My Two-for-Tuesday train WFH reads:

• Good News-Bad News About the Economy: The hard part about markets and the economy is that there are often conflicting signals about what’s going on. Even when things are good there are ominous signs about impending doom. And even when things are bad there are promising signs of impending improvement. I would describe the current situation as much better than expected considering the circumstances but there are still plenty of risks on the horizon. (A Wealth of Common Sense)

• A Dozen Contrarian Thoughts About Inflation: I have been writing a lot about inflation — what people get wrong about it, why the FOMC is usually late to the party, and what the various causes of inflation (real, modeled, and imagined) actually are. All of this research into the space has led me to have ideas about inflation, many of which are out of step with the mainstream. Here are 12 ideas that are (or were) contrarian thoughts on inflation. (The Big Picture) but see also Inflation Came Down and Everyone Was Right: Inflation has been falling over the past year, yet, inconsistent with ‘mainstream macro,’ unemployment has not increased. What are some of the reasons this could happen? (Rortybomb)

• Wall Street Pranksters Admit to $2 Bear Stearns Gag 15 Years Later: Image of bill became viral sensation capturing the bank’s fall Pranksters were three friends with no ties to Bear Stearns. (Bloomberg)

• The stock market’s up big this year — but not because of earnings growth. Wall Street analysts think companies in the S&P 500 will see earnings per share rise just 1% in 2023, compared with 2022. The S&P 500, on the other hand, is up 17%. In other words, share prices are outpacing puny expectations for profit growth. (Axios)

• New Glut City: The city’s mega-office landlords are panicking, pivoting, and shedding what’s worthless. One opens his books. (Curbed) see also The office is dead. Long live the office (at least some of the time): While the research may render the RTO debate over and done, there are plenty of ways to reimagine the office of the future. (Fast Company)

• Investors Are Bailing on Cathie Wood’s Popular ARK Fund: “Cathie Wood’s flagship exchange-traded fund has rallied more than 50% this year. Investors are using that as an opportunity to get out. They have pulled a net $717 million from the ARK Innovation ETF over the past 12 months, according to FactSet. That exodus marks a notable shift for a fund that had consistently drawn investor cash since its 2014 inception. Once the largest actively managed ETF with nearly $30 billion in assets under management, the fund has shrunk to roughly $9 billion, mostly due to investment losses.” (Wall Street Journal)

• A New Job for Electric Vehicles: Powering Homes During Blackouts: Some energy experts say battery-powered vehicles will increasingly help keep the lights on and support electric grids, rather than straining them. (New York Times) see also All the Ways to Slow a Car (Even Some Bad Ways): Electric vehicles are increasingly popular, so it’s time to talk about regenerative braking—and all the other ways you can stop a vehicle. (Wired)

• Here are all the positive environmental stories from 2023 so far We’re going to be regularly updating this page with good news about our planet in an effort to combat climate anxiety. (Euro News)

• What I Saw in Elon Musk’s Truth Army: Twitter’s “Community Notes” volunteers are supposed to make the platform “the most accurate source of information about the world.” I became one. (Slate) see also Here’s How Twitter Could Become Irrelevant: Threads, from Instagram, has many distinct qualities that make it the first credible threat to Elon Musk’s vision of what a social network should be. (Wall Street Journal)

• Where Johnny Cash Came From: The Man in Black grew up in Dyess, Arkansas, in a community of poor farmers working government land. (National Endowment for the Humantiies)

Be sure to check out our Masters in Business this week with Tom Wagner, Co-Portfolio Manager at Knighthead Capital. The $10 billion event-driven is a deep value-focused investor specializing in companies that need financial and operational restructuring. He is a co-investor with football legend Tom Brady in several sports assets, including a Pickleball team, Birmingham City FC in the English Football League, and an endurance auto racing team. Wagner began his career doing hedge fund accounting at Ernst & Young.

