My Two-for-Tuesday morning train reads:

• Why Are Interest Rates Spiking? The bond market continues to be even crazier than the stock market. We’ve witnessed a massive move in long-term bond yields these past couple of weeks and months. Yields on the 10, 20 and 30 year Treasury were all up in the neighborhood of 60 basis points over the past 16 trading sessions. Yields are up 1% or more on each of these bond maturities since the end of June. (A Wealth of Common Sense) see also Things Don’t Make Sense: It’s been a weird couple of months in the market and the economy. Today we learned that nonfarm payrolls exploded to 336,000 for September, more than twice the 170,000 consensus estimate. Yields rocketed higher and stocks slumped pre-market as traders and investors did an about-face to reprice an accelerating economy that would keep the Federal Reserve’s foot not on but near the brakes. And then an hour into the session, stocks exploded higher. (Irrelevant Investor)

• The propane industry’s weird obsession with school buses, explained: Electric school buses are better for kids’ health. The propane industry has other ideas. (Vox)

• Investing Has Been Ugly. Stick With It Anyway. Most people have lost money in the markets over the last several months, but people who have held on have prospered, our columnist says. (New York Times) see also Breaking US Profits: Rising rates are beginning to nibble into corporate earnings. (Financial Times)

• How to Build a Private Credit Portfolio: GIC and StepStone tested model portfolios for risk-mitigation and return enhancement. Here’s what they found. (Institutional Investor)

• The U.S. Economy’s Secret Weapon: Seniors With Money to Spend: Americans 65 and older account for record share of spending and are less susceptible to interest rates. (Wall Street Journal) see also Amid Strikes, One Question: Are Employers Miscalculating? UPS, the Hollywood studios and the Detroit automakers appear to have been taken aback by the tactics and tougher style adopted by new union leaders. (New York Times)

• Coordinated ‘swatting’ effort may be behind hundreds of school shooting hoaxes. In state after state, heavily armed officers have entered schools prepared for the worst. Students have hidden in toilets, closets, nurse’s offices. They’ve barricaded doors with desks and refrigerators. Medical helicopters have been placed on standby while trauma centers have paused surgeries, anticipating possible victims. Terrified parents have converged on schools, not knowing if their children are safe. (Disgusting). (Washington Post)

• Twitter Was for News: Elon Musk keeps finding inventive ways to ruin the one thing his social network was great for. (Slate) but see Twitter: Your First Source of Investment News (2013): Twitter has become the “new” news wires. It has supplanted AP, Dow Jones and Bloomberg for breaking news. This “Twitter Effect” is now common. Seal Team Six killing Osama bin Laden broke on Twitter. The uprisings of the Arab Spring were first covered via Twitter. So, too, was the death of former British prime minister Margaret Thatcher. (The Big Picture)

• After Shunning Scientist, University of Pennsylvania Celebrates Her Nobel Prize: School that once demoted Katalin Karikó and cut her pay has made millions of dollars from patenting her work (Wall Street Journal)

• In some states, more than half of the local election officials have left since 2020: In some battleground states, more than half of the local election administrators will be new since the last presidential race, according to a new report from the democracy-focused advocacy group Issue One shared exclusively with NPR before its release. (NPR) see also Two right-wing judges seem to be trying to rig a US House race: Once again, the Supreme Court must deal with judicial arsonists on the Fifth Circuit. (Vox)

• After decades of legal battles, John Fogerty is finally free. Is it too late to find happiness? For decades, Fogerty was so distraught over his experience with CCR’s label, Fantasy Records, that he refused to perform any of the songs they had control over. “That thing was signed in January of ’68,” he said, referring to Creedence’s contract, which handed Fantasy all copyrights, while also requiring the band to write 180 original songs. “And basically, we were doomed.” (Los Angeles Times)

Be sure to check out our Masters in Business interview interview this weekend with author Michael Lewis. His latest book Going Infinite: The Rise and Fall of a New Tycoon about the rise and fall of FTX’s founder Sam Bankman Fried. Lewis spent a year embedded with Bankman Fried, who at one time was both the youngest billionaire worth nearly $100 billion dollars. The quirky crypto founder is now under arrest and awaiting trial for massive fraud.

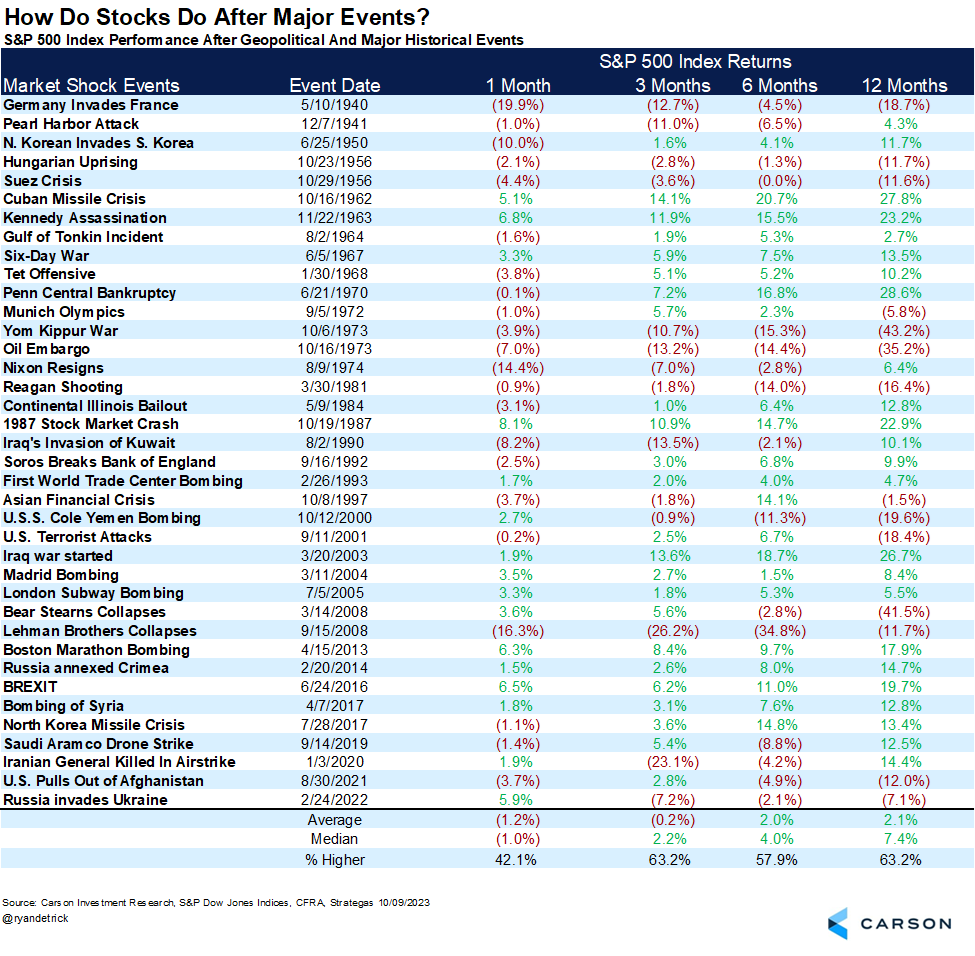

How stocks do after major geopolitical events (WWII forward)

Source: @RyanDetrick

Sign up for our reads-only mailing list here.