My Two-for-Tuesday morning Vegas reads:

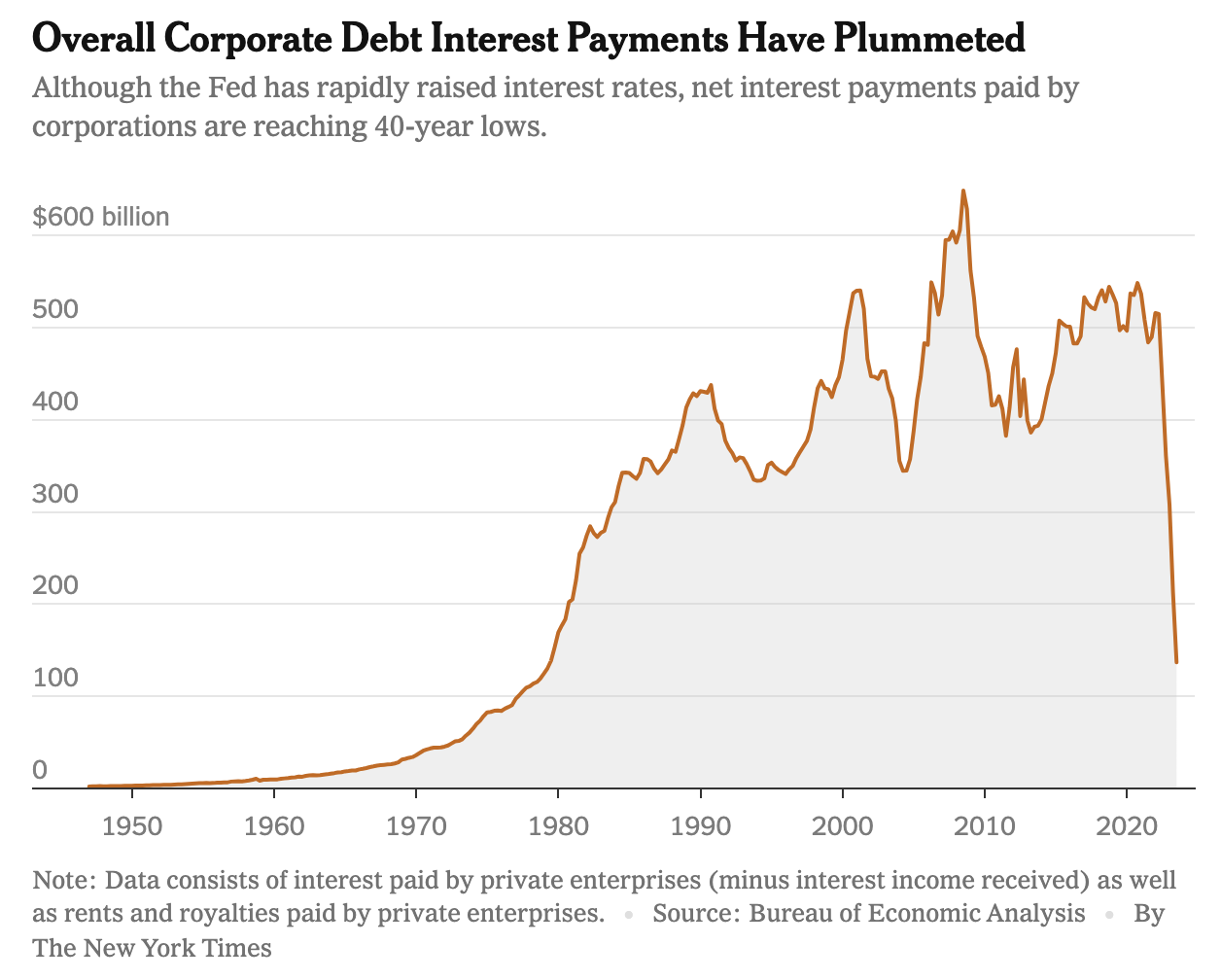

• The U.S. Economy Is Booming. Or Stagnating? The Mystery of the Missing Interest. The latest estimates of domestic income and domestic product are alarmingly inconsistent. The gap is mostly attributable to the bizarre (alleged) decline in net interest paid by businesses. (The Overshoot) see also How Does a Person’s Lived Experience Tell them the Local Economy Is Good, but the National Economy Is in the Tank? Stories about record-low unemployment are few and far between, and pieces on workplace satisfaction, the surge in mortgage refinancing and interest savings, and explosion in work-from-home are virtually none existent. (Center For Economic and Policy Research)

• The $7 Trillion ETF Boom Gets Blamed Again for Dumb Stock Moves: Study argues passive ETF ownership increases stock gyrations Investors dump billions into index-tracking funds each year. (Bloomberg)

• Why Americans’ ‘YOLO’ spending spree baffles economists: Despite past trends, US consumers are spending at record levels. Economists are mystified – and struggling to forecast an end point. (BBC) see also Americans Are Finally Turning Frugal After Splurging Over Summer: Government data, retailer warnings indicate consumer pullback Further labor-market cooling may put more pressure on spending. (Bloomberg)

• The Full Reset: To understand the power of starting clean, you have to know the nuance of why the German military became as strong as it did in the 1930s. (Collaborative Fund)

• It’s 2023 and fund managers still suck: Passive passes active ahead of the ETF Christmas sales. (Financial Times) see also Don’t Put Your Eggs in One Basket. That Investing Principle Still Holds. The storm over the so-called 60/40 investment portfolio misses the point, our columnist says. The key issue is diversifying your portfolio, and that is as important as ever. (New York Times)

• ‘Honestly, he kind of sucks’: why trash talking can feel good – and bad: Venting can help us bond, but it can also leave a sour taste in your mouth – where is the line, and why do we love doing it? (The Guardian)

• Tesla’s article-to-Cybertruck delivery ratio currently stands at 219 to 1: What Thursday’s Cybertruck launch did do was cause another glut of media stories about Cybertruck. For November Factiva logged 1,072 individual stories in the global English-language press, which made it the third most Cybertrucky month of the year to date. (Financial Times) see also “Clown Car” Personally, I think the cyber truck is just too damn ugly. I cannot ever imagine buying one of these. It looked like a vector graphic pulled out of an early 1980s video game. Then again, I am not planning for a zombie apocalypse, a weird niche market where these might be useful. (The Big Picture)

• Ohio voted to protect abortion rights. Republicans are scheming to undo it: Twenty-seven GOP members emphasized in a letter after the 7 November vote they would work to prevent its implementation. (The Guardian)

• Trump’s biggest loss yet: No immunity: U.S. District Judge Tanya S. Chutkan on Friday issued a stunning rebuke to four-times indicted former president Donald Trump, rejecting his motion to dismiss his Jan. 6, 2021, charges on absolute immunity: Chutkan’s ruling might turn out to be the most consequential legal defeat yet for Trump and quite possibly a decisive turning point in the 2024 presidential election. (Washington Post) see also Loyalists, Lapdogs, and Cronies: In a second Trump term, there would be no adults in the room. (The Atlantic)

• Kiss to become ‘immortal’ thanks to Abba’s avatar technology: When rock band Kiss played their final farewell concert in New York this weekend, they ended with a gesture that will ensure their digital immortality. (BBC)

Be sure to check out our Masters in Business interview with Michael Fisch, CEO and co-founder of American Securities, a $27-billion dollar private equity firm that traces its roots to the Sears IPO. The firm uniquely partners with acquisition targets, retaining management for the duration.

Corporate America Has Dodged the Damage of High Rates. For Now.

Source: New York Times