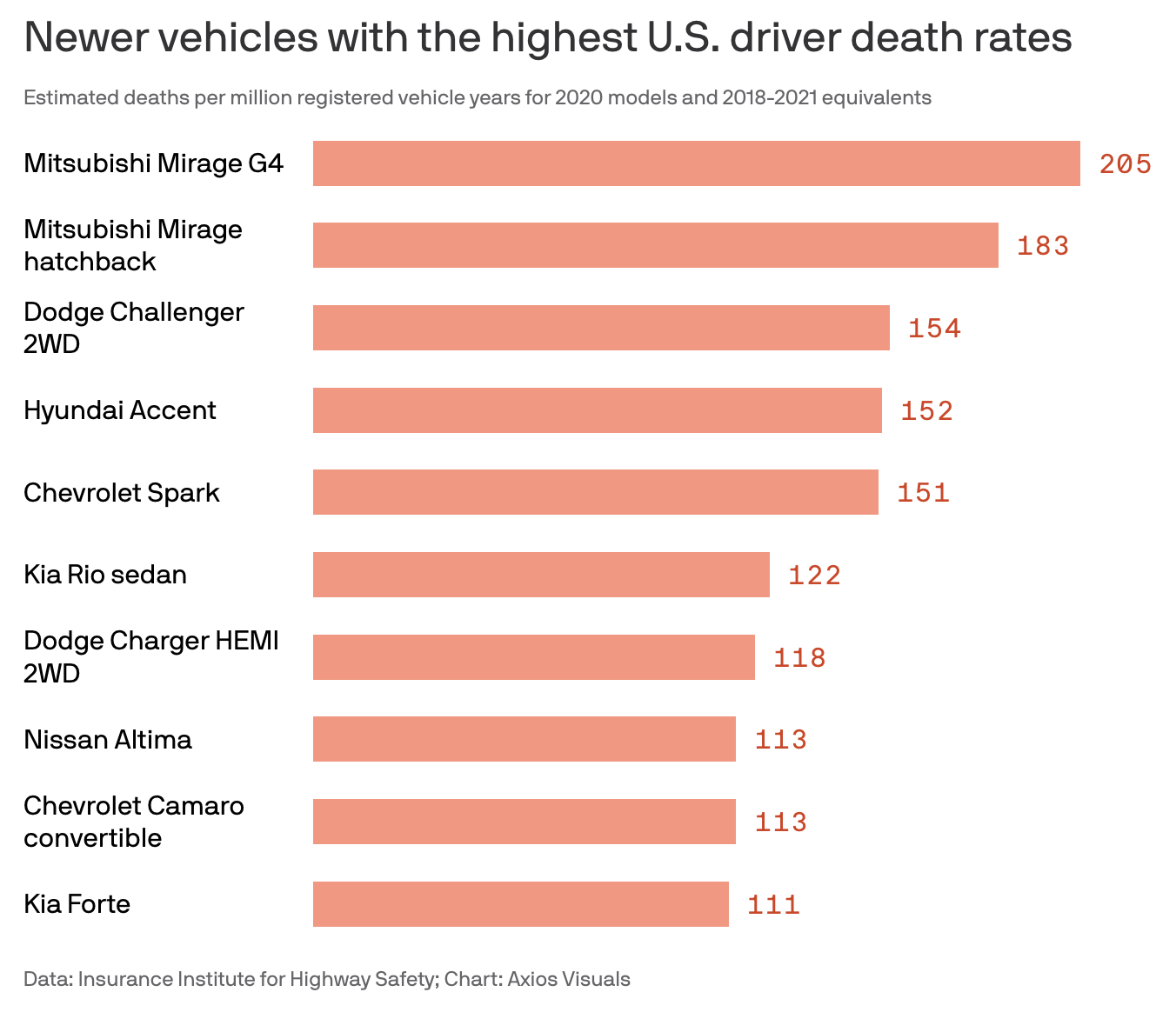

These vehicles are the deadliest cars on the road, IIHS auto safety report says

Source: Axios