My Two-for-Tuesday morning Halloween train reads:

• The race to create the ‘Amazon of real estate’ could change homebuying forever: Decades of mounting regulations, an influx of new players in the industry, and the fallout from the housing market’s collapse in 2008 have made real-estate transactions increasingly bloated with paperwork and intermediaries. Companies have raised billions of dollars by promising to make the thornier parts of the homebuying process smoother. But after years of trying, the basic structure of buying and selling a home remains pretty much the same. (Business Insider) See also The Sales Pitch for an 8% Mortgage: Buy Now, Refinance Later—for Free! An offer to refinance if rates drop in the future might not help you save in the long run. (Wall Street Journal)

• Great news about American wealth: Regular Americans are getting richer: A week ago, the Fed and Treasury released its 2022 data from the Survey of Consumer Finances (SCF), which is a big survey they do every three years in which they ask households about their finances. Household surveys are important because they allow us to calculate things like medians — if you want to know how a household in the middle of the national income or wealth distribution is doing, you need to talk to a ton of households to find out what that distribution looks like. (Noahpinion)

• Bond Index Funds Are Hurting Again. It Isn’t Just Rising Interest Rates. (Barron’s) see also Bond Market Outlook: Valuations Suggest Potential for Equity-Like Returns With Less Risk (PIMCO)

• Workers Are Doing Less Work for the Same Pay: Employers are offering more paid time off in a strong labor market. Employees are using it. (Wall Street Journal)

• Oil and Politics in the Mid-Transition: A world with terminally declining oil demand has never been experienced before, but the growth era for fossil fuels is ending, as many producers, investors and forecasters are acknowledging. This does not put climate goals in close reach, as CO2 flows need to fall far more dramatically to reduce the stock that is already too high (Phenomenal World) see also The Oil Revolution: The myths and realities of the oil price shock of 1973. (Phenomenal World).

• Why Have Climate Catastrophes Toppled Some Civilizations but Not Others? Researchers are honing in on what helps societies survive climate shocks, like the volcanic eruptions that helped fell the Roman Empire or the drought that plagued the ancient Mayans. (Wired)

• The Hunt for Crypto’s Most Famous Fugitive. ‘Everyone Is Looking for Me.’: After a $40 billion cryptocurrency crash, Do Kwon hopscotched across Asia and Europe to evade authorities (Wall Street Journal) see also The Trial of Sam Bankman-Fried, Explained. White-collar defendants use three main defenses: “It wasn’t me, I didn’t mean it, and the people that say I did are lying.” FTX’s Sam Bankman-Fried is likely to go for “I didn’t mean it,” experts say. (Wired)

• As Red States Curb Social Media, Did Montana’s TikTok Ban Go Too Far? Montana is at the forefront of a wave of new tech laws passed by Republican-led states. Some give parents control over their children’s social media accounts. (New York Times)

• In the Cities of Killing: The Hamas massacre, the assaults on Gaza, and what comes after. (New Yorker) see also What a lonely time to be a Jew in America. instead of bringing condemnation on the terrorists, the attack has inspired a wave of antisemitism around the world and, most painfully, here in the United States. This glorification of a terrorist atrocity reveals a moral bankruptcy on the far left. (Washington Post)

• The last new Beatles song, ‘Now And Then,’ will be released this week: Sixty years after the onset of Beatlemania and with two of the quartet now dead, artificial intelligence has enabled the release next week of what is promised to be the last “new” Beatles song. (AP News)

Be sure to check out our Masters in Business next week with Michael Carmen, who is the Co-Head of Private Markets at Wellington Management. He manages a diversified portfolio of late-stage growth equity in technology, consumer, health care, and financial services sectors. Wellington is one of the world’s top 20 asset managers, was founded in 1933, and runs $1.2 trillion in client assets.

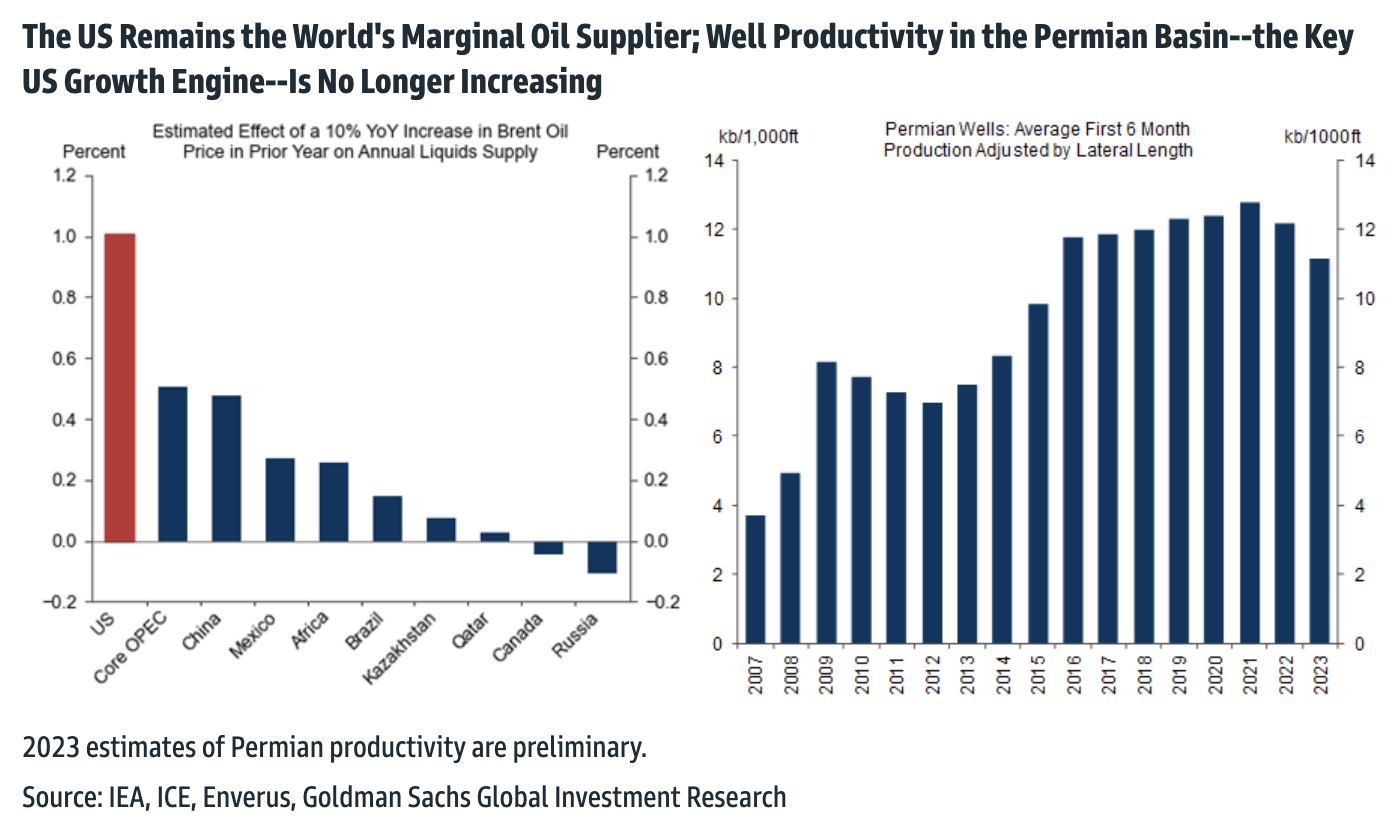

US Shale: The Marginal Supplier Matures

Source: Goldman Sachs