Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures:

• Deception, exploited workers, and cash handouts: How Worldcoin recruited its first half a million test users: The startup promises a fairly-distributed, cryptocurrency-based universal basic income. So far all it’s done is build a biometric database from the bodies of the poor. (MIT Technology Review)

• Banks fined $549 million for hiding messages in iMessage and Signal: Wells Fargo and other Wall Street firms snuck around and found out. (The Verge)

• How Fake Science Sells Wellness: Dubious claims in product marketing are everywhere. Don’t fall for them. (New York Times) see also Influencers Built Up This Wellness Startup—Until They Started Getting Sick: Inside the fiasco that turned Daily Harvest, a vegan food company backed by celebs including Gwyneth Paltrow, into a cautionary tale. (Businessweek)

• China’s Military, ‘Chasing the Dream,’ Probes Taiwan’s Defenses: Day by day, the People’s Liberation Army is turning up the pressure, deploying an ever-wider array of planes and ships. (New York Times)

• A new investigation exposes the stomach-churning practice that goes into making your bacon: The pork industry’s forced cannibalism, explained. (Vox)

• Political violence in polarized U.S. at its worst since 1970s: “In the early 1970s, American political violence was perpetrated more often by radicals on the left and focused largely on destroying property…In contrast, much of today’s political violence is aimed at people – and most of the deadly outbursts tracked by Reuters have come from the right.” (Reuters) see also Why the Populist Right Hates Universities: American conservatives are taking cues from Hungary’s Viktor Orbán because elite education is a convenient enemy for authoritarian populists. (The Atlantic)

• He Thought He Saw Wrongdoing on Wall Street. It Took Over His Life. Years ago, Peter Clothier thought proxy firms were counting shareholder votes incorrectly. His life fell apart after he reported it. (Wall Street Journal)

• John Eastman Comes Clean: Hell Yes We Were Trying to Overthrow the Government: Eastman gets into the core justification and purpose for trying to overturn the results of the 2020 election and overthrow the constitutional order itself. He invokes the Declaration of Independence and says quite clearly that yes, we were trying to overthrow the government and argues that they were justified. Problem is, the Declaration of Independence has no legal force under American law. (Talking Points Memo) see also Previously Secret Memo Laid Out Strategy for Trump to Overturn Biden’s Win: The House Jan. 6 committee’s investigation did not uncover the memo, whose existence first came to light in last week’s indictment. (New York Times)

• Unstoppable: This Doctor Has Been Investigated at Every Level of Government. How Is He Still Practicing? Medical boards, a health department and even federal investigators have scrutinized Dr. James McGuckin’s vascular clinics. Today he still practices, despite a decadelong string of sanctions, fines and lawsuits. (ProPublica)

• Clarence Thomas’ 38 Vacations: The Other Billionaires Who Have Treated the Supreme Court Justice to Luxury Travel: The fullest accounting yet shows how Thomas has secretly reaped the benefits from a network of wealthy and well-connected patrons that is far more extensive than previously understood. (ProPublica) see also Clarence Thomas’s $267,230 R.V. and the Friend Who Financed It: The vehicle is a key part of the justice’s just-folks persona. It’s also a luxury motor coach that was funded by someone else’s money. (New York Times) see also ‘Unprecedented, stunning, disgusting’: Clarence Thomas condemned over billionaire gifts: Calls for the supreme court justice to resign grow as new details of 38 more undeclared gifts and vacations from rich donors emerge. (The Guardian) see also Lawyers with supreme court business paid Clarence Thomas aide via Venmo: Payments to Rajan Vasisht, an aide from 2019-21, underscore ties between the justice and lawyers who argue cases in front of him (The Guardian)

Be sure to check out our Masters in Business interview this weekend with Ted Seides, founder of Capital Allocators, an advisory platform to managers and allocators. Previously, he worked under David Swensen at the Yale Investments Office, where he invested directly with three of Yale’s managers. We discuss his famous bet with Warren Buffett about whether a selection of hedge funds could beat the S&P 500 over a decade. (Buffett won).

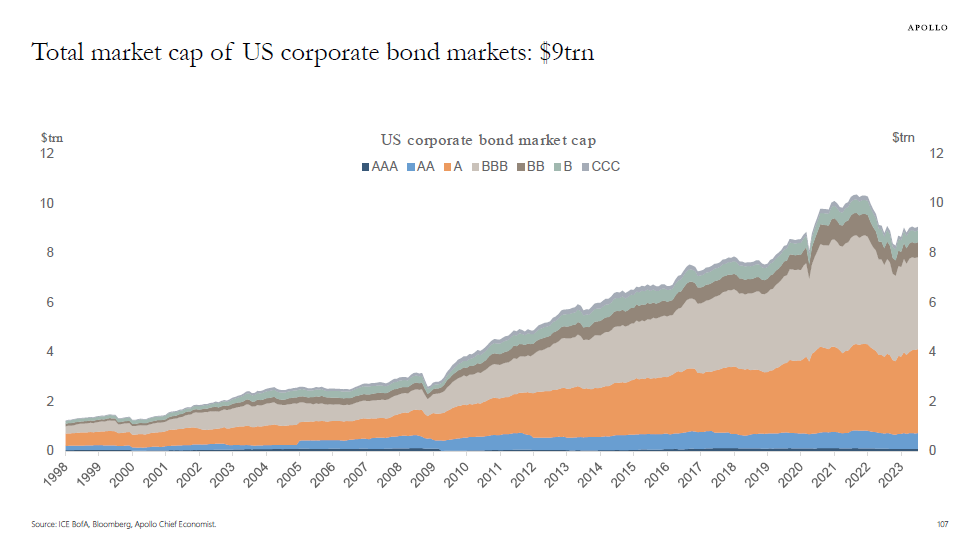

The total market cap of US corporate bond markets is now at $9trn, and the market cap of BBB is currently $3.7trn and single-A is at $3.4trn, see chart below.

Source: Torsten Slok, Apollo Global Management

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.