We spend way too much time trying to predict the future (especially this time of year).

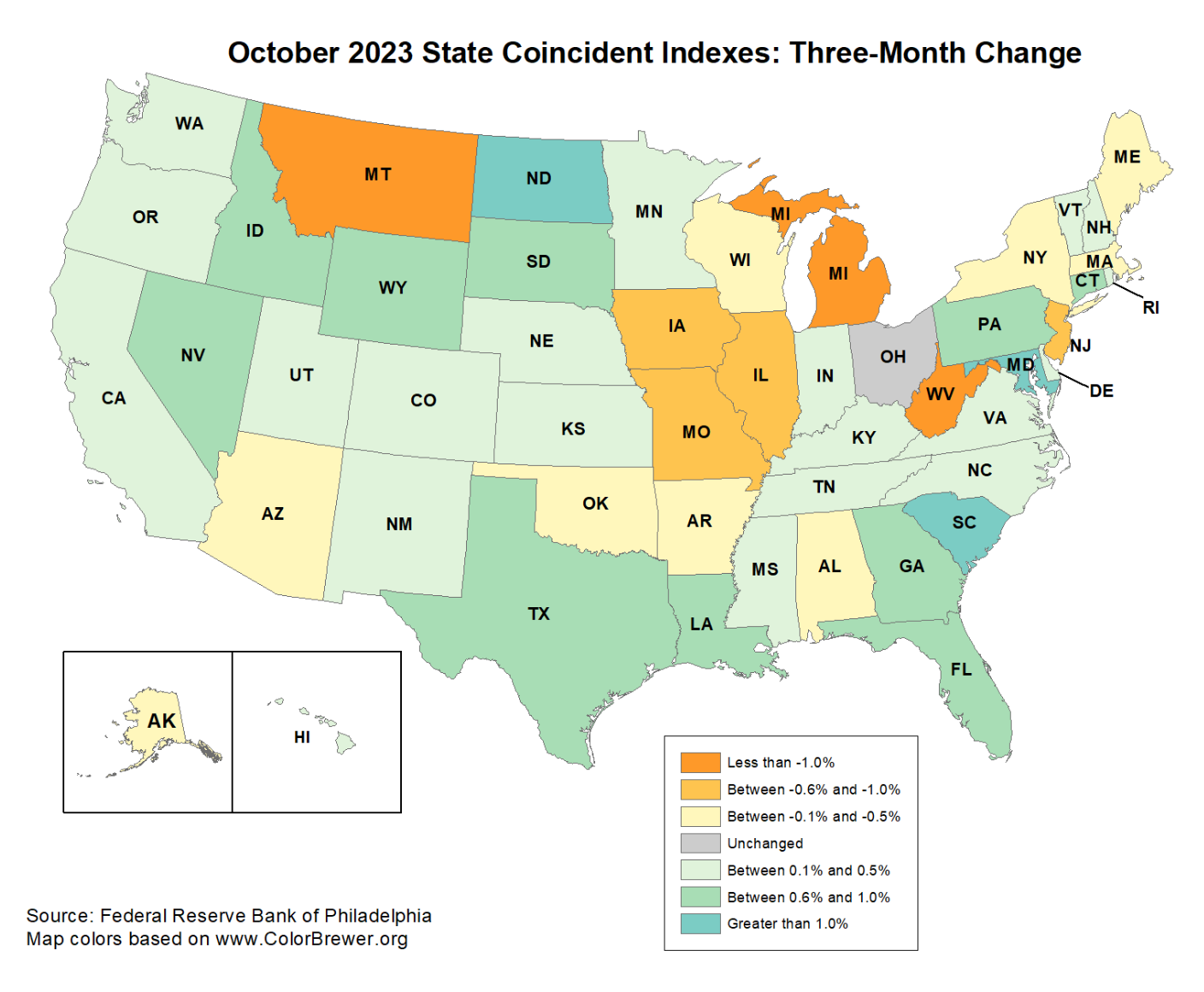

Rather than engage in futility, let’s look at the coincident indexes in all 50 states over the past 3 months, via the Federal Reserve Bank of Philadelphia (October 2023). Note: I have been occasionally eyeballing this map since 2008, and it does a good job of showing the overall trend of the economy (on an obvious lag).

“Over the past three months, the indexes increased in 33 states, decreased in 16 states, and remained stable in one, for a three-month diffusion index of 34. Additionally, in the past month, the indexes increased in 16 states, decreased in 27 states, and remained stable in seven, for a one-month diffusion index of -22.”

Note that back in March of this year, only one state— Alaska — was negative. That quarter, the indexes increased in 49 states and decreased in just one, for a three-month diffusion index of 96 (50 is breakeven).

This data tells us three broad things:

1. The economy is mixed to good, with 2/3rd of states expanding and 1/3rd of states slowing; Dropping from +96 to -22 is a substantial decrease, regardless of the high GDP print last Q.

2. The economy has decelerated appreciably since 2 quarters ago.

3. This confirms the rapid decrease in CPI inflation and is consistent with inflation peaking around the mid-point of 2022.

Those 3 above are the facts; what follows are 5 opinions you might consider:

1. With 33 states expanding, the economy is obviously not in a recession at present. However, it is clearly slowing, and the odds of a recession, while still relatively low, are rising.

2. It should be clear to everyone now (as it has been to some for months) that the Federal Reserve’s hiking cycle is over.

3. We cannot yet tell how much credit the FOMC deserves for the decrease in inflation; as discussed previously, many other factors were driving inflation lower;

4. I can say without hesitation that the slowdown in the economy HAS BEEN CAUSED by the Federal Reserve’s higher interest rate policy.

5. I will add that the FOMC stayed on emergency footing for years too long, were late to raising rates, then raised them too quickly, and last, raised them too high.

The pent-up demand caused by the lockdowns seems to be running its course; it is not over but it is late in that cycle. While most supply chains seem to have normalized, there still are persistent shortages in Labor, Housing, Chips, etc.

While I am hopeful we will avoid a recession, it is certainly within the range of reasonably possible outcomes. If that comes to pass, it is an unforced error, a mistake made by the Fed in their slovenly approach to interest rate policy.

Previously:

The Post Lock-Down Economy (November 9, 2023)

The Fed is Finished* (November 1, 2023)

Inflation Comes Down Despite the Fed (January 12, 2023)

For Lower Inflation, Stop Raising Rates (January 18, 2023)

Source:

State Coincident Indexes, October 2023

Federal Reserve Bank of Philadelphia, November 22