We’ve got shrinkage. In banks.

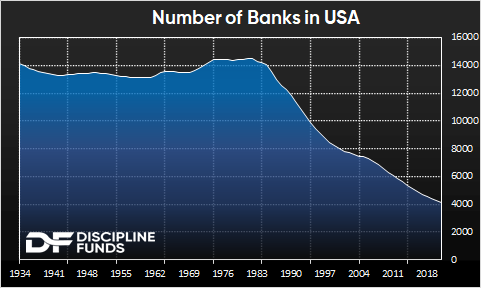

One of the interesting secular trends that has been in place for 30+ years is bank shrinkage. The US banking system has consolidated from 14,000+ entities in the late 1970s to just over 4,000 entities today. So the collapse of small banks is not surprising. But what’s happening today is accelerating the process.

The basic gist of this acceleration is multi-faceted: the government has implicitly supported small banks; and explicitly supported big banks. This is, of course, all exacerbated by the Too Big To Fail policies of the last 10+ years. And then you have the recent surge in interest rates which is a double whammy for small banks. Not only can they not compete on deposit rates, but they incurred large mark-to-market losses on their bond holdings from the rate hikes. So now depositors are sitting around saying “why do I have my money deposited with this small bank that can’t compete on deposit rates AND might be insolvent?“ That’s the cause of this “walk on the banks” that is currently going on.

A useful analogy in understanding the risks of all of this is the piping of your home. Banks are the plumbing in our financial system. They control and direct the flow of funds in the system. The Fed influences the pressure in the water main and when they sent rates to 5% quickly they broke the water main to many people’s homes (the small pipes couldn’t handle the pressure change). So now the regional plumbers are scrambling to seal the leaks. And some of them are realizing that the leaks are too much for them to contain. The process of fixing all these leaks causes disruptions across the flow of water in the house. This is being seen in the economy through the tightening of lending standards which is reducing credit issuance. How much does the flow of water slow here? We don’t know quite yet because it’s really only just beginning to be seen in the real economy.

In the long-run these problems always sort themselves out. Some banks fail, the water main gets fixed and life goes on. But in the meantime these leaks can cause big disruptions and we’re all in the process of discovering how much damage was caused to the pipes AND whether those leaks will cause damage in other parts of the house like commercial real estate, residential, consumer credit, etc.

Like all of investing, it’s a temporal conundrum. If you’re patient and have a long time horizon then none of this really matters. But if you’re sensitive to volatility and need liquidity then this is consistent with the sort of environment where you need to be more cognizant of the potential short-term risks because they’re elevated.