This week’s Federal Reserve decision was interesting mainly because there was no hint at a pivot. The market had been pricing in a rate cut this year, but the Fed made it pretty clear that that’s not happening. They essentially said they’re close to finished, but might raise rates two more times this year. I (somewhat) jokingly said on Twitter that the message could be distilled down to “We’re done hiking interest rates, but we are ready to break the economy if you idiots starts buying fart jars again”. In short, the Fed is ready to declare victory on inflation, but they are keeping their guns drawn in case consumers get irrational again like they did in 2021 buying fart jars and NFTs and whatnot.

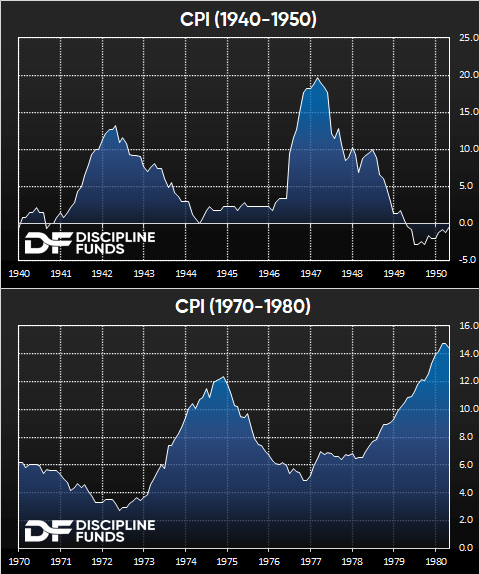

More broadly, I think the Fed is going to wait until they are absolutely, 100% certain that inflation is dead before they start cutting. The last thing they want to do is hint at a rate cut and spark a surge in consumption that puts upward pressure on inflation. That’s the old 1970s or 1940s double bump resurgence in inflation concern. In both periods the rate of change in inflation surged, then slowed and then surged again. This is the nightmare scenario for the Fed.

Yesterday’s CPI made it pretty clear that inflation is coming down and it’s coming down pretty fast. And while the 4% reading is well off the peak of 9% last year it’s still DOUBLE the Fed’s target inflation rate of 2%. The trouble is, inflation isn’t coming down as fast as the Fed would like and then when we get to the target rate the Fed is likely to be absolutely certain that it’s sticky at that level before they start pivoting.

So the important questions are:

- When will we get to 2%?

- How long will we be at 2% or below before the Fed hints at cuts?

Our inflation model has headline CPI at 2.25% twelve months out. So the odds of a rate cut in 2023 are very low. The more likely scenario is that we’re moving into 2024 and the Fed starts hinting at some policy normalization and then can start easing rates down as 2024 unfolds. But rate cuts are not a 2023 story. They’re much more likely to be a 2024 story. The reasoning for this is that the Fed knows that their guidance can lead to speculation. So, if they hint at rate cuts the market could view that as stimulative which could induce a resurgence in inflation. So that’s why they’re still hinting at hikes – they don’t want you to run out and buy fart jars in anticipation of lower future rates and accommodative economic conditions.

At the same time, there’s an interesting paradox in all of this where the longer the Fed is tight the slower the economy is going to be. And that creates this sort of bimodal distribution in the data where our base case is still a “muddle through” economy but the longer the Fed remains tight the more it increases the risk of a credit event that forces the Fed to tighten sooner than later.

As it all pertains to portfolio management and asset allocation – this all means that the current high T-Bill rates are here to stay for now. But it also likely means that more intermediate term bonds are increasingly attractive as you can clip a positive real yield AND have the potential for a bit of principal upside in the case that the Fed backpedals or pivots in the coming 18 months.