My end-of-week morning NFP train WFH reads:

• Warren Buffett’s Formula for Success: One Good Decision Every Five Years: Berkshire Hathaway has obliterated the market in his 58 years at the company. He credits roughly 12 decisions. (Wall Street Journal) see also The 10 Greatest US Investors and the Virtues That Made Them: There can be few fields of human endeavor in which history counts for so little as in the world of finance. Past experience, to the extent that it is part of memory at all, is dismissed as the primitive refuge of those who do not have the insight to appreciate the incredible wonders of the present. (CFA Institute)

• International Diversification—Still Not Crazy after All These Years: International diversification has hurt US-based investors for over 30 years, but the long-run case for it remains relevant. Both financial theory and common sense favor international diversification, which is buttressed by empirical evidence that is very supportive at longer horizons and for active strategies. Finally, it would be dangerous to extrapolate the post-1990 outperformance of US equities, as it mainly reflects rising relative valuations. If anything, the current richness of US equities may point to prospective underperformance. (AQR)

• How to win at cards and life, according to poker’s autistic superstar. It would take some time, but many of the qualities that caused so much frustration in childhood — hyper-focused, analytical, determined — would fuel a meteoric tear through the poker world. Now, at 33, he has a pair of World Series of Poker bracelets and $23 million in career earnings. He’s often referred to as Jungleman, a nod to his longtime screen name on poker sites. But while he built his bankroll through online cash games, he also has made a splash at recent tournaments, dressing in costume when he won his first two bracelets — wrestler “Macho Man” Randy Savage at one, Goku from the Japanese anime series “Dragon Ball Z” at another. (Washington Post)

• Cadillac’s Lyriq EV Might Be a Winner If GM Can Build Enough of Them: After waiting more than a year for delivery, some buyers are scrapping their reservations. (Businessweek)

• Would you live next to co-workers for the right price? This company is betting yes: A growing number of employers around the country have decided to build their own housing for workers, mostly for them to rent but sometimes to buy. They include big names like Disney and Meta, the meatpacker JBS and local school systems and health care providers. Elon Musk is reportedly planning a new neighborhood in Texas for employees of his companies SpaceX, Tesla and Boring. The trend underscores the scale of the country’s affordable housing shortage and the ripple effects it has on the wider economy. (NPR)

• How Silicon Valley’s Troubles Are Reshaping Venture Capital: After unprecedented dominance of US startup funding in the 2010s, the region has lost some ground. But it’s still No. 1 by a long distance. (Bloomberg)

• What the U.S.-China chip war means for India: A Q&A with Pranay Kotasthane, who explains how India is pushing itself as an alternative to China in the ongoing trade war between Washington and Beijing. (Rest Of World)

• For Saner Politics, Try Stronger Parties: Well-intended reforms have made the national parties weak and ineffective—and unable to resist their most extreme elements. (Wall Street Journal)

• Tolkien’s Middle-Earth wasn’t a place. It was a time in (English) history. The fellowship’s journey through Middle-Earth mirrors the modernization of the English countryside. Different regions in Middle-Earth correspond to distinct periods of English history. The Lord of the Rings juxtaposes a pre-industrialized Shire with a post-industrialized Mordor. If the English were more like hobbits, Tolkien argues, England would be a better, greener place. (Big Think)

• Octopus time We humans are forward-facing, gravity-bound plodders. Can the liquid motion of the octopus radicalise our ideas about time? (Aeon)

Be sure to check out our Masters in Business interview this weekend with Julian Salisbury, Chief Investment Officer of Goldman Sachs Asset & Wealth Management, with $737 billion in assets under management. He is a member of the Management Committee and Co-Chair of the Asset Management Investment Committees, (private equity, infrastructure, growth equity, credit, and real estate).

