My back-to-work morning train WFH reads:

• Morgan Stanley’s CEO Built a Wall Street Powerhouse. His Next Act Is No Less Ambitious. The firm plans to hit $10 trillion in client assets over the next decade. If James Gorman can get it there, the stock will keep winning. (Barron’s)

• How Moneyball Investing Ran Into a Data Squeeze Play: Quants can arbitrage away the advantages in factors and statistics almost as soon as they’re discovered. Look at the once-innovative Oakland A’s. (Bloomberg) see also Baseball Home Runs Are Increasing Thanks to Climate Change: More than 500 major league home runs since 2010 can be attributed to global warming, according to Dartmouth researchers. (Bloomberg)

• Jim Chanos’ Short-Only Fund, Ursus, Came Out on Top in 2022: The firm’s assets were also bolstered by two new funds that are shorting data centers. (Institutional Investor)

• Give More, Pay Less: They will receive a charitable deduction if their contributions exceed certain thresholds and eliminate up to a 20% federal tax on appreciated securities. This break also applies to individual state taxes. (A Teachable Moment)

• The U.S. Built a European-Style Welfare State. It’s Largely Over. In the early, panicked days of the pandemic, the United States government did something that was previously unimaginable. It transformed itself, within weeks, into something akin to a European-style welfare state. (New York Times)

• I’m not selling. Am I part of the housing problem? The homeowners choosing not to sell. (BBC)

• Bees are sentient’: inside the stunning brains of nature’s hardest workers. ‘Fringe’ research suggests the insects that are essential to agriculture have emotions, dreams and even PTSD, raising complex ethical questions. (The Guardian)

• If It’s Advertised to You Online, You Probably Shouldn’t Buy It. Here’s Why. Targeted ads shown to participants were pitching more expensive products from lower-quality vendors than identical products that showed up in a simple Web search. (New York Times)

• Trump is no longer the social media king: Why the former president’s arrest was a whimper, not a roar, on Twitter, a platform designed for these moments. (Vox) see also On social, it’s a fine line between idiot & genius. This brutal reality applies to aging bloggers, Twitter gurus, and influencers. It doesn’t matter who you are, how many degrees you have accumulated, or how many books you have written. And this is even true for the seemingly invincible of them all — the billionaire. Even the richest man in the world isn’t immune from echoing his limitations. You will almost always reveal your limitations and eventually lose that special sheen. (Om)

• Gone to the Dogs: Man’s best friend is a shorebird’s worst enemy. What will it take to control beach dogs—and, more importantly, their owners? (Hakai Magazine)

Be sure to check out our Masters in Business next week with Aswath Damodaran, Professor of Finance at New York University’s Stern School of Business. Known as the Dean of Valuation, he teaches Corporate Finance and Valuation to the MBA students at Stern where he has been voted “Professor of the Year” by the graduating M.B.A. class nine times. His textbook “Investment Valuation” is the standard in the field. His next book comes out in December, and is titled The Corporate Lifecycle: Business, Investment, and Management Implications.

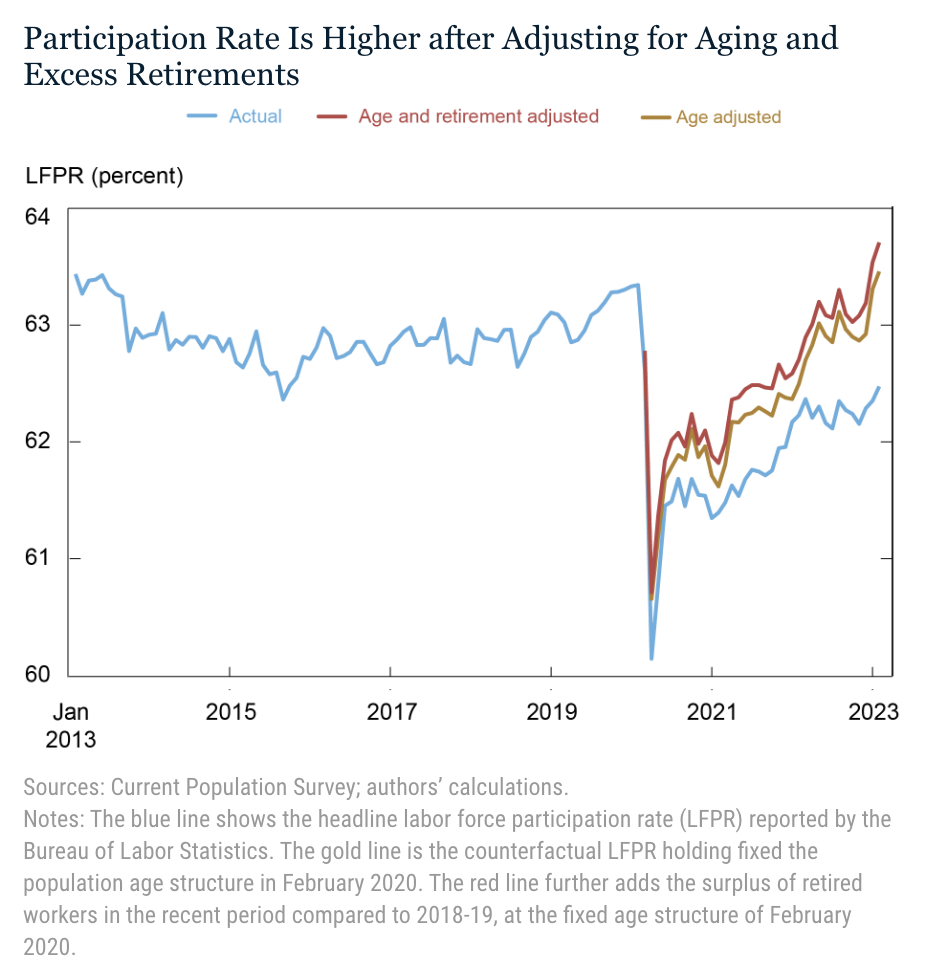

What Has Driven the Labor Force Participation Gap since February 2020?

Source: Liberty Street Economics

Sign up for our reads-only mailing list here.