from spending unnecessary time and money along the journey.

Thanks for reading Part 2 of this series on How to Crush the CFP Exam! Stay tuned for Part 3, which will cover specific test-taking strategies and other important tips for managing stress/burn-out as you complete the journey toward your CFP designation and beyond.

About the Author: Jess Bost

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.