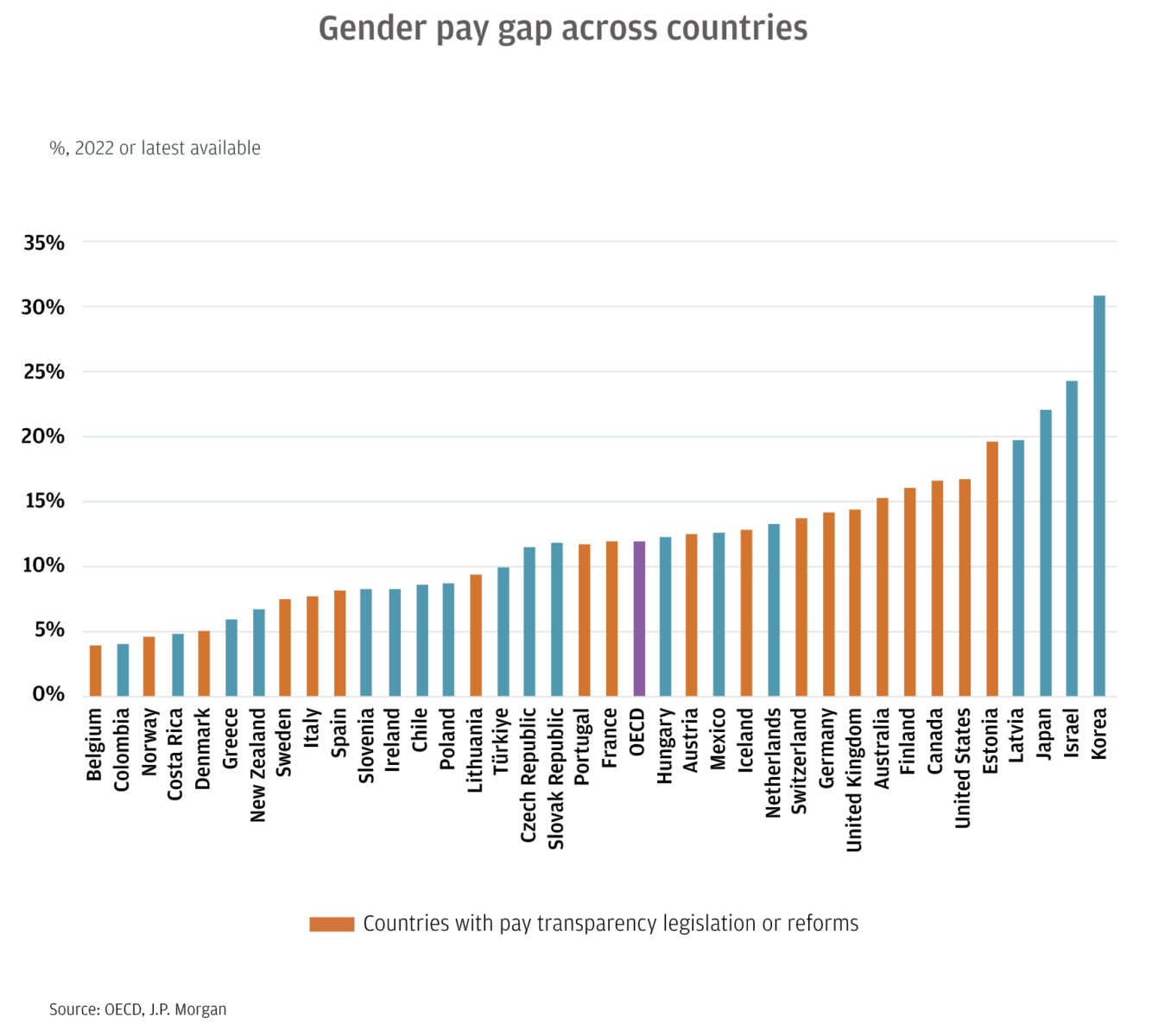

Women still lag behind men in pay, home ownership, labor force participation, and board representation

Source: J.P. Morgan Research

Sign up for our reads-only mailing list here.