My mid-week morning train WFH reads:

• The Pandemic Small-Business Boom Is Fueling the US Economy: Startup registrations remain 42% ahead of 2019 levels, with growing numbers of companies founded by women and minorities. (Businessweek)

• Some Fed Officials Are Turning Cautious about Raising Rates Too High: Central bank officials face a puzzle as inflation slows, but economic activity is firmer than anticipated. (Wall Street Journal) see also How Hard Should the Fed Squeeze to Reach 2% Inflation? The strategy the central bank adopts to fight the last mile of inflation has big, potentially painful implications for consumers, the markets and the economy. (Wall Street Journal)

• Should We Expect Valuations to Mean-Revert Over Time? It makes sense to assume that multiples mean-revert. And over long periods, they do: stocks traded at high single-digit multiples in the late 40s and early 50s, high teens multiples in the 60s and early 70s, back to high single digits in the early 80s, straight up to a record of 40+ during the great large cap growth bull market of the late 90s, then down to the mid-teens during the early-2010s recovery. But it’s equally true that timing these reversions is hard. (The Diff)

• How Nvidia Built a Competitive Moat Around A.I. Chips: The most visible winner of the artificial intelligence boom achieved its dominance by becoming a one-stop shop for A.I. development, from chips to software to other services. (New York Times)

• Is the AI boom already over? Generative AI tools are generating less interest than just a few months ago. (Vox)

• Why It’s So Hard for China to Fix Its Real Estate Crisis: Beijing has often addressed economic troubles by boosting spending on infrastructure and real estate, but now heavy debt loads make that a hard playbook to follow. (New York Times)

• The Booming Business of American Anxiety: A flurry of companies and entrepreneurs aim to fill the demand for mental-health help. (Wall Street Journal)

• Our Universe wasn’t empty, even before the Big Bang: All of the matter and radiation we measure today originated in a hot Big Bang long ago. The Universe was never empty, not even before that. (Big Think)

• Trump’s Toast, Folks: The Georgia indictment alleges that Trump orchestrated a sprawling criminal conspiracy involving more than 20 named and unnamed co‐conspirators ranging across half‐a‐dozen states for the purpose of unlawfully changing the result of the November 2020 presidential election. There is nothing subtle or nuanced about this indictment—in effect, it accuses Donald Trump, Rudy Giuliani, Mark Meadows, John Eastman, Jeffrey Clark, Sidney Powell, and a dozen others of staging an unsuccessful coup. (Cato Institute) see also Trump’s Last Two Indictments Complement Each Other Perfectly: Jack Smith’s federal document filed in Washington was spare almost to the point of being an inky line drawing, whereas Fani Willis’ Georgia filing is rich and detailed and pointillist. Smith targeted one defendant only, whereas Willis went after 19 defendants on 41 counts. Smith mentions a handful of co-conspirators; Willis notes 30 unindicted co-conspirators. As Norm Eisen and Amy Lee Copeland point out, Smith’s case will likely be blacked out for television and audio audiences, whereas Willis’ suit will most likely become must-see TV for weeks on end. (Slate)

• Can ‘Ahsoka’ Be the Fulcrum of the ‘Star Wars’ Franchise? An audacious attempt to bring animated favorites to a live-action connected universe, the ‘Ahsoka’ experiment reflects the state of ‘Star Wars.’ Its level of success may help determine the wider franchise’s future. (The Ringer)

Be sure to check out our Masters in Business with legal scholar Cass Sunstein, who founded and leads Harvard Law School’s program on behavioral economics and public policy. He authored several books, including the bestselling “Nudge: Improving Decisions About Health, Wealth, and Happiness.” (written with Nobel Laureate Richard Thaler) and the New York Times best-seller “The World According to Star Wars.” His new book is “Decisions about Decisions: Practical Reason in Ordinary Life.”

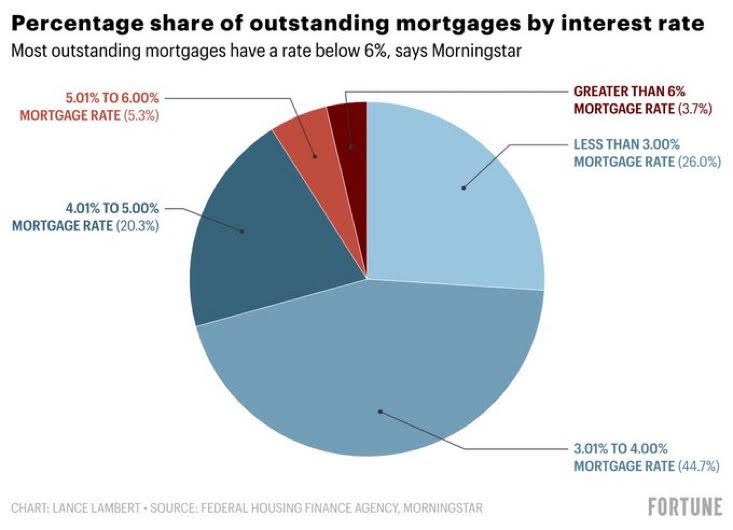

91% of U.S. mortgage borrowers have a mortgage rate below 5.01%

Source: @NewsLambert

Sign up for our reads-only mailing list here.