One of the more foolish arguments1 that seem to be emanating from the Fed about their intention to raise rates another quarter point today: The 2% inflation target that has been in place pretty much the entire post-financial crisis era.

There is no empirical evidence that shows 2% as the optimal long-run inflation target, for a central bank that has a dual mandate of price stability and maximum employment. It is a round number that people kinda made up and stayed with for no apparent reason.

If there was something magical about 2% as the ideal balance between prices and jobs, that would be avery different thing. But the 2% inflation target is LITERALLY a random number that originated in New Zealand in the 1980s.2 Roger W. Ferguson Jr., former Vice Chairman of the Federal Reserve observed in a recent CFR note, “Surprisingly, it came not from any academic study, but rather from an offhand comment during a television interview.” For reasons no one has intelligently articulated, other countries subsequently adopted it as their target.

Laurence Ball, Professor of Economics at Johns Hopkins and Research Associate at the National Bureau Of Economic Research, made the case in 2013 that 4% was a more rational target. “Raising inflation targets to 4% would have little cost, and it would make it easier for central banks to end future recessions,” he noted.3

The Federal Open Market Committee has justified the 2% inflation based on inflation expectations. The Board of Governors stated, “When households and businesses can reasonably expect inflation to remain low and stable, they are able to make sound decisions regarding saving, borrowing, and investment, which contributes to a well-functioning economy.”

The problem with this approach (as we have repeatedly shown, is that it is utterly useless. Inflation expectations are typically at their lowest right before a surge in inflation occurs; they are at their highest levels just as inflation rolls over and heads downwards. People’s inflation expectations mimic the typical overenthusiastic investor, piling in at the top of the market and panic selling near the bottom.

Expectations are no way to run monetary policy and are more fit for a Monty Python film.4

Consider: We had 2% inflation expectations the entire post-GFC era. The economy was sluggish, job creation as weak, consumer spending was soft. ZIRP and QE had driven rates to zero (or negative in some parts of the world), and 2% seemed a reasonable albeit arbitrary upside target. But after $6 trillion in fiscal stimulus, mortgage rates at 7.5%, perhaps 3% makes much more sense as a downside inflation target.

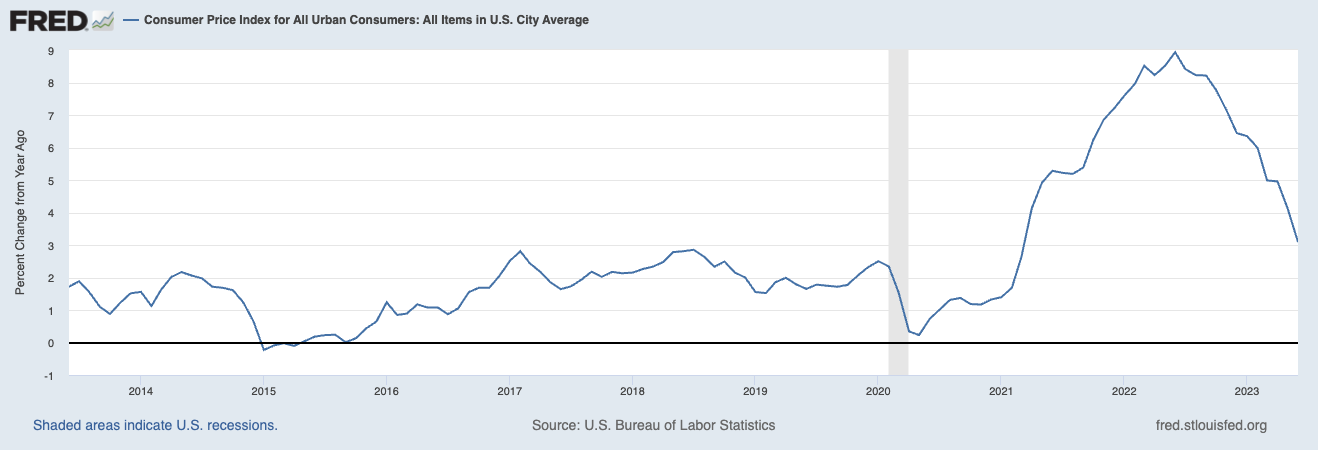

I have noted in the past that the Fed was late to get off its emergency footing, late to recognize inflation pierced its 2% target to the upside (March 2021), late to begin raising rates (March 2022), late to recognize inflation had peaked (June 2022), late to recognize that they have already beaten inflation in (July 2023).

I have a pet theory as to why they have been consistently so late: Many economists have misunderstood this entire economic cycle, including inflation. These older school economists – who demanded vigilance against rising prices, declared inflation to be persistent, sticky, and non-transitory or even stagflationary – all made their bones in the 1970s/80s. They are haunted by a very different type of economy that had very different inflation drivers. Their PTSD is palpable.

They are taking the wrong lesson from that era. As Professor Ball wryly observed to the NYT’s Jeff Sommers, “If 4% was good enough for Volcker, it should be good enough for us.”

Update: May 16, 2024

Paulie the K links to this Neil Irwin piece from 2014!

Of Kiwis and Currencies: How a 2% Inflation Target Became Global Economic Gospel (Dec. 19, 2014)

Previously:

A Dozen Contrarian Thoughts About Inflation (July 13, 2023)

More Inflation Expectations Silliness (July 5, 2023)

Inflation Expectations Are Useless (May 17, 2023)

For Lower Inflation, Stop Raising Rates (January 18, 2023)

Why Is the Fed Always Late to the Party? (October 7, 2022)

Inflation Expectations: A Dubious Survey (September 21, 2022)

Transitory Is Taking Longer than Expected (February 10, 2022)

__________

1. Let’s hold aside the claim that the Fed needs to “maintain credibility,” as that squishy argument is simply too ridiculous to address.

2. The case for 4% inflation, Laurence Ball, VoxEU/CEPR 24 May 2013

3. Like 20% for a bull or bear market, its made up, without any data supporting it as either an indicator or a predictor.

4. Peasants: We have found a witch! (A witch! a witch!)

Burn her burn her!

Peasant 1: We have found a witch, may we burn her?

(cheers)

Vladimir: How do you known she is a witch?

P2: She looks like one!

V: Bring her forward

(advance)

Woman: I’m not a witch! I’m not a witch!

V: ehh… but you are dressed like one.

W: They dressed me up like this!

All: naah no we didn’t… no.

W: And this isn’t my nose, it’s a false one.

(V lifts up carrot)

V: Well?

P1: Well we did do the nose

V: The nose?

P1: …And the hat, but she is a witch!

(all: yeah, burn her burn her!)

V: Did you dress her up like this?

P1: No! (no no… no) Yes. (yes yeah) a bit (a bit bit a bit) But she has got a wart!

(P3 points at wart)

V: What makes you think she is a witch?

P2: Well, she turned me into a newt!

V: A newt?!

(P2 pause & look around)

P2: I got better.