Insurance is a sensible part of any financial plan. Good insurance should be designed as a temporal tool. For instance, you buy life insurance during a specific time period in your life when your dependents would be financially devastated by your death. This is why term life insurance is almost always the right option for life insurance – it is designed to cover a specific long duration period in your life when your dependents are most likely to be negatively impacted by your death. 20 year term life insurance is a long duration instrument with a negative expected real return except in case of death in which case it exhibits a very asymmetric and acute positive real return. You’re buying a long-term asset that is designed to lose money, but will create a very large short-term real return in the case of an outlier risk event.

Investment portfolio insurance is a more interesting thought exercise. In our All Duration model instruments like options, gold, managed futures, long T-Bonds and cryptocurrency all exhibit characteristics that are similar to insurance. That is, they often exhibit long periods of low real returns, but in specific and unusual environments they often generate very large short-term returns. This makes sense because each of these instruments generally insure against very specific things such as tail risk, inflation, deflation and fiat currency risk.

But in a world of positive real return cash the story changes. After all, insurance is designed to provide you with short-term certainty around an uncertain outlier event. And when cash is yielding a high real return I think you can argue that cash is the ultimate portfolio insurance.

There was a popular paper published back in 2017 that described how T-Bills outperform most common stocks:

Four out of every seven common stocks that have appeared in the CRSP database since 1926 have lifetime buy-and-hold returns less than one-month Treasuries.1

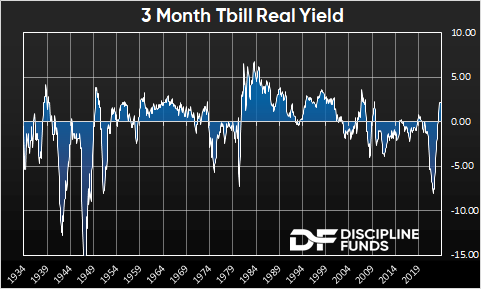

This is true, in large part, because T-Bills had high positive real returns for much of the last 90 years. When T-Bills have positive real yields your financial certainty is very high. When T-Bills have negative real yields financial certainty tends to be low. This is because the Fed will be maintaining a highly unusual policy stance when real yields are low. For instance, financial uncertainty has been relatively high over the last 25 years because we’ve had a series of booms and busts around the Nasdaq bubble, GFC and Covid. So the Fed remained unusually easy for much of this period and that resulted in low real T-Bill yields. The low inflation resulted in a policy stance that was literally trying to force people out of cash and into other instruments. These are periods where broader diversification makes a lot of sense because the unusual environment results in negative real returns in cash and uneven returns across stocks and bonds.

This story changes substantially when cash yields a high real return like today. In other words, when cash yields a high real return it becomes the ultimate insurance instrument because it gives you a risk free inflation beating return in the short-term. And that is the ultimate form of financial certainty.

1 – Bessembinder, Hendrik (Hank), Do Stocks Outperform Treasury Bills? (May 28, 2018). Journal of Financial Economics (JFE), Forthcoming, Available at SSRN: https://ssrn.com/abstract=2900447 or http://dx.doi.org/10.2139/ssrn.2